Gilead Sciences (GILD) has positioned itself at the front line in the global war against COVID-19. The biotech’s experimental drug remdesivir is currently in two Gilead sponsored Phase 3 trials in over 90 locations, and two further investigator sponsored Phase 3 trials in China. The drug is currently registered in 11 ongoing trials, from which a handful of data readouts are expected in the next 2 to 6 weeks.

So far, remdesivir has shown powerful in vitro efficacy against RNA viruses in cell-based assays and evidence of efficacy in both in California and Washington states; Additionally, there has also been some anecdotal evidence from American cruise passengers, as well as locals, treated in Japan.

Oppenheimer’s Hartaj Singh noted, “We believe GILD likely has further positive in-vitro data from Chinese CDC in nonhuman primate (NHP) cells and potentially also from US CDC in human cells.” Yet, Singh remains “cautious going into the impending data readouts,” due “the limited data against human patients.” And compared to the ongoing Gilead Phase 3 trials, the Chinese studies have broader inclusion and exclusion criteria, leading to fears there will be mixed results displaying no clinical significance on account of “too heterogeneous a patient population in both studies.”

Singh concluded, “As we approach the impending Chinese (April) and GILD (May) Phase 3 readouts, we caution investors to NOT expect a simple Yes/No outcome. We believe the outcomes will be more nuanced and our recent KOL (key opinion leader) calls indicate that physicians will be comfortable with less-than-perfect results.”

To this end, Singh reiterates an Outperform rating on Gilead shares, along with an $80 price target. The figure implies possible upside of a modest 5% from current levels. (To watch Singh’s track record, click here)

All in all, Gilead has been one of 2020’s success stories, with shares rising nearly nearly 15% versus the S&P’s 20% loss. The biggest question for investors, then, is whether those gains are likely to continue. Looking at the consensus breakdown, opinions from other analysts are more spread out. 10 Buys, 9 Holds and 2 Sell ratings add up to a Moderate Buy consensus. In addition, the $76.88 average price target indicates just a slight upside from current levels.

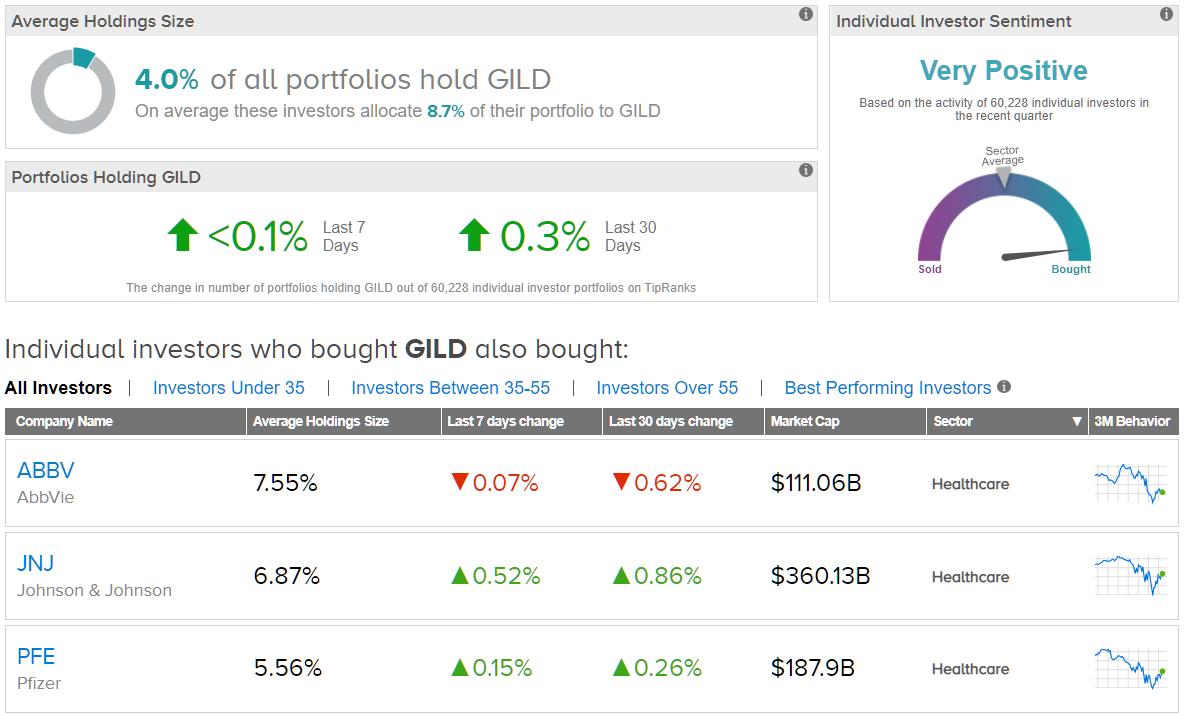

Importantly, Gilead boasts a 10 score from TipRanks Smart Score. That’s thanks to a combination of bullish datapoints, including a bullish positive sentiment from investors, increased hedge fund activity, positive news sentiment and even bullish opinions from the financial blogging community. (See Gilead stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.