Shares of Check Point Software Technologies (CHKP) are up 4.5% in the pre-market trading, thanks to better-than-expected 2Q earnings. Its adjusted earnings of $1.58 per share increased 15% year-over-year and came ahead of analysts’ expectations of $1.44.

The company’s revenues of $506 million increased 4% year-over-year and beat analysts’ estimates of $488 million. Check Point said that it witnessed increased sales across categories including cloud, endpoint, and high-performance network and security solutions.

Gil Shwed, Check Point’s CEO, said “We delivered solid second quarter results driven by strong sales execution despite the rising impact of the COVID-19 pandemic.”

The COVID-19 induced global lockdown measures have accelerated organizations’ cloud migration, which is driving demand for the company’s network security gateways products. Also, the work-from-home and online learning necessities are driving sales of Check Point’s remote access VPN solutions.

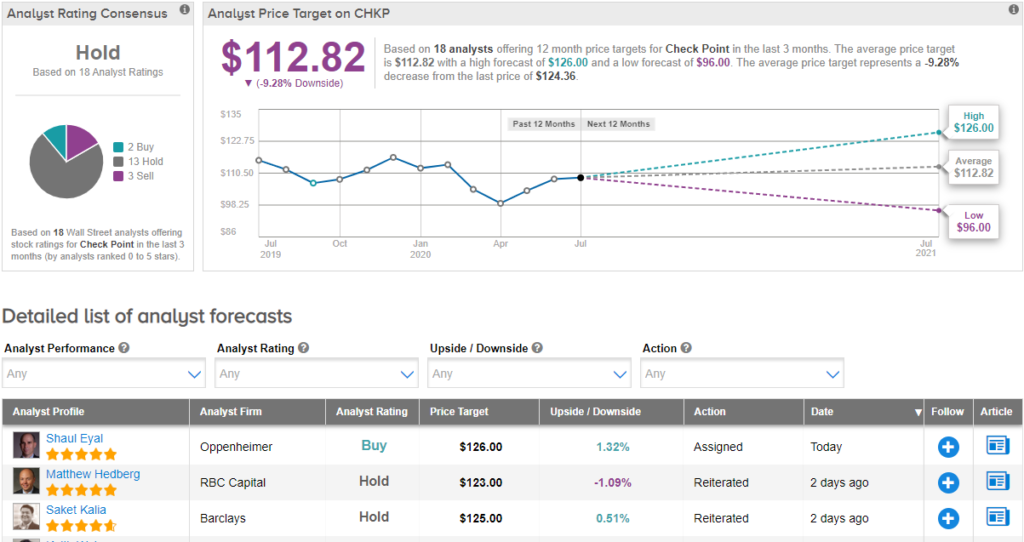

Oppenheimer analyst Shaul Eyal assigned a buy on Check Point with a price target of $126.

Overall, the majority of analysts are sidelined on the stock with a Hold analyst consensus. With its shares up 12.1% this year, the average target price of $112.82 implies a 9.3% downside in the coming 12 months. (See Check Point’s stock analysis on TipRanks).

Related News:

Phillip Morris Beats Quarterly Estimates

Halliburton Jumps 5% as 2Q Earnings Top Estimates

Lockheed Martin Beats Quarterly Estimates, Raises 2020 Outlook