Online pet products retailer Chewy Inc (CHWY) is gearing up to report its earning results on September 10, after the market closes.

Chewy is a leading pure-play e-tailer in the United States, offering pet owners virtually everything their pet needs, with the mission “to be the most trusted and convenient Online destination for pet parents everywhere.”

Ahead of the upcoming earnings report, RBC Capital analyst Mark Mahaney has reiterated his bullish buy rating on the stock with a price target of $62.

“Given the acceleration we saw across the e-Commerce space, we believe it is reasonable to assume that CHWY will continue to benefit from this sustained tailwind and a potential acceleration of Revenue growth to 50%+ for FQ2 would not be surprising” cheers the analyst.

Based on intra-quarter data points and model sensitivity work, he views the Street’s FQ2 estimates as reasonable, and FQ3 estimates (implying roughly flat Q/Q Revenue growth and a 7-pt Y/Y deceleration) as conservative.

Specifically, Mahaney is forecasting revenue of $1,641MM, in-line with the Street and at the high end of CHWY’s guidance at $1,620-$1,640MM. He is also looking for an EBITDA loss of ($1.2MM) vs. the Street at ($16.1MM), and GAAP EPS of ($0.14), ahead of the Street at ($0.18).

Other key data points to keep an eye on include active customers and net sales per active customers, says Mahaney. For FQ2, the RBC analyst estimates that Chewy will add 700K net new Active Customers (vs. the record 1.6MM net adds in FQ1:20) to reach 15.7MM Active Customers with sales per active customer of $372, implying 6% Y/Y growth.

Taking a step back from earnings, Mahaney believes Chewy has a large and attractive opportunity, with a market leadership position, and a very compelling value proposition for pet owners and suppliers.

“We point out that key differentiators to Chewy’s model include the extremely high-touch customer service, wide product selection, and convenience it offers” he adds, giving it a highly loyal customer base that has enabled it to deliver 100MM+ orders since its 2011 founding. (See CHWY stock analysis).

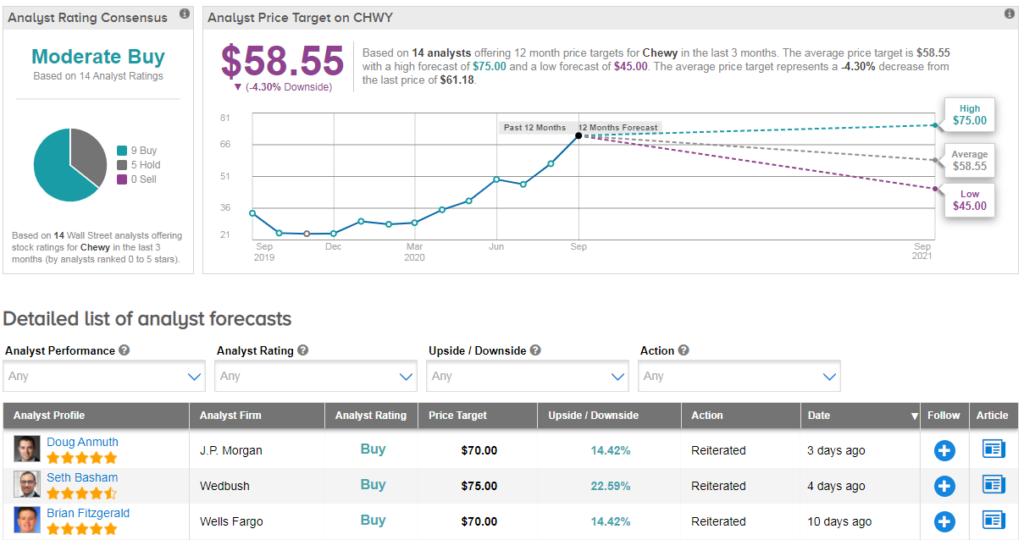

Shares in Chewy have more than doubled year-to-date, and the stock scores a cautiously optimistic Moderate Buy Street consensus. Meanwhile, thanks to the recent rally, the $59 average analyst price target indicates shares can pull back 4% from current levels.

Related News:

Uber, CarTrawler Team Up For New UK Car Rental Service

Verizon Boosts Shareholders’ Return With Dividend Hike

Cooper Companies Gains Over 5% On Strong 3Q Results