Citigroup Inc.’s (C) shares slid almost 6% after the investment bank reported a 46% profit decline in the first quarter, citing higher loan loss provisions and surging credit costs amid a worsening economic outlook.

Net income in the first quarter fell to $2.5 billion, or $1.05 per diluted share. Analysts on average had expected Citigroup to earn $1.04 per share. Revenues rose to $20.7 billion in the first three months of the year from $18.6 billion in the same quarter last year, driven by income growth from fixed income and equity markets, the investment bank said.

Citigroup’s allowance for loan losses in the quarter surged to $20.8 billion, or 2.91% of total loans, compared to $12.3 billion, or 1.82% of total loans, in the same period a year ago. Following the financial results disclosure the investment bank’s shares dropped 5.8% to $42.86.

“Our earnings for the first quarter were significantly impacted by the COVID-19 pandemic. We managed our expenses with discipline and had good revenue performance as the economic shocks caused by the pandemic weren’t felt until late in the quarter,” said Citigroup chief executive officer Michael Corbat. “However, the deteriorating economic outlook and the transition to the new Current Expected Credit Loss standard (CECL) caused us to build significant loan loss reserves.”

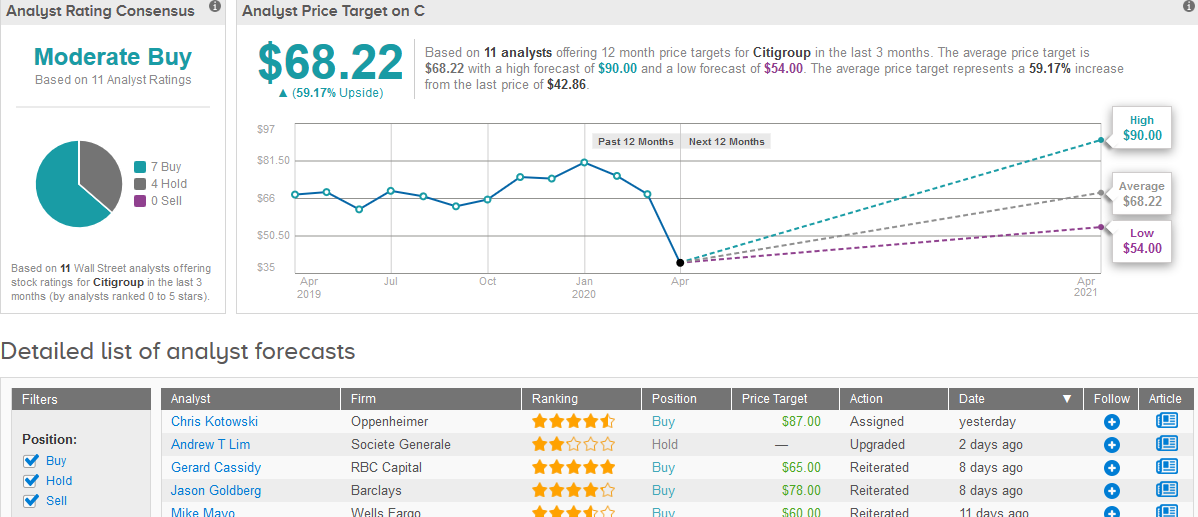

Five-star analyst Chris Kotowski at Oppenheimer yesterday maintained his Buy rating for Citigroup with a $87 average price target. Kotowski’s rating echoes another 6 Buys from Wall Street analysts, while 4 have a Hold on the stock adding up to a Moderate Buy consensus rating. The $68.22 average price target is more conservative than Kotowski’s but still implies 59% upside potential in the coming 12 months.

“All of the work we have done in recent years has put us in a very strong position from a capital, liquidity and balance sheet perspective,” said Corbat. “While no one knows the severity or longevity of the virus’ impact on the global economy, we have the resources we need to serve our clients without jeopardizing our safety and soundness.”

Related News:

Goldman Sachs Profit Plummets 49% as Loan-Loss Provisions Balloon

Costco Ramps Up Dividend By 8%

Arcus Surges 50% In After-Hours Trading On Rumored Gilead Stake