Shares of Chinese corporations listed in the U.S. had a strong start to 2023. For context, Alibaba (NYSE:BABA), Baidu (NASDAQ:BIDU), JD.com (NASDAQ:JD), Tencent Holdings Limited (TCEHY), and Pinduoduo (NASDAQ:PDD) stocks have registered double-digit gains. Meanwhile, BABA outperformed its peers and marked an increase of about 22% in 2023. The easing of regulatory headwinds is driving these stocks higher.

Notably, Chinese tech stocks took a significant beating in the past couple of years. The regulatory clampdown by the Chinese government on tech stocks, COVID-related challenges, fear of delisting from the U.S. stock exchange, and overall weakness in the economy dragged the ADS (American Depositary Share) of these Chinese firms lower.

However, the situation is gradually improving for these companies. The Chairman of China’s Banking and Insurance Regulatory Commission, Guo Shuqing, recently said that the crackdown on technology companies is over.

The relaxation of the regulatory crackdown is a positive development for these companies. Given the improving operating environment, Goldman Sachs analyst Ronald Keung added BABA stock to its “Conviction Buy List” and raised the price target to $138 from $133. Keung believes that the worst is over for BABA and expects its earnings to grow at a mid-teens rate through 2025.

What Do Analysts Say About BABA Stock?

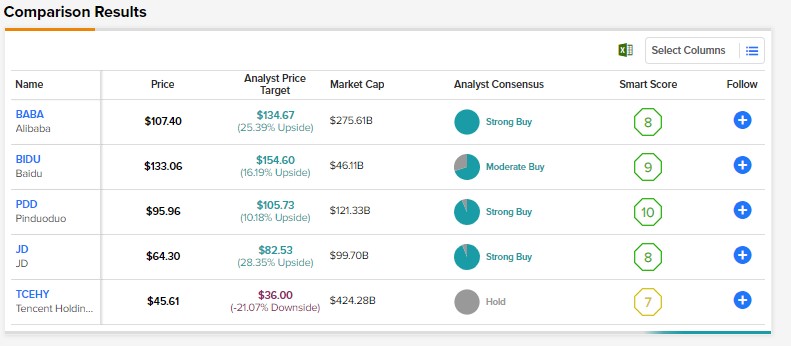

Including Keung, 15 analysts have recommended a Buy on TipRanks. Overall, BABA stock has a Strong Buy consensus rating on TipRanks. Moreover, analysts’ average price target of $134.67 implies 25.39% upside potential.

Bottom Line

The normalization of regulatory pressure and the reopening of the Chinese economy will likely support the financials and shares of Chinese companies.

The TipRanks’ Stock Comparison tool shows that BABA, PDD, and JD stocks carry a Strong Buy consensus rating on TipRanks. Moreover, barring Tencent, these stocks have an Outperform Smart Score on TipRanks. (Stay abreast of the best that TipRanks’ Smart Score has to offer.)

However, the challenges related to the COVID-19 pandemic could hurt the prospects of these companies.