CatchMark Timber Trust (CTT) has agreed to sell 18,063 acres of its Oregon timberlands, known as the Bandon property, to Roseburg Resources for $5,536 per acre. This translates to a total consideration of $100 million. The transaction is expected to close in Q3.

CatchMark focuses on the ownership and management of prime timberlands and has interests in 1.5 million acres.

CatchMark CEO Brian M. Davis said, “By selling this asset, we will be better positioned to reinvest in the growth of our core portfolio in the U.S. South where we have a robust operating platform and see the strongest opportunity for future growth.” (See CatchMark Timber stock chart on TipRanks)

Davis added, “We have successfully capitalized on the current favorable market conditions for our Pacific Northwest property. The sale of our Bandon timberlands highlights our ability to execute accretive capital recycling transactions that allow us to continue to pursue our strategy of investing in prime timberlands in high-demand mill markets and managing operations to generate stable and predictable cash flow.”

CatchMark had acquired the Bandon property in 2018 for $88.8 million. It expects to register a gain of over $20 million in Q3. By the close of this sale, Catchmark expects to achieve 75% to 80% of its targeted harvest volume for the Pacific Northwest region for 2021.

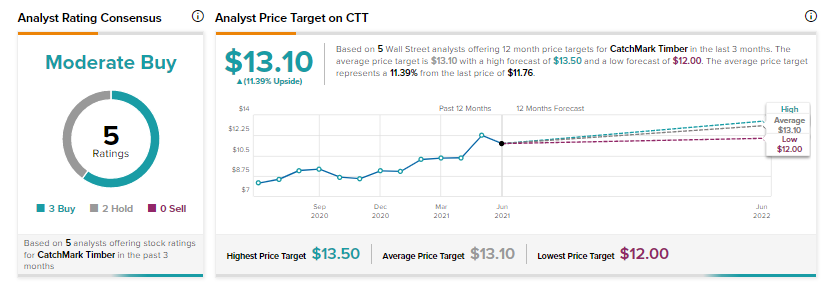

On June 2, Raymond James analyst Buck Horne reiterated a Buy rating on the stock and increased the price target to $13.50 (14.8% upside potential) from $11.50 owing to improvement in log prices.

Horne believes the present -9% NAV discount is unduly wide for the stock considering an “improving macro backdrop and rising timber demand, as sawmill activity continues to steadily increase across the country thanks to booming demand for new home construction and repair/remodel activity.”

Consensus on the Street is a Moderate Buy based on 3 Buys and 2 Holds. The average CatchMark Timber analyst price target of $13.10 implies 11.4% upside potential. Shares have gained 39% over the past year.

Related News:

MicroStrategy Adds Bitcoins Worth $489M; Shares Plunge 10%

Accenture Makes Strategic Investment in Imburse

NetApp Buys Data Mechanics to Optimize Data Analytics, Machine Learning Initiatives