Warehouse supermarket chain Costco (COST) has reported net sales of $15.49 billion for the retail month of March, an increase of 11.7% from $13.87 billion last year. Comparable sales trends in the US also remained strong with a 12.1% US comp increase for the month of March.

Similar to other retailers, COST is also seeing surging consumer demand online with e-commerce sales accelerating by 49.8% in March.

However, the results do suggest a recent softening. “We believe this reflects a pull forward in demand, restrictions in stores impeding customer traffic, shoppers browsing less in discretionary areas, and the shutdown of select services” writes Oppenheimer’s Rupesh Parikh.

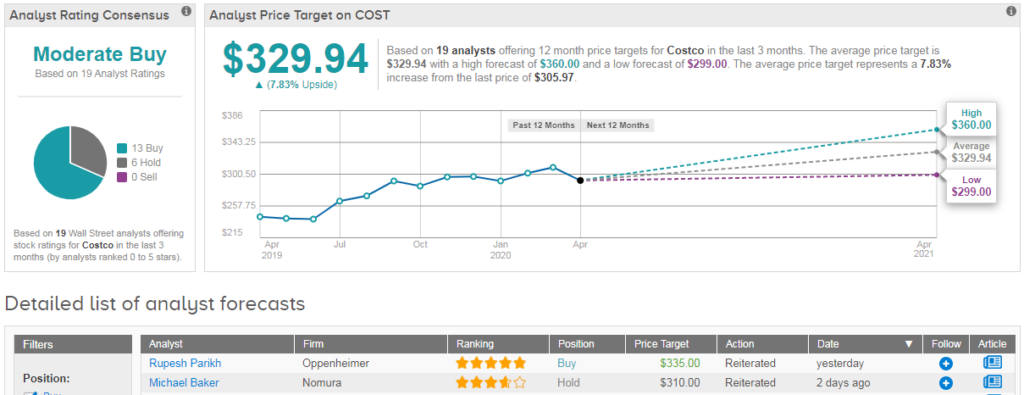

He recommends that investors take advantage of a likely continued volatile trade from here, adding “sales trends could slow further from here.” The analyst reiterated his COST buy rating on April 8 with a $335 price target (9.5% upside potential). COST shares have meaningfully outperformed year-to-date, up 4% vs. a 15% decline in the S&P 500.

Net-net, Parikh is staying firmly onside when it comes to Costco stock: “We view COST as both an attractive shorter-term beneficiary of money flows related to coronavirus fears and a longer-term winner, which should help to drive continued outperformance.”

The rest of the Street is slightly more cautious; the stock shows a Moderate Buy consensus on TipRanks with a $330 average price target. (See Costco’s stock analysis on TipRanks)

Related News:

Morgan Stanley: 2 Stocks to Consider Buying (And 1 to Forget)

Stitch Fix Reveals Significant Logistics Disruption, Withdraws Guidance

Starbucks Feels The Pain; Expects 46% Fall In Earnings, Pulls Full Year Guidance