As we face the likelihood of significant shifts in economic policy under incoming President Trump, it’s time to start taking a closer look at financial stocks. While you might think first of bank stocks, the finance sector includes much more – everything from insurance companies to fintech, and acts as a bellows for the overall economy.

Trump’s first term saw solid economic growth, sparking high hopes for a repeat in the next few years, and growth is always positive for the banking and financial sector. The conventional wisdom sees the likelihood of growth outweighing the Federal Reserve’s move toward rate cutting, and that finance will see a net positive in the near- to mid-term.

This has Compass Point analyst Dominick Gabriele taking a positive look at fintech, the melding of finance and high tech, and telling investors that it’s time to load up on two tech-oriented financial service stocks.

According to the TipRanks database, both of these stocks are Buy-rated and have already seen solid growth in recent months; let’s look into the details, and find out why the Compass Point analyst believes that their good times will keep on rolling.

Fidelity National Info (FIS)

The first stock up, FIS, or Fidelity National Information Services, is one of the finance market’s major tech players. The company acts as a third-party service provider in the financial industry, processing payments and clearing transactions across the financial industry. The company counts more than 5,800 client firms across 150 countries, and services approximately $8 trillion in assets.

Fintech isn’t just big business, it’s huge. Overall, the industry is estimated by Mordor Intelligence to reach more than $600 billion by 2029, and Fidelity National Info has leveraged its expertise to generate nearly $10 billion in total revenues last year. The company boasts a market cap exceeding $46 billion. Shares in FIS have outperformed the overall markets in recent months; the stock has gained over 45% year-to-date, compared to the 25% gain on the broader S&P 500 index in the same time period.

When we look into FIS’s financial results, last reported for 3Q24, we find that the company reported $2.6 billion in revenue, up 4.4% year-over-year and some $40 million better than had been expected. The non-GAAP EPS figure came to $1.40, 11 cents per share better than the forecast. Looking ahead to the end of the year, FIS has adjusted its full-year revenue forecast upwards to the range of $10.14 billion to $10.17 billion, compared to the consensus estimate of $10.15 billion. The EPS guidance for 2024 was revised upwards to between $5.15 and $5.20, above the $5.13 consensus expectation.

For Compass Point’s Dominick Gabriele, this company holds a solid growth position in a growing industry. He writes of the stock, “We expect a return to pre-COVID valuation as banking segment revenue accelerates to 4.4% YoY in 2025 and holds at 4% in 2026. Our analysis inside leads us to believe FIS can meet or exceed consensus EPS expectations in 2025 and 2026 with room to reach 13% EPS growth in a blue sky scenario. FIS continues to beat consensus expectations since 2023, and we believe investors are gaining confidence in FIS’ management team to deliver on financial metrics. We see both revenue and adjusted EPS YoY growth acceleration in 2025 and 2026 as return on invested capital (ROIC) improves.”

Gabriele adds, of this stock’s high potential for the near-term, “FIS is traditionally viewed as a defensive stock but given a potential re-rating, we believe FIS’ stock is attractive even as investors search for beta post U.S. presidential election results.”

The analyst goes on to put a Buy rating on the shares, along with a $126 price target that implies a one-year upside potential of 46%. (To watch Gabriele’s track record, click here)

FIS has picked up 20 recent analyst reviews, and their overall breakdown of 10 Buys, 9 Holds, and 1 Sell gives the stock a Moderate Buy consensus rating. The stock is selling for $86.08 and its $98.80 average price target suggests that it will gain 15% in the coming year. (See FIS stock forecast)

The second stock we’ll look at here is Fiserv, which has been in the fintech business since 1984, and has built itself up into a $126 billion giant of the industry. The company uses digital tech to move money and information, the key assets of the financial industry. Fiserv is committed to bringing both excellence and innovation to the fintech sector, and has made its service applicable to every aspect of the finance world, at any scale imaginable: banks and credit unions, large enterprises and financial institutions, software providers, small businesses and individual customers. The company’s services are available to customers online, or via a smartphone app.

