On Monday evening, biotech Moderna (MRNA) announced that it has filed an Investigational New Drug (IND) application with the U.S. Food and Drug Administration (FDA), seeking approval to market the company’s new mRNA vaccine candidate (mRNA-1273) as a prophylactic to prevent infection with the novel coronavirus (SARS-CoV-2).

mRNA-1273 is currently undergoing Phase 1 clinical trials led by the National Institute of Allergy and Infectious Diseases under the National Institutes of Health, and if the results of these Phase 1 trials justify it, Moderna would like to proceed directly into a planned Phase 2 study in the second quarter of 2020.

In that latter study, Moderna proposes to enroll 600 healthy participants to undergo two vaccinations with mRNA-1273, given 28 days apart, in order to “evaluate the safety, reactogenicity and immunogenicity” of the vaccine in preventing infection with COVID-19.

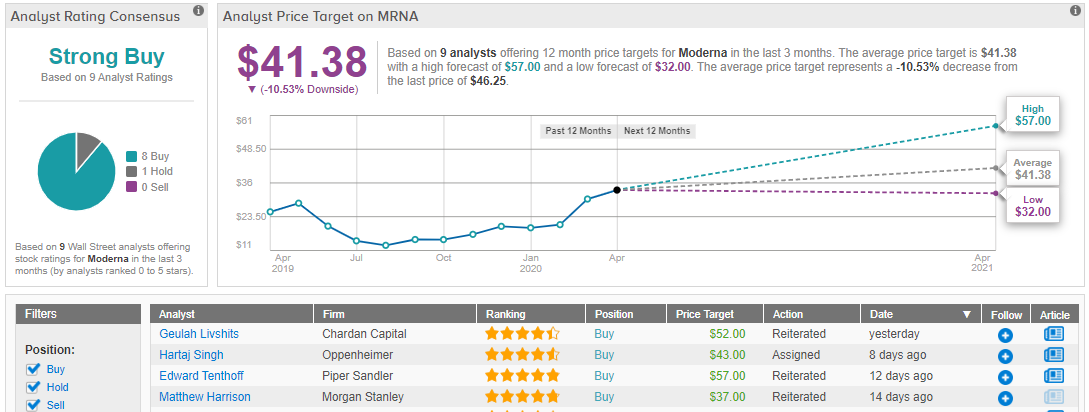

News that Moderna has filed its IND already sparked a quick reaction on Wall Street, where Chardan analyst Geulah Livshits promptly raised her price target on the already buy-rated stock 30%, from $40 a share to $52. (To watch Livshits’ track record, click here)

As Livshits explained in her note, Moderna has already “received feedback from the FDA regarding its trial design,” and “has been manufacturing mRNA-1273 material in anticipation of a phase II trial for the past month” already. Indeed, Livshits believes that “it is quite likely some older volunteers have already been dosed,” so the Phase 2 trial could almost be said to be underway already. The analyst notes further that “no major unexpected safety signals associated with the vaccination itself have been seen thus far,” which is certainly a promising way for the drug to be beginning its Phase 2 trials.

Assuming all goes well, furthermore, Livshits predicts that the drug could move right ahead into Phase 3 clinical trials as early as “fall 2020.”

Now what does this mean for the stock? The answer may surprise you.

Investors’ focus on “COVID-19” and its potential cures is entirely understandable. Notwithstanding this, however, Livshits suggests that the “long-term sales projections for mRNA-1273” will be only “modest,” “given limited visibility on commercial prospects for the program in the long term.” (I.e., in an ideal situation, COVID-19 will be quickly cured or rendered moot, such that there won’t be a huge market for the vaccine going forward). Long-term, the analyst places greater emphasis on Moderna’s Epstein-Barr virus (EBV) vaccine, and the company’s autoimmune programs as having greater commercial potential.

That being said, Livshits does believe there is some potential for profit from mRNA-1273 as well, as governments may decide to stockpile the coronavirus vaccine in 2021-22, against the potentiality of a renewed outbreak of COVID-19. The analyst believes such stockpiling could yield sales of as much as $800 million for Moderna in the 2021 to 2022 period, and perhaps $50 million in incremental sales annually thereafter.

For a company that only did $60 million in revenue in all of 2019, that should be enough to move the needle quite nicely. We may receive an additional update on the phase I trial enrollment with Moderna’s 1Q20 results on 7 May 2020.

Overall, Livshits’ bullishness gets the backing of her colleagues, as the rising mRNA-vaccine maker currently has a Strong Buy rating from the Street. However, the 12-month average price target stands at $41.38, which would have indicated much upside last month, before the share price’s incredible rally, but now indicates about 10% downside. This is partly due to the fact analysts have yet to update their ratings following the run up. In the coming days, though, it remains to be seen, whether Moderna can hold on to today’s massive gains. (See Moderna stock analysis on TipRanks)