With one million flights delayed or canceled this winter, airlines have not been on everyone’s good side lately. However, even though Delta (DAL) canceled 8,000 flights in February, traffic increased by 2.4% and passenger revenue per available seat mile (PRASM) rose 4%. Goldman Sachs analyst Tom Kim recently recommended BUY DAL saying, “Delta Airlines is our top pick among our North American airline coverage, driven in part by its cost restructuring strategy.” Tom added that he believes, “the stock will continue to gradually re-rate higher as the carrier’s cost-cutting initiatives support EBITDAR margin expansion in 2014-15E.”

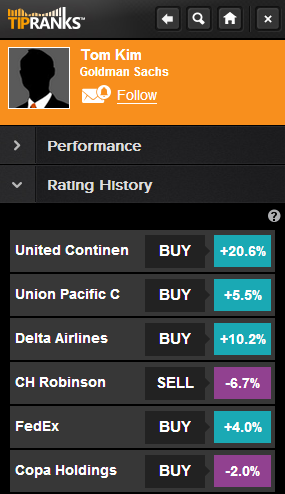

Tom is ranked 197 out of 2428 analysts with a 5.1% average return and a 69% success rate of recommended stocks. Tom earned this position by successfully recommending aviation companies like DAL as well as, United Continental (UAL) and Union Pacific Corp. (UNP).

Tom’s last BUY DAL recommendation from the end of 2013 earned him a strong positive return. “On October 2, DAL provided an encouraging operating update for September. PRASM growth last month accelerated to +5.5% yoy, albeit off easier yoy comps. Notably, the gains came on the back of improvements on the Transatlantic an domestic markets.” Tom earned +10.2% over S&P-500.

Most recently, Tom recommended BUY United Continental (UAL) despite the fact that the company was trailing behind its fellow airlines. Tom argued, “1) The carrier has been an under-earner that we think is poised to post outsized earnings growth in 2014. We expect EPS to almost double in 2014 to $4.87. (2) The stock is undervalued versus its global network peers.” This recommendation earned Tom +20.6% over S&P-500.

And Tom earned another positive return when he recommended BUY Union Pacific (UNP) earlier this year. Tom upgraded his recommendation from HOLD to BUY with a price target of $176 because he saw an opportunity for an attractive entry point. Tom noted, “We believe the correction in the stock price has created a good entry point, as our long-term thesis remains intact. UNP has a solid franchise with a diverse revenue mix. We believe its exposure to crude by rail should bolster medium-term earnings growth, while contributions from cross-border traffic should provide an incremental edge over its Class I peers over the long term.” Tom earned +5.5% over S&P-500.

But while Tom has earned some significant returns, he has incurred some losees along the way. In June of 2013 Tom recommended SELL C. H. Robinson Worldwide (CHRW) counting on “underperformance to persist.” However, the stock did not continue along a negative path and Tom lost -6.7% over S&P-500.

Clear skies are on the horizon, allowing for scheduled flights and on-time departures. To continue following Tom’s recommendations as the airlines (hopefully) return to their normal routines, be sure to download TipRanks and start making informed financial decisions with advice you can trust.