What can be said about Q2 2020 earnings expectations that hasn’t been said already? According to Factset we should be prepared to see S&P 500 profits decline by 43.8% year-over-year (YoY). It’s probably not even worth mentioning what that expectation was pre-COVID, but I will anyways… 4.4% on December 31. Q2 earnings season is on tap to be the worst since Q4 2008, and depending on whose data you use that quarter reported -69.1% (FactSet), -52.4% (S&P Global Market Intelligence), or -65.2% (Refinitiv (Thomson Reuters)). It’s all bad, and we’re frighteningly close to those all-time lows, a lot of negative surprises could make that a reality.

Could estimates be more accurate due to the lack of corporate guidance??

To my last point, you might be thinking, “But we never see a lot of negative surprises! Companies always beat!” And that’s true, on average over the last 10 years ~70% of S&P 500 companies have beaten quarterly earnings expectations. John Butters at FactSet says the 5 year average is even higher at 73%, and companies beat by an average of 5 percentage points. Because of this, throughout my career covering earnings I’ve gotten into the habit of looking at the consensus estimate for profit growth at the beginning of the season and bumping it up by 5 percentage points. For example, the -43.8% then would become -38.8%. This consensus expectation is based on sell side estimates, which are in turn based on corporate guidance. But what happens when there is no corporate guidance for Wall Street to go off of?

Around half of S&P 500 companies have withdrawn previous Q2 guidance or simply never issued it in Q1 reports as they typically do. We know the sell side leans heavily on corporate guidance, never straying too far from those numbers in order to keep the lines of corporate access open. We also know companies issue conservative guidance so they beat expectations and see a pop in their stock price on reporting day.

My prediction is that the lack of short-term guidance from corporations will lead to more genuine analyst estimates for the Q2 2020 season. I’m hesitant to say this will mean more accurate estimates, as the climate is still pretty uncertain…. but with that said, analysts had one quarter to analyze quarterly results with a COVID backdrop and should be pretty clear on the implications this summer with the absence of an official treatment or vaccine. Because of that I do think the final consensus for the S&P 500 will have an earnings surprise much lower than the historical 4.9%, with a beat rate well below the historical average of ~70%.. I’d guess somewhere in the low 60s would be fair, inching closer to that 50% mark which statistically is what we should see.

Will COVID finally put an end to quarterly corporate guidance? (We are hoping yes!)

Predictions about how COVID will change things permanently have been flying around for months, an acceleration of trends that had already begun… more remote work, at home fitness etc. Maybe this will kick off a new era of companies only providing longer-term guidance which many in the industry have been calling for consistently over the years.

In February 2016, BlackRock CEO Larry Fink, famously wrote a letter to the CEOs of S&P 500, asking them to curb activities that encourage short-termism, chief among them was the issuance of quarterly EPS guidance. His plea was a focus on long-term growth frameworks. “To be clear, we do believe companies should still report quarterly results — “long-termism” should not be a substitute for transparency — but CEOs should be more focused in these reports on demonstrating progress against their strategic plans than a one-penny deviation from their EPS targets or analyst consensus estimates.”

Jaime Dimon and Warren Buffet then revived that conversation in 2018 in a Wall Street Journal column, urging public companies to discontinue the practice of providing quarterly earnings for the same reasons Fink did two years earlier — this ritual forces companies to focus on managing a number in the short-term, rather than focusing on creating long-term value for shareholders.

And research has shown that guidance is more or less useless and a time suck to boot. A McKinsey paper in 2006 concluded that providing quarterly guidance does not impact valuations or returns, but it does require a copious amount of time from senior management to prepare reports.

It seems like a good time for companies to start doing away with this practice now that most have waded in, intentionally or not.

When every sector is a laggard

Here’s the part where I would usually break down the leading/lagging sectors. But there are actually no “leaders” this quarter in terms of profit growth, with only a few sectors showing slight revenue growth. Allow me to explain.

Laggards

Energy

This one is a doozy, with profits for the sector expected to fall -148.3% (all sector estimates from FactSet) YoY. Energy is also the biggest revenue laggard with the top-line anticipated to drop 42.2%. Slower demand for oil due to COVID and the resulting oil price war between Russia and Saudia Arabia have suppressed the sector, with no signs of a summer comeback that would match a typical year. With that said, oil prices logged their best quarterly performance since the Gulf War in Q2, yet are still down 30%+ for the year.

Consumer Discretionary

Another obvious one here as consumers are not consuming as much as they would have this time of year. Even as retail and restaurants try to open back up, increasing coronavirus infections have softened some of those plans. Consumer Discretionary is right on the heels of the Energy sector, with profits anticipated to be down 119% for Q2. There are of course names in the space doing well at this time.. AMZN, HD, PTON are just a few of the names we like.

Industrials

The Airlines and Aerospace sub-sectors are dragging this one down, with Boeing, Southwest Airlines and Delta weighing most heavily. All 5 airlines in the S&P 500 (United, Alaska, Southwest, Delta, American) have seen their price targets dropped in the last 3 months, with United Airlines seeing the biggest drop of 44% over that time. Two weeks ago Delta warned thousands of its pilots about a potential furlough on the horizon as revenues for 2020 are anticipated to only reach 25% of what they were last summer, others are expected to follow suit.

With that said, price targets for some of these names have started to make a slow comeback in the last couple of weeks. One name to highlight is LUV, as it showed up on our “Top Recommended Stocks” screener this week. SouthWest has seen it’s consensus price target from the top analysts decrease by 7% in the last quarter, but potential upside over the next 12-months still stands at 40%.

Financials

Banks kick off the Q2 season next week, and expect more of the dismal results seen in Q1. Yes there will continue to be some bright spots, mainly brought about by higher trading volumes in what was another volatile quarter, but whether they beat or miss will be of little interest to investors who will be tuned into loan-loss provisions with laser focus. According to the FDIC report in June, banks set aside $52.7B in Q1 for potential loan losses, a 280% increase from the prior year. Even considering what a huge number that is, there is no doubt amongst analysts that this number will have to be increased in coming quarters.

“Leaders” – but not really

Utilities

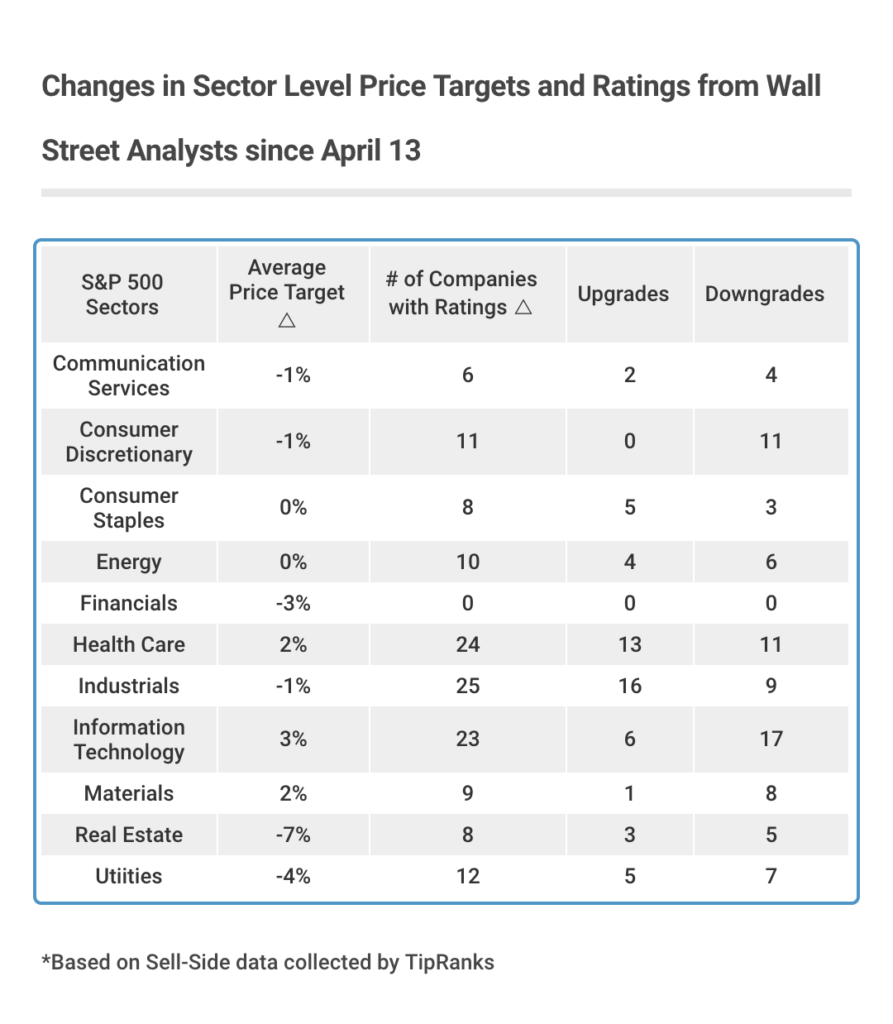

Like mentioned, there are no leaders this season, so let’s just call these “less bad laggards.” Utilities leads that list with an expected profit decline of -0.4%. Despite earning this very special accolade, don’t expect investors to retreat to defensive names. In fact, the aggregated 12-Mo PT from Wall Street has fallen 4% (see chart below) for S&P 500 Utilities constituents, the second most of any sector behind Real Estate at -7%.

Health Care

Health Care has gotten a lot of attention since March, as pharma and biotech names both big and small work on COVID therapies and vaccines. Health Care profits are expected to decline 14% YoY, yet revenues are anticipated to be up slightly at 0.5%. The sector has seen the second largest increase in Price Targets, and the second highest number of ratings upgrades in the last quarter (see chart below).

Information Technology

Big tech has been a strong point throughout the volatility this year, with names like AMZN, AAPL, MSFT, FB all closing at all time highs last month. YoY earnings for the sector are still expected to be down 9.5%, with revenues down 1.2%. This sector has seen Price Targets increase an average of 3%, the most of any sector.

Nearly 20% of S&P 500 companies have been downgraded

The chart below shows the average Price Target increase/decrease by sector since April 13 (the beginning of the last earnings season), as well as the number up ratings upgrades and downgrades by sector.

But that’s not all….

Geopolitical tensions will also be competing for investor attention this season, as US/China relations are continually more strained, the US threatens additional import duties on Europe, and OPEC continues its quest to lower crude production.

Also, the end of the government stimulus program will come just as Q2 earnings season hits its stride, and at a time when US workers may be losing their jobs for a second time since March as states that maybe opened up more quickly start to scale back to curb increasing coronavirus infections.

Saddle up

Despite gearing up for what’s anticipated to be the worst earnings season since the great recession, there is some comfort in knowing that these terrible estimates are already priced in, and that Q2 is expected to be the trough/things should get better from here. These days it’s hard to know if huge misses this season could truly shock the markets, they haven’t necessarily been reacting to the earnings reports, but as always we’re prepared for an ‘anything can happen’ season.