In terms of actual services, Fiserv offers solutions for account processing and digital banking, as well as networking and card issuer processing. The company can handle a variety of e-commerce tasks, including payments, merchant acquisition, and customer and merchant account management. Fiserv saw more than $19 billion in revenues last year, and its stock is a component of the S&P 500.

That last point is important, as FI shares have outperformed their parent index by a wide margin recently. The stock is up more than 67% this year; as noted above, the S&P 500 has gained ~25% during the same time.

In the third quarter of this year, its last reported, Fiserv had an adjusted revenue total of $4.88 billion, flat year-over-year and just missing the forecast by $30 million. The bottom-line figure, presented as a non-GAAP EPS of $2.30, was 4 cents better than had been anticipated. Along with these results, the company reported a 23% increase in free cash flow during the first nine months of 2024, to a total of $3.34 billion. Fiserv also raised its outlook for 2024 revenue growth to the range of 16% to 17%.

Checking in again with Compass Point’s Gabriele, we see that the analyst is impressed with Fiserv’s continued growth and solid business model. He says, “FI is a steady compounding business with a trusted management team. FI has a strong mix of recurring SaaS revenue in their financial solutions segment (49% of total revenue) and cyclical upside in their merchant segment (51% of total revenue) with overall recurring revenue at ~85%. We believe this mix of business provides a unique balance to generate LT double-digit EPS growth with rising return on invested capital (ROIC). We believe FI can produce accelerating EPS growth in both 2025 and 2026 to ~19%.”

These comments are presented along with a Buy rating on the stock – and the analyst’s price target, now set at $278, implies an upside of 25.5% in the year to come.

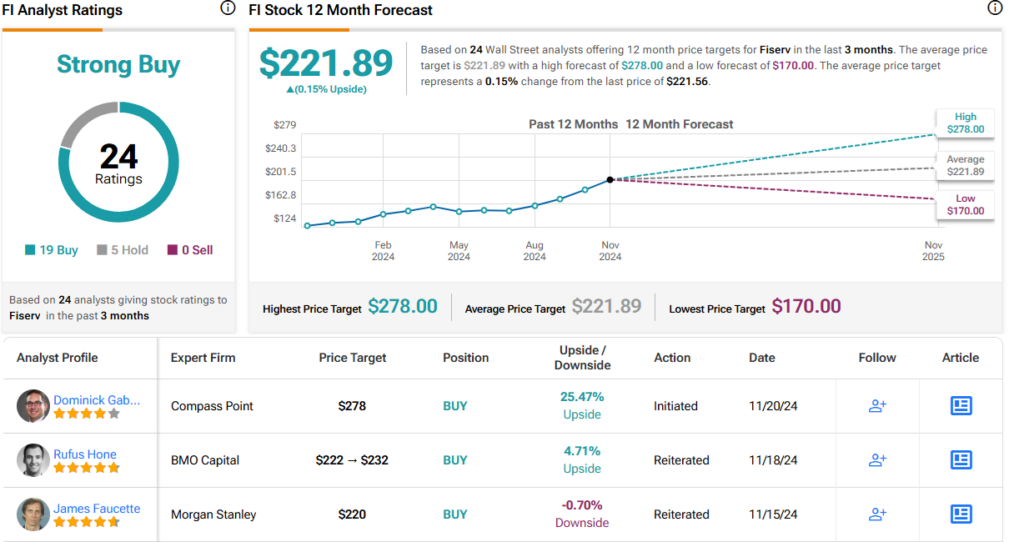

There are 24 recent reviews on record for FI shares, and these include 19 Buys to 5 Holds for a Strong Buy consensus rating. The stock’s rapid gains this year have pushed the share price almost to the $221.89 average target price. It will be interesting to see whether analysts update their targets or downgrade their ratings shortly. (See FISV stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.