Cogeco Communications (CCA), North America’s 8th largest cable operator, posted an increase in revenue of 3.1% and a slightly higher profit in the third quarter.

Revenue came in at C$624.3 million in Q3 2021, compared to revenue of C$605.8 million in the prior-year quarter. Canadian broadband services revenues increased by 10.2%, while U.S. broadband services revenue increased by 7.2% in constant currency terms.

Profit for the third quarter amounted to C$102.8 million, of which C$95.7 million (C$2.02 per share) was attributable to the owners of the company, compared to C$96.7 million and C$90.8 million (C$1.89 per share) for the corresponding period of fiscal 2020.

The company declared a quarterly dividend of C$0.64 per share.

Cogeco Communications President and CEO Philippe Jetté said, “In Canada, we continue to see positive trends with our Internet services and growth in our residential business, with the changes over the past year in how Canadians work and live. Over the course of the quarter, Cogeco Connexion announced several network expansion projects in collaboration with the governments of Québec and Ontario to expand its high-speed Internet services to underserved and unserved areas.”

On June 30, Cogeco announced that its subsidiary Atlantic Broadband had entered into a definitive agreement with WideOpenWest, Inc. to acquire all its cable systems in Ohio. (See Cogeco Communications stock charts on TipRanks)

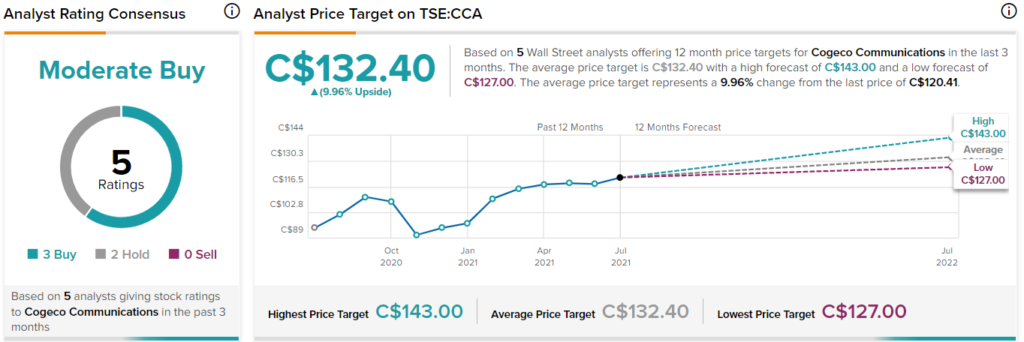

On Tuesday, RBC Capital analyst Drew Mcreynolds reiterated a Hold rating on CCA and set a C$127.00 price target. This implies 5.5% upside potential.

The rest of the Street is cautiously optimistic about CCA with a Moderate Buy consensus rating based on 3 Buys and 2 Holds. The average Cogeco Communications price target of C$132.40 implies upside potential of about 10% to current levels. Shares have gained more than 20% over the past year.

Related News:

Shaw Communications Posts Better-Than-Expected Q3 Results

BlackBerry Q1 Revenue Falls, Beats Estimates

Alithya Loss Narrows in Q4, Sales Hit Record