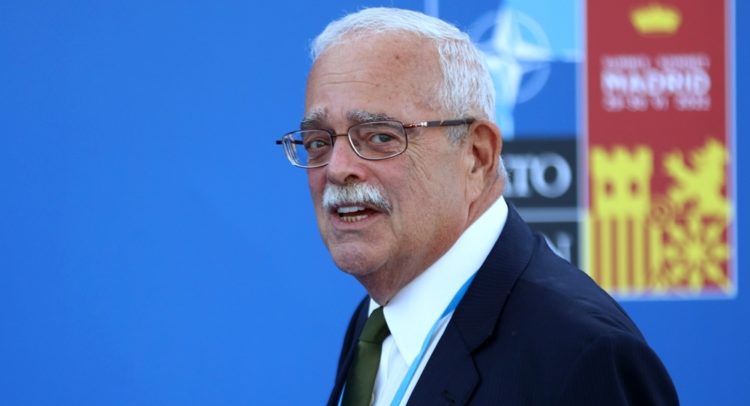

According to CapitolTrades.com, a platform providing politician trading data, Gerry Connolly, the U.S. representative for the 11th District of Virginia, has recently sold shares of Dominion Energy (NYSE:D) and Leidos Holdings (NYSE:LDOS).

Per the data, Connolly made these trades in December 2022. The Dominion Energy trade had a transaction size range of $1-$15K. Meanwhile, Leidos Holdings had a transaction size range of $15-$50K.

Using TipRanks’ data, let’s examine what’s on the horizon for D and LDOS stocks.

Why is Dominion Energy Stock Dropping?

Dominion Energy’s management announced a business review plan focusing on capital allocation and the regulatory option to maximize shareholders’ returns. However, the uncertainty related to the review plan, higher interest rates, and regulatory issues irked investors.

Notably, Wells Fargo analyst Sarah Akers downgraded the shares of this power and energy company to Hold and reduced the price target to $64 from $73. Akers listed balance sheet concerns, earnings uncertainty, and the company’s track record issues as the main reasons for the downgrade.

Overall, on TipRanks, Dominion Energy stock has received one Buy, 10 Hold, and one Sell recommendation, leading to a Hold consensus rating. Furthermore, analysts’ price target of $68.55 indicates 9.54% upside potential.

Our data shows that hedge funds sold 238K shares of Dominion Energy last quarter. Meanwhile, Dominion Energy carries a Neutral Smart Score of five.

Is LDOS Buy or Sell?

Leidos Holdings is a technology and engineering company focused on defense, health, and aviation. On TipRanks, LDOS stock sports a Moderate Buy consensus rating reflecting seven Buy and four Hold recommendations. Further, analysts’ price target of $120.09 implies 22.82% upside potential.

LDOS’ diversified portfolio, increase in defense spending, and new business wins keep most analysts optimistic. However, higher interest rates will likely remain a drag.

Cowen & Co. analyst Cai von Rumohr said, “LDOS’ est. above-avg. growth/margins and 12.0x TEV/EBITDA still merit an Outperform; but potential for a below-consensus guide could be a near-term cap for the stock.”

Along with analysts, hedge funds are optimistic about LDOS. Per our data, hedge funds bought 391.3K shares of LDOS last quarter. LDOS stock has a maximum Smart Score of “Perfect 10.”

Bottom Line

It could be profitable for retail investors to follow the politicians’ trades. Also, investors can leverage TipRanks’ Experts Center to trade confidently.

As for Dominion Energy, the uncertainty related to its business review plan, analysts’ Hold consensus, and Neutral Smart Score implies limited upside potential. Meanwhile, ongoing business momentum and the “Perfect 10” Smart Score indicate LDOS could outperform the broader market.