Are you charged up about ChargePoint (NYSE:CHPT) stock? Be careful – you may be shocked as your ROI (return on investment) could be less than what you expect. I am neutral on CHPT stock because ChargePoint demonstrated its ability to sell electric vehicles (EVs) but didn’t manage to convert robust revenue into a bottom-line improvement.

ChargePoint operates an extensive network of EV charging stations in North America and Europe. Amazingly, ChargePoint’s infrastructure has provided more than 145 million charging sessions. Notably, ChargePoint has teamed up with Fisker (NYSE:FSR) to make it ultra-convenient for Fisker’s drivers to get a fast charge when they need it.

So far, it sounds like ChargePoint is on the right track. Yet, don’t be a hasty investor, as some of ChargePoint’s fiscal facts aren’t ideal, and Wall Street won’t likely describe the company’s current-quarter guidance as electrifying.

ChargePoint Nearly Doubled Its Revenue, but Not All is Perfect

It’s funny how publicly-listed businesses will often put their good news at the top of a press release, but then you have to scroll down and read the fine print to get the full story. Thus, ChargePoint loudly and proudly announced the company’s top-line improvement in its fourth-quarter and Fiscal 2023 results, but it will take some digging to discover the less-than-stellar stats.

Still, it’s impressive that ChargePoint increased its Q4 revenue by 93% year-over-year to $153 million while also growing the company’s FY2023 revenue by 94% to $468 million. ChargePoint President and CEO Pasquale Romano proudly observed that his company “delivered its largest sequential revenue growth to date and another record quarter.”

I won’t deny that these results are encouraging. However, we can already start to detect some problems. For one thing, Romano stated that ChargePoint’s quarterly revenue was below the company’s guidance range, which was $160 million to $170 million; the chief executive cited supply and shipment challenges as reasons for the revenue shortfall. Furthermore, Wall Street’s analysts had expected ChargePoint to report revenue of $165 million for the quarter.

Will supply-chain and shipment issues continue to be a major problem for ChargePoint? It’s certainly possible, as the company guided for current-quarter revenue of $122 million to $132 million. This range isn’t particularly ambitious, as it falls below Wall Street’s consensus forecast of $140 million.

ChargePoint’s Capital Position Needs Improvement

Romano declared, “We just doubled the company in a year,” referring to ChargePoint’s revenue. That point is duly noted, but it’s not the full picture. Prospective investors should also examine ChargePoint’s net income and capital position, which aren’t ideal.

Turning to the bottom line, cautious investors should know that ChargePoint is still an unprofitable company. If ChargePoint can’t turn a profit even after nearly doubling the company’s revenue, something is definitely amiss here.

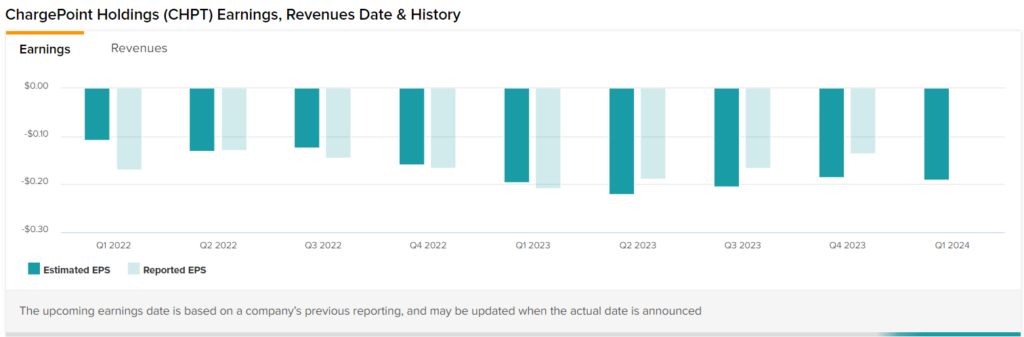

In ChargePoint’s defense, I must acknowledge that the company beat Wall Street’s fourth-quarter EPS estimate of a $0.19 loss by posting a $0.14 loss. I suppose that the bulls might consider this to be a “victory.” On the other hand, ChargePoint’s fourth-quarter GAAP net loss of $78 million is deeper than the company’s $60.1 million net loss from the year-earlier quarter.

Finally, here’s a tidbit that you’d have to scroll down and use your magnifying glass to discover. ChargePoint’s position of cash and cash equivalents declined from $315.24 million as of January 31, 2022, to $264.16 million as of January 31, 2023. That’s a 16% decrease, and it indicates that ChargePoint’s capital position is heading in the wrong direction.

Frankly, the company’s investors should insist that ChargePoint’s management, including the CEO, must provide a specific action plan to address CHPT’s financial issues.

Is CHPT Stock a Buy, According to Analysts?

For what it’s worth, the analyst community seems to favor ChargePoint and generally expects the company’s shares to gain value. In fact, CHPT stock comes in as a Strong Buy based on six Buys and two Hold ratings. The average ChargePoint stock price target is $17, implying 65.5% upside potential.

Conclusion: Should You Consider ChargePoint Stock?

Interestingly, Wall Street analysts seem to be bullish on CHPT stock. Most likely, they’re impressed with ChargePoint’s near-doubling of its quarterly and annual revenue. Maybe they’re also anticipating an easing of supply chain and shipping issues.

Those are fair points, so I’m not outright bearish on CHPT stock. I am neutral, though, as ChargePoint still needs to provide a clear-cut road map to fix the company’s financial shortcomings. Hence, while ChargePoint is still a promising company in the fascinating EV-charging niche market, I believe this isn’t the right time to consider CHPT stock.