Charter Communications (CHTR) shares popped 4.24% after the company delivered impressive second-quarter results driven by mobile, internet, and advertising sales growth. Revenue was up 9.5% from the same quarter last year to $12.8 billion and better than the $12.61 billion that the Street expected. The growth in revenue came on the back of a 6.8% increase in residential revenue, and mobile sales increased 67.5%. Advertising sales revenue was up 65.1%.

Net income attributable to shareholders climbed to $1 billion compared to $766 million reported last year same quarter.

Consequently, Charter Communications reported earnings of $5.29 a share, better than the $4.78 a share that analysts expected. (See Charter Communications stock charts on TipRanks)

“Our operating strategy continues to deliver strong customer and financial growth despite an operating environment that has yet to return to normal,” said CEO Tom Rutledge.

The company repurchased 6.1 million Class A common shares for $4 billion during the quarter. Residential and small and medium business (SMB) customer relationships surged 332,000. Residential and SMB internet customers also increased by 400,000.

Charter Communications exited the quarter with $3.99 billion in net cash flows from operating activities, up from $3.5 billion a year ago. Free cash flow, on the other hand, increased to $2.1 billion from $1.9 billion in the same quarter last year.

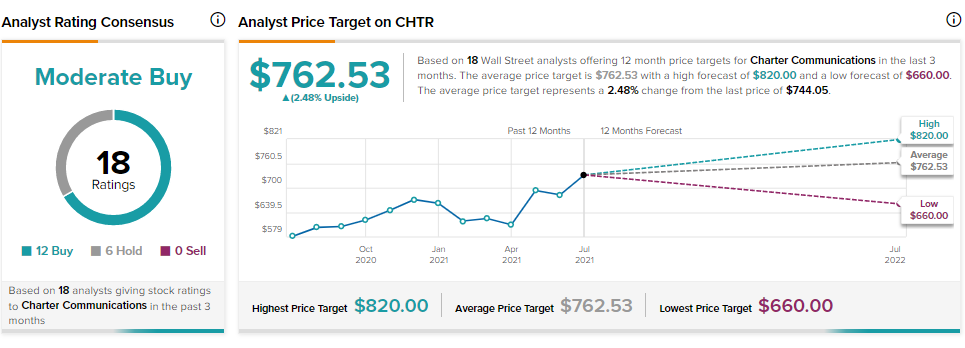

Pivotal Research analyst Jeffrey Wlodarczak recently reiterated a Buy rating on the stock but raised his price target to $820 from $800, implying 10.21% upside potential to current levels.

Consensus among analysts is a Moderate Buy based on 12 Buys and 6 Holds. The average Charter Communications price target of $762.53 implies 2.48% upside potential to current levels.

CHTR scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

5 Top Dividend Stocks for August 2021

Merck Q2 Earnings and Revenue Miss Estimates

Ardelyx Receives FDA Nod; Shares Pop 14.5%