Carnival Corp.’s (CCL) shares climbed 21% after Saudi Arabia’s sovereign wealth fund, the Public Investment Fund (PIF), on Monday disclosed an 8.2% stake in coronavirus-hit Carnival Corp.

PIF made the offering for Carnival’s 43.5 million shares worth about $369.3 million on March 26, according to the SEC filing. The investment makes PIF the second-largest investor in the world’s biggest cruise line.

Since the start of the year, Carnival has seen its shares lose more than three-quarters of their value as the coronavirus pandemic has forced cruise ship companies to halt operations and suspend cruises.

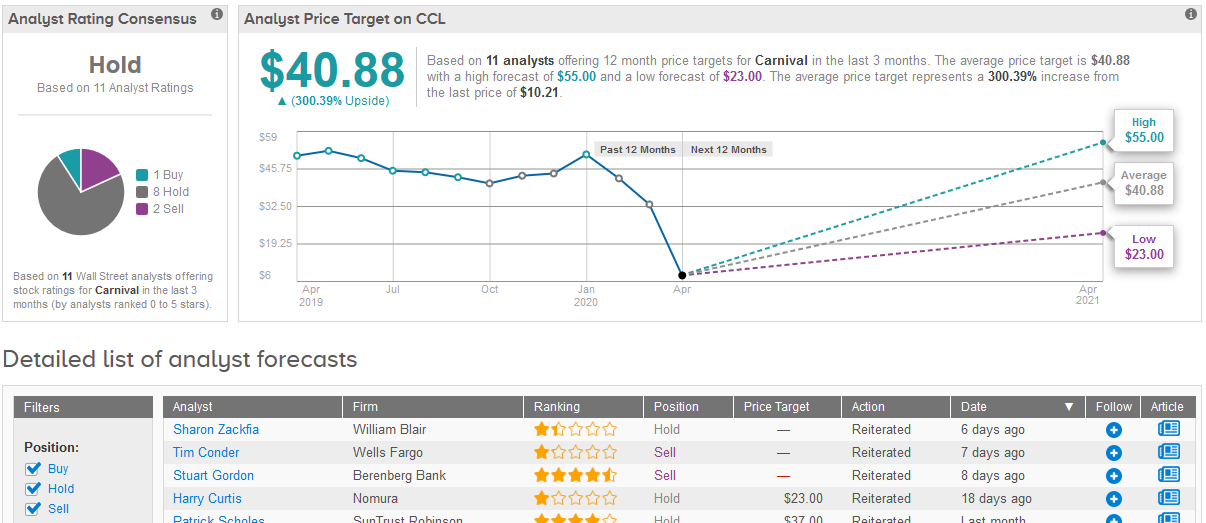

Wall Street analysts take a cautious stance on Carnival stock. The analysts’ Hold consensus rating is split into 8 Holds, 2 Sells and 1 Buy. The $40.88 average price target suggest a 300% upside potential should it be met in the coming 12 months. (See Carnival’s stock analysis on TipRanks)

PIF, which manages over $300 billion in assets, is also an investor in Uber Technologies (UBER) and electric car company Lucid Motors. It also has a stake in Softbank’s $100 billion Vision Fund.

Last week, Carnival said it was raising $6.25 billion in debt and equity, while also suspending its dividend payments, in an effort to cope with the financial crisis induced by the coronavirus impact.

Related News:

Battered Cruise Operator Carnival Seeks $6 Billion To Deal With Covid-19 Fallout

Coronavirus Fighter Gilead Sciences Might Be Expensive, but It’s Still Worth Owning

Tesla: Despite Record Q1 Numbers, Uncertainty Looms Ahead