The appetite for Constellation Brands (STZ) buying the rest of Canopy Growth (CGC) appears very low after the company reported another equity loss from the large cannabis investment. If anything, Constellation Brands has huge regrets from making such a large gamble on the Canadian cannabis business near the peak of the market. Canopy Growth jumped to recent highs and Constellation Brands doubling down on Canopy Growth appears very unwise and highly unlikely here.

FOMO

One can argue Canopy Growth still trades around $20 due to the inherent put on the stock. This fear of missing out on a Constellation Brands bid for the rest of the company has the stock overvalued, thereby limiting the actual potential of a bid.

Constellation Brands owns 35% of the outstanding shares of Canopy Growth and owns warrants to purchase a controlling interest in the cannabis stock with one huge hitch. The warrants have exercise prices far above the current price of Canopy Growth with prices starting at C$50.40 per share.

Constellation Brands could save substantial amounts of money by purchasing the rest of Canopy Growth for $30 per share. The latter would still offer a 50% premium above where the stock traded in the prior couple of months.

An offer by the wine & spirits company to pay $30 now would cost an additional $7.0 billion.

Lack Of Funds

The bigger issue is paying up to a $10+ billion market cap for a money losing company with FY21 (March) revenue expectations of only $583 million. Not only is the price not right here, but also the shareholders of Constellation Brands have no interest in absorbing quarterly EBITDA losses in the $100 million range.

Constellation Brands just forecast free cash flows in the $1.5 billion to $1.6 billion range while promising shareholders a substantial portion of those cash flows returned to shareholders via dividends and stock repurchases through 2022. The company already has net debt of $11.5 billion so one shouldn’t foresee another $7 billion spent on the rest of Canopy Growth.

The more likely outcome is an aggressive move to snap up a controlling interest (another 15% of the company) in the scenario where the stock dips down to $10. The one hesitation is the company won’t want to absorb the quarterly losses, but investors should be much more comfortable with a Constellation Brands put on the stock somewhere around $10 where a market valuation of $3.5 billion and a large level of cash would provide a more reasonable valuation to pay for the leading cannabis stock.

Either way, one needs to watch for the new CEO to implement cost reductions before Constellation Brands could ever build a bigger position. CEO David Klein doesn’t actually start at Canopy Growth until January 14, but he has a mandate to rationalize costs which include curtailing production growth similar to Aurora Cannabis (ACB).

Consensus Verdict

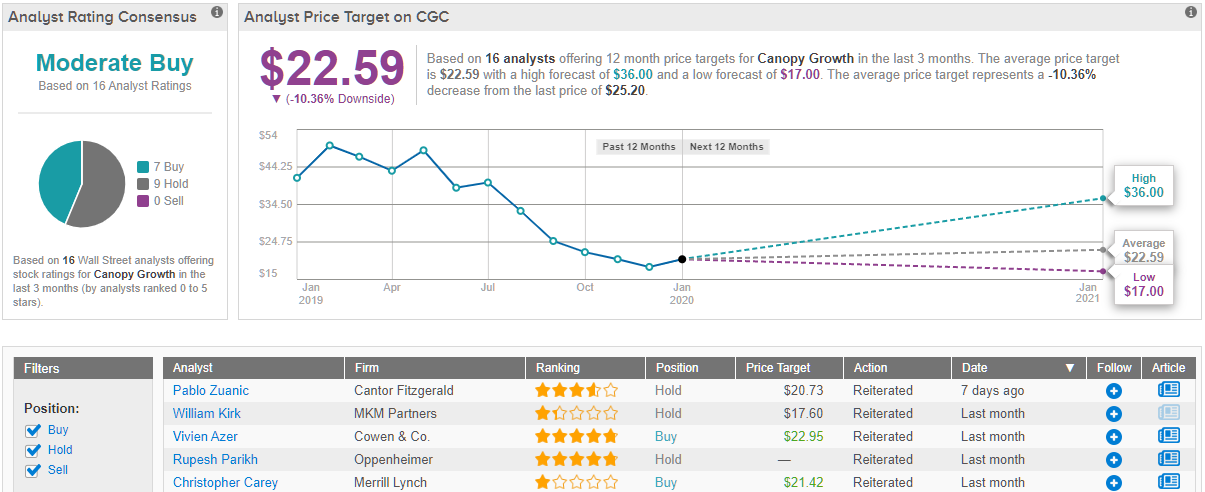

The market’s current view on Canopy Growth is a mixed bag, indicating uncertainty as to its prospects. The stock has a Moderate Buy analyst consensus rating with 7 recent “buy” ratings. This is versus 9 “hold” ratings. Furthermore, the $22.59 price target suggests a downside potential of nearly 10% from the current share price. (See Canopy Growth stock analysis at TipRanks)

Takeaway

The key investor takeaway is that Canopy Growth isn’t a safe bet here due to the involvement of Constellation Brands. The more likely outcome is further weakness before the wine & spirits company would get more aggressive with snapping up more Canopy Growth shares versus waiting until warrants are exercisable at far higher prices.