The COVID-19 vortex is sucking in heavyweights and is not done just yet. Industrial titan General Electric (GE) has found it difficult to pull away, with bad news mounting by the day. Cowen analyst Gautam Khanna sees no turnaround on the horizon, noting the “bull case is entirely stale.”

“GE’s FCF turnaround prospects have eroded, given the sharp and protracted decline in Aviation. This extends the prospective “hangover”, for years, from debt-equivalent items that will rise (debt; pension/long-term care deficit; etc),” said the 5-star analyst.

The sharp decline is mostly on account of GE’s heavy dependency on the commercial aviation sector. As the company’s key cash flow generator, GE Aviation’s importance cannot be underestimated. The segment brought in $32.9 billion in revenue in 2019, while generating $4.4 billion in FCF, which helped in countering cash outflows in the power and renewable energy segment.

On Monday, GE announced it will cut 13,000 jobs from the Aviation payroll, amounting to 25% of its workforce, as the coronavirus pandemic’s impact has resulted in a “deep contraction” of the commercial aviation industry. The job cuts are part of recently announced cost-cutting plans. For the rest of the year, GE expects to reduce operational costs by more than $2 billion and save over $3 billion more in “cash preservation activities.” Yet, despite the cost cutting measures, Khanna sees more hard times ahead.

“We believe Q2 FCF will be highly negative (perhaps $4B burn), and Q3 may remain negative, even with restructuring saves. E.g If A/M sales double in Q3 vs. Q2, A/M sales would rise by under $1B (& FCF would rise by less), and some items (like aero OEM) will stay lower for years,” said the analyst.

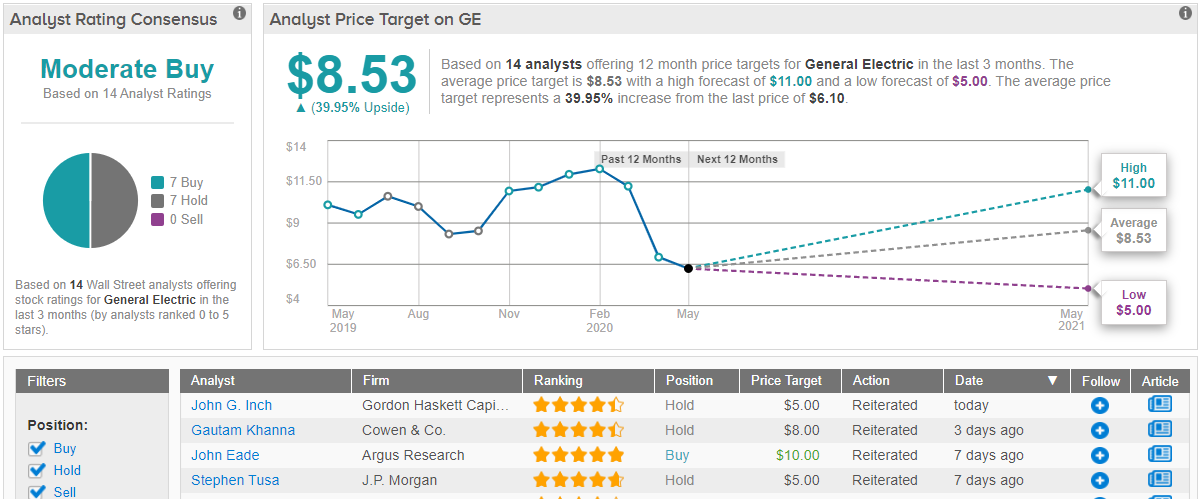

To this end, Khanna reiterated a Market Perform (i.e. Hold) rating on GE shares along with an $8 price target. With GE stock in the doldrums, the figure implies upside of 31%. (To watch Khanna’s track record, click here)

The Street’s outlook for GE is currently split down the middle, with 7 Buy and Hold ratings, each. The bulls have the edge, though — the average price target is $9.03 and implies upside of 45% over the next year. (See GE stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.