The clock is ticking to stop COVID-19 dead in its tracks, and diagnostics company Co-Diagnostics (CODX) isn’t wasting any time. For investors thinking the story couldn’t get any better after it posted a 1,049% year-to-date gain, think again.

On April 3, its Logix Smart COVID-19 test kit was granted Emergency Use Authorization (EUA) by the FDA for use in detecting the deadly virus. The test has already shown 100% sensitivity and 100% specificity in identifying SARS-CoV-2 without showing any cross-reactivity with other coronaviruses. Not to mention the test is easy to use as well as interpret, and the number of test shipments is steadily rising.

Writing for H.C. Wainwright, five-star analyst Yi Chen acknowledges that current FDA policy doesn’t require CODX to obtain an EUA in order to sell the product in the U.S. However, Chen stated, “The EUA issuance should help the company garner recognition and branding power among potential customers… In our view, Co-Diagnostics’ COVID-19 test would outcompete other PCR tests in the marketplace with its combination of high accuracy and low cost.”

Further explaining the implications of CODX’s test, Chen points out there’s substantial concern surrounding the accuracy of other currently available COVID-19 tests. According to a report published in The Wall Street Journal, health officials estimate that one out of three COVID-19-infected patients are getting a negative test result, implying that the sensitivity rates of these tests are only about 70%. This is incredibly problematic as it allows people to unknowingly spread the virus.

“In comparison, with 100% sensitivity and 100% specificity enabled by the CoPrimer technology platform, Co-Diagnostics’ Logix Smart COVID-19 test appears highly unlikely to produce a false negative or false positive result. In addition, the Logix Smart COVID-19 test does not produce ambiguous results that are hard to interpret. Therefore, we believe the company’s test should experience increasing market adoption in the U.S. and overseas, even though PCR tests from larger firms are available on the market,” Chen commented.

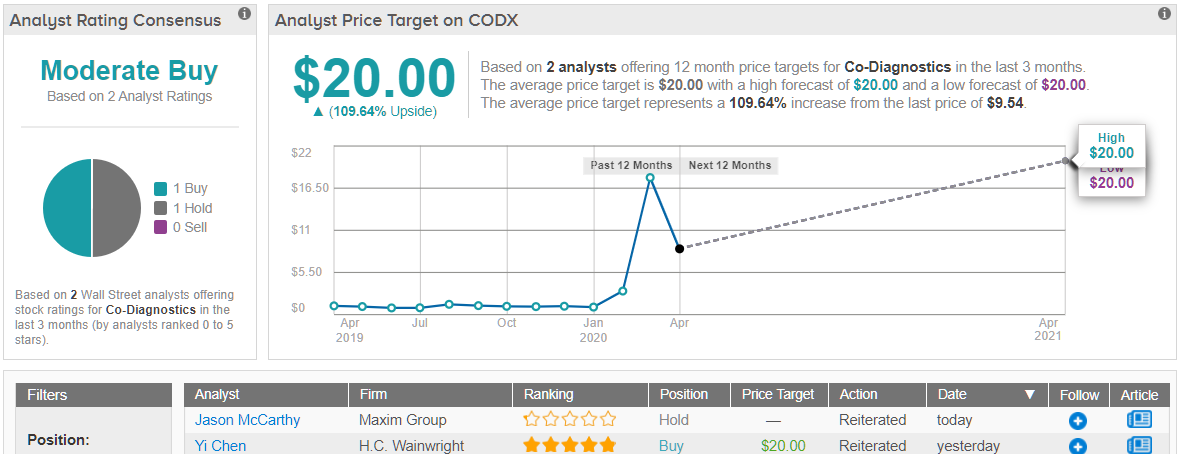

In line with his bullish approach, Chen kept a Buy rating and $20 price target on the stock. This conveys his confidence in CODX’s ability to soar 111% in the next year. (To watch Chen’s track record, click here)

What does the rest of the Street think about CODX’s long-term growth prospects? As it turns out, only one other review has been issued in the last three months. It was a Hold, and thus the consensus rating is a Moderate Buy. At $20, the average price target matches Chen’s. (See Co-Diagnostics stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.