It has been a record-breaking year for the stock market, with new highs repeatedly being reached. The S&P 500 has broken its all-time-record 19 times this year, overall making 25% gains. Traditionally, or more accurately, 71% of the time, when the S&P 500 has recorded such annual gains, the rally continues the following year.

According to leading investment bank Credit Suisse, next year won’t be an anomaly. The Swiss institution’s chief U.S. equity strategist Jonathan Golub says healthier revenue growth, reduced profit headwinds, and a reversal of slowing economic data are among reasons why the market could gain another 10% by the end of 2020.

Not ones to argue with such experts, as Credit Suisse ranks 5th in TipRanks’ Top Performing Research Firms, we thought we’d take a look at some stocks the financial giant currently has on its radar, specifically ones with a Strong Buy consensus rating.

Let’s take a look.

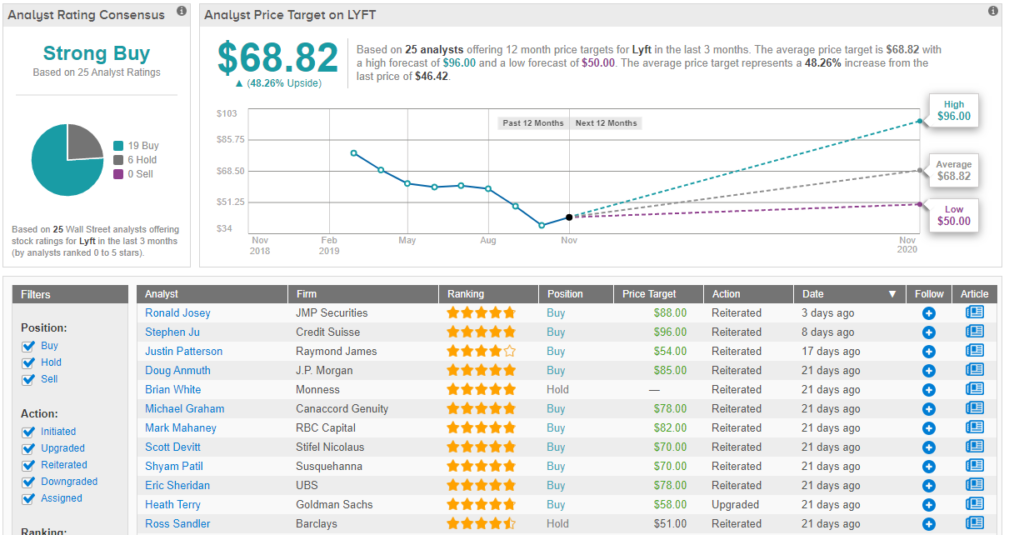

Lyft (LYFT)

First on our list is Lyft, which has been left on the curb waiting for some good news to arrive. Since going public in March, the ridesharing company has had a torrid time in the market, on a downward spiral whilst shedding over 40% of its value. But is the gloom finally about to – there’s no other way of putting this – lyft?

Since the start of October it has added 11% to its share price, indicating next quarter’s report might be the first to note positive gains. The recent boost in the market can be attributed to former rival Juno, which closed shop in New York and saw its corporate clients picked up by Lyft.

Credit Suisse’s Stephen Ju recently hosted an investor meeting with several leading members from the Lyft team, and he is confident the company is taking the right steps towards profitability. The 5-star analyst reiterated his Buy rating along with a price target of $96. His target implies a grand increase of 106% should the target be reached. (To watch Ju’s track record, click here)

Among key takeaways for Ju were Lyft’s easing on promotional campaigns, as its marketing and promotional spend has put downward pressure on profitability, improved data on consumer behavior which will help improve the Lyft product and the onboarding of external insurance providers which should have the ability to drive contribution profit.

Ju concluded, “Lyft is more focused on adding higher value users and rides. And with the recent price hikes and the ongoing reduction of contra revenue incentives, the company places greater emphasis on revenue share gain.”

Sharing the positivity, with 19 Buys and 6 Holds assigned in the last three months, the Street is in the same lane as Ju, giving Lyft a Strong Buy consensus. The average price target is $68.82, implying handsome upside of 48% from its current price of $46.35. (See Lyft stock analysis on TipRanks)

PTC Therapeutics (PTCT)

PTC Therapeutics develops orally administered drugs for what are known as orphan diseases – disorders so rare that their lack of a market makes it hard to receive funding for the purpose of developing treatments.

The company has several approved medicines worldwide and several more in the pipeline. Currently the spotlight is on its Risdiplam drug, in advanced development for the treatment of spinal muscular atrophy (SMA).

The company recently reported positive SUNFISH (type 2/3 SMA) Part 2 Ph3 results for the drug which left management extremely pleased with the outcome. The SUNFISH trial is a two-part study evaluating Risdiplam in people with Type 2 and 3 SMA between 2 and 25 years of age. The data is set to be presented in February at the SMA conference in France.

Credit Suisse’s Martin Auster recently met with PTCT management, and the analyst came away impressed, noting, “We are incrementally more confident that PTCT is well positioned over the next year with multiple catalysts on the horizon, most importantly announcement of Risdiplam NDA submission Q4 2019,” further adding, “We see Risdiplam being standard of care for older type 2/3 SMA patients, with the opportunity to achieve ~$3b in global sales (PTC is eligible for tiered high single digit to low double digit royalties.”

Auster’s confidence in PTC has caused him to increase his price target to $58, implying an ample 36% increase from the biotech’s current price. (To watch’s Auster’s track record, click here)

The analyst’s bullishness gets the backing of his colleagues, as the rising biotech currently has a Strong Buy rating from the Street. The 5 “buys” and 1 “hold” ratings provide an average price target of $59.50, implying upside of 39% from its current price of $42.71. (See PTCT stock analysis on TipRanks)

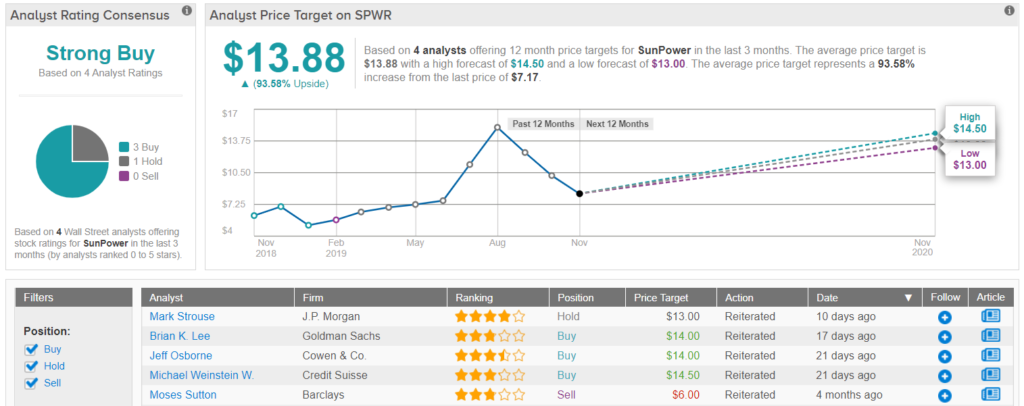

SunPower (SPWR)

Possibly named following a very short brainstorming session, SunPower is an energy company which designs and manufactures solar panels.

At least that was simple. Things have recently gotten a little more complicated, after the company spun off part of its business to create a new company called, Maxeon Solar. The new company will manufacture solar cells overseas, while SunPower will cater to the residential and commercial solar markets in the US. Apart from hoping the move will provide a boost to SunPower shares, Chief Executive Officer Thomas Werner said, “This transaction will also simplify both organizational structures, lowering costs, while improving efficiency and creating (two) more nimble companies.”

SunPower’s stock has had quite a ride this year, increasing by 200% before crashing back down whilst shedding 50% of its value. Credit Suisse’s Michael Weinstein thinks the pullback could be the right time for investors to hop onboard.

The analyst said, “We reiterate our Outperform rating given continued focus on US distributed generation (DG) business, company shores up much awaited manufacturing partner (TZS’ $298m investment and capacity expansion plan), addresses overhangs (legacy liabilities and convertible debt refinance), and unlocks sum of parts (Maxeon Solar to be listed by 2Q20).”

Weinstein’s price target is $14.50, indicating substantial gains of 102%. (To watch’s Weinstein’s track record, click here)

The analyst is in good company, as the rest of the Street currently rates SPWR a Strong Buy. Over the last 3 months, 3 analysts have recommended a Buy on SPWR and 1 suggests a Hold. With an average stock-price forecast of $13.88, resulting in gains of 95%. (See SunPower stock analysis on TipRanks