Shares of Copart rose 4% in after-market trading on Wednesday after the online auction and vehicle services provider reported better-than-expected 4Q results.

Copart’s (CPRT) 4Q revenue of $525.7 million came ahead of the Street consensus of $420.1 million. It’s adjusted EPS jumped 15% to $0.69 year-over-year and surpassed analysts’ expectations of $0.39.

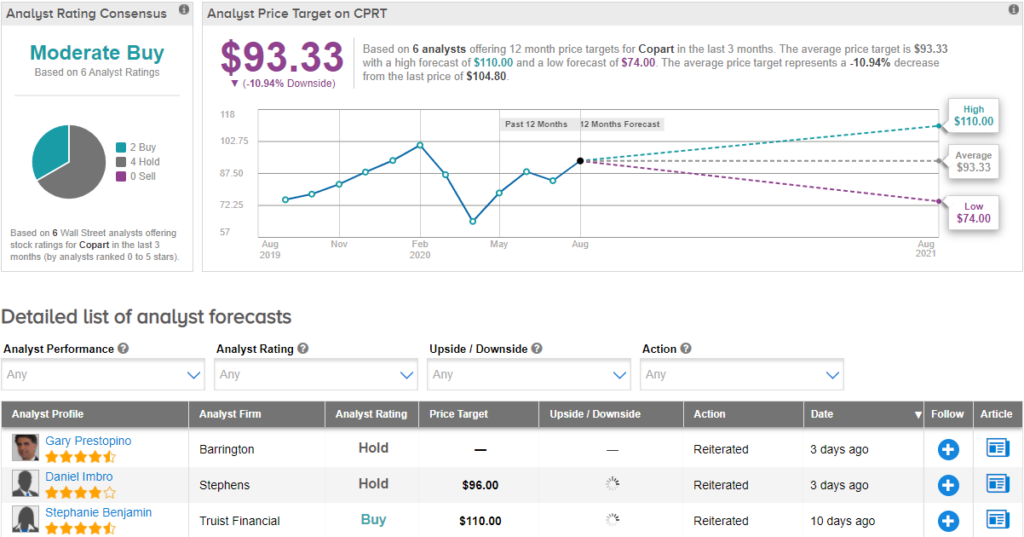

On Aug. 31, Barrington Research analyst Gary Prestopino reaffirmed his Hold rating on the stock citing stronger-than-expected improvement in vehicle miles driven. Prestopino noted that “Since late April, the market has seen a stronger improvement than originally anticipated with markets reopening and vehicle miles driven rebounding from the March-April time frame.” (See CPRT stock analysis on TipRanks).

Overall, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 2 Buys and 4 Holds. The average price target of $93.33 implies a downside potential of about 11% to current levels. Shares are up more than 15% year-to-date.

Related News:

Roth Lifts Gogo’s PT After Commercial Aviation Unit Sale

DraftKings In The Spotlight As Michael Jordan Joins Board; Stock Rises 4%

Medtronic’s Organizational Revamp To Cut Costs By Up To $475M