As weird as it may sound, it’s really not that exceptional to come across stocks that have shed 80% of their value over the past year, especially from those that went public via the SPAC route prior to the market meltdown.

Once such example is Lucid Motors (NASDAQ:LCID), the luxury EV maker that was put through the wringer in 2022. Factoring in supply chain snags and logistical problems, the start-up slashed its annual production targets twice last year and investors turned away in droves.

However, the shares have been on the up at the onset of 2023 and last week the company provided a positive update. Lucid pre-announced 4Q22 production and delivery numbers; at its Arizona facility, the company produced 3,493 vehicles during the quarter, amounting to a 53% sequential increase on 3Q22’s 2,282 vehicles. 1,932 vehicles were delivered – a 38% quarter-over-quarter uptick. For the whole year, the company manufactured 7,180 vehicles, beating its guidance which called for between 6,000 to 7,000 vehicles. In total, Lucid’s vehicle deliveries reached 4,369 in 2022.

The production numbers trumped Cantor’s Andres Sheppard’s expectations, who remains firmly in the EV maker’s corner.

“We are encouraged by LCID’s 4Q22 production and delivery numbers,” the analyst said. “LCID’s FY22 production vehicles are above company guidance and a good sign that production is beginning to scale and ramp up, in our view. We remain bullish on LCID over the long term, and we continue to believe that the company’s vehicles are able to provide greater battery efficiency, longer range, faster charging, and more interior space relative to peers.

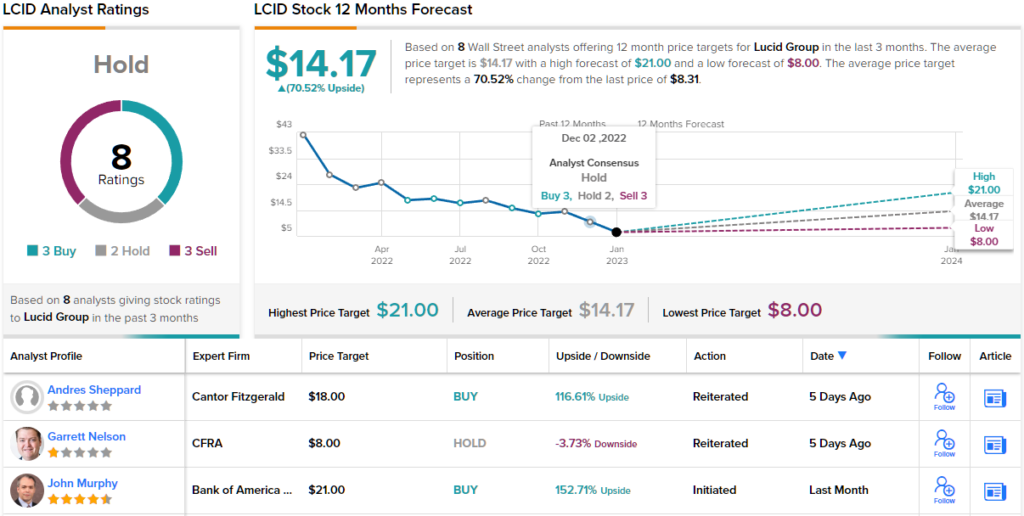

Sheppard awaits Lucid’s Q4 earnings call (February 22) to make any changes to his model, but meanwhile sticks with an Overweight (i.e., Buy) rating backed by a price target of $18. Should the figure be met, investors will be sitting on returns of ~118% a year from now.

So, that’s the Cantor View, what about the rest of the Street’s take? The analyst community is largely divided between the bulls and the bears when it comes to Lucid Motors’ market opportunity. The stock claims a Hold consensus rating, based on 3 Buys, 2 Holds and 3 Sells. (See Lucid stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.