Caterpillar Inc (CAT) is negotiating with banks to raise a fresh $3 billion 9-month revolving credit facility, Bloomberg reports. CAT stock fell close to 2% on April 9, while the Dow Jones index gained 1.2%.

According to people familiar with the matter, the deal could be increased to about $5 billion in total and will help boost CAT’s liquidity.

Both Citibank, which is leading the deal, and Caterpillar declined to comment, Bloomberg says.

The world’s biggest construction equipment company currently has approximately $10.5 billion in revolving credit facilities, following a $2 billion deal in the bond market earlier this week.

CAT has also withdrawn its 2020 earnings forecast and suspended some operations, as well as withholding annual salary increases- including for CEO Jim Umpleby.

“We have faced and overcome many challenges during our 95-year history. Working together, I am confident we will emerge even stronger after the impact of the pandemic subsides,” Umpleby told employees last week.

However the company did confirm that it will pay out its regular $1.03 dividend this quarter on May 20, which translates to a 3.3% dividend yield.

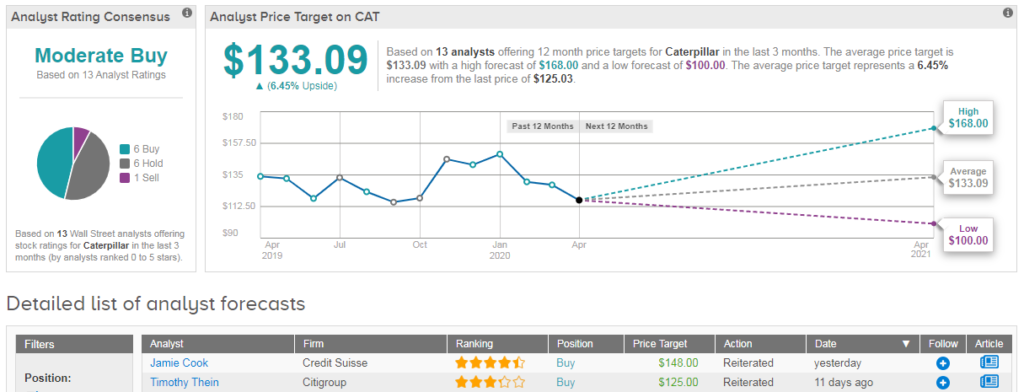

Analysts are cautiously optimistic on CAT’s outlook, with a Moderate Buy analyst consensus. Their $133 average price target translates into upside potential of 6%. (See CAT’s stock analysis on TipRanks)

Credit Suisse analyst Jamie Cook dropped his Caterpillar price target to $148 from $162 on Thursday. Despite reducing his estimates due to a slowdown in construction activity, the analyst told investors: “We believe CAT is better positioned to handle a downturn even if this proves severe.”

Related News:

Tesla Scored Record China Sales In March, Says Industry Association

Disney+ Hits New Milestone With 50 Million Paid Subscribers

Chesapeake Energy Sets Date For Reverse Stock Split, Stock Down 80% YTD