Canopy Growth (CGC) had an astonishing revelation prior to this past holiday weekend for the stock market. The new CEO was expected to reorganize the business, but a delay to the cannabis beverages business was an unexpected jolt to the Canadian cannabis company. One has to wonder what other issues will be disclosed as CEO David Klein completes his second week on the job.

Beverage Debacle

Canopy Growth shocked the market last week by admitting their cannabis-infused beverages were not ready to scale for the market. The news is surprising considering the company is already a month into the legalization of Cannabis 2.0 products such as edibles and beverages.

New CEO David Klein suggests the time period since Canopy Growth obtained Health Canada license in late November 2019 wasn’t enough time to work out the kinks with THC in a brand new beverage facility. The company suggests updates will be provided on the release of the FQ3 results on February 14, or roughly two months after the market already thought their cannabis beverages were hitting the market.

Canopy Growth provided a Cannabis 2.0 update back on December 6 with no indication of these impending problems with ramping up a new facility. At the time, the large cannabis player promoted several drinks hitting store shelves in early January followed by other varieties of the Tweed, Houseplant, Quatreau and Deep Space brands. Previously, Canopy Growth had outlined in detail a vast selection of cannabis-infused drinks expected to be ready for the 2.0 launch in December or early January.

Investors had no reason to doubt the company’s beverage ambitions considering the backing of wine and spirits giant Constellations Brands (STZ).

High Expenses

What the news means is that Canopy Growth remains in the R&D phase without the revenues. The company continues to spend while not getting any returns for investors as the 150,000 sq. ft. beverage facility is now open and only producing expensive THC chocolate bars.

Naturally, Canopy Growth is wise to delay any release to get the THC mix correct before hitting market. The company might have been wiser to focus on the beverages endeavor versus recently jumping into the U.S. CBD market.

The company has a massive operating expense base by trying to be all things to the global cannabis market with none of the results warranting the vast investments. Canopy Growth has the weakest gross margins in the sector at 38% in the last quarter assuming tons of adjustments while having the largest operating expense base. For FQ2, the company had adjusted operating expenses at C$160 million, or nearly double the amount spent by Aurora Cannabis.

The first step of the new CEO was to delay the cannabis beverages hitting market, but what investors really wanted to see is Canopy Growth rationalizing expenses. This beverage facility delay only elevates expenses unattached to current revenue production.

Consensus Verdict

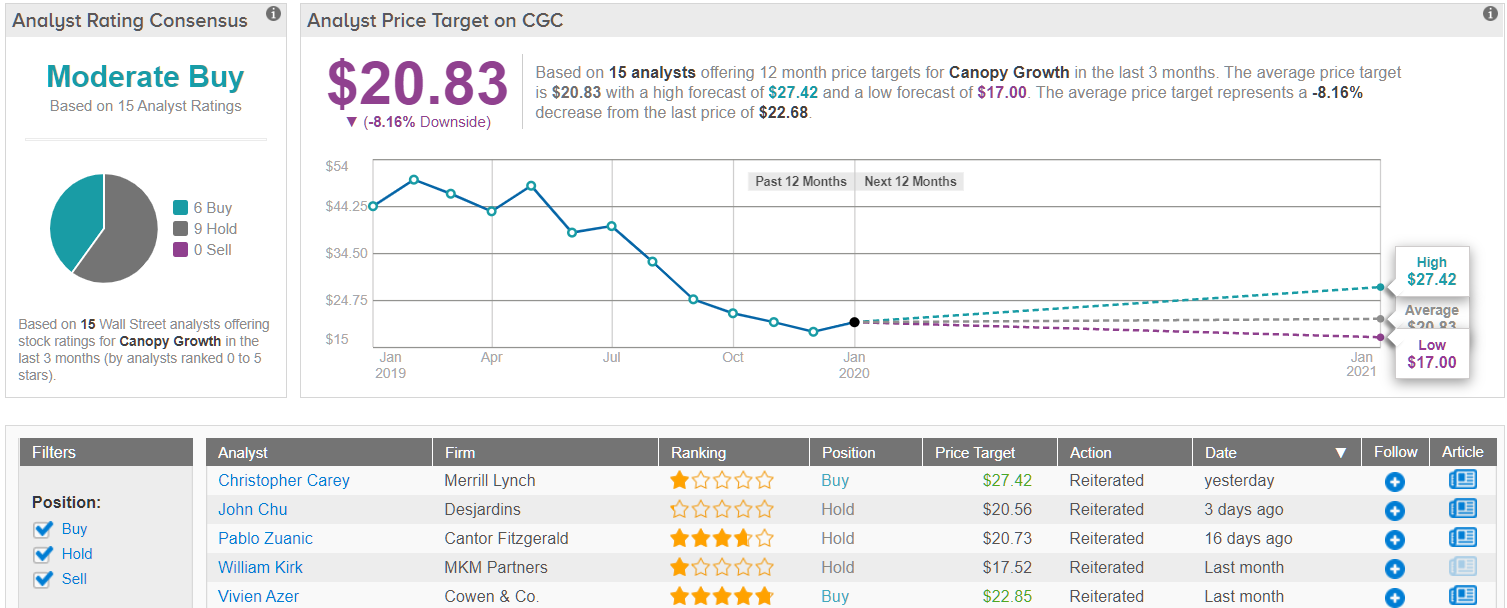

Wall Street isn’t completely sold on this ‘show me’ story. Out of 15 analysts polled in the last 3 months, 6 are bullish on Canopy Growth stock, while 9 remain sidelined. Is the stock overvalued or undervalued based on these expectations? With a downside potential of nearly 8%, the stock’s consensus target price stands at $20.83. (See Canopy Growth stock analysis on TipRanks)

Takeaway

The key investor takeaway is that Canopy Growth hit another big problem with meeting financial targets. The company remains in major spend mode over six months after firing ex-CEO Bruce Linton and the latest news suggests the new CEO is nowhere close to reorganizing the business.

The stock is far too expensive at an $8.5 billion market cap when the company can’t even get cannabis-infused beverages onto the market while daily operating losses remain in the millions.

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.