Costco Wholesale (NASDAQ:COST) is scheduled to release its third-quarter Fiscal 2023 results today, after the market closes. The retailer is expected to have benefitted from rising memberships in the to-be-reported quarter.

Nevertheless, given the inflationary pressures, Costco may have been impacted by lower demand for discretionary products and a slowdown in e-commerce.

Overall, the Street expects Costco to post earnings of $3.29 per share in Q3, nearly 8% higher than the prior-year period figure of $3.04. Meanwhile, revenue is pegged at $54.5 billion, representing year-over-year growth of 3.6%.

Earlier in May, Jefferies analyst Corey Tarlowe reiterated a Buy rating on Costco following its April sales data. In Tarlowe’s opinion, Costco benefits from its “channel shift from traditional grocery, department stores, and specialty retail.” Additionally, he sees it as a plus that the business can draw in customers of all ages with its alluring membership club products.

Is COST Stock a Good Buy?

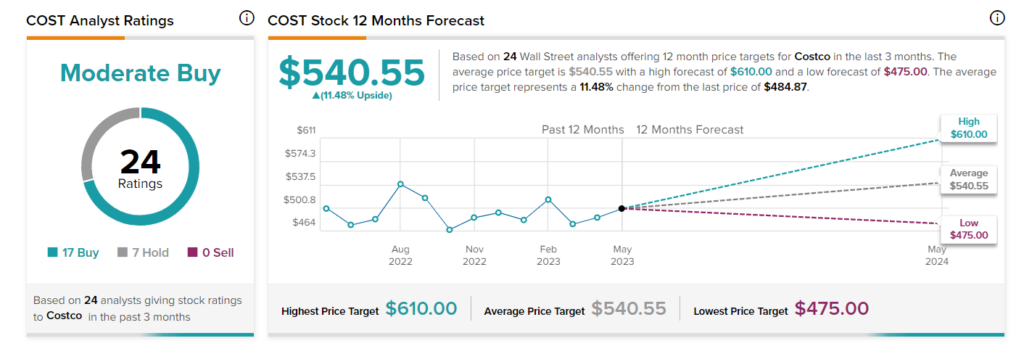

Wall Street is cautiously optimistic about Costco stock. It has a Moderate Buy consensus rating based on 17 Buys and seven Holds. The average stock price target of $540.55 implies 11.5% upside potential. COST stock is up 7.4% so far this year.

Ending Thoughts

Costco’s ability to expand globally by opening 27 new stores in 2023 should support the retailer’s top and bottom line figures. Furthermore, the company’s value pricing strategy and loyal customer base position it well to perform well amid all market conditions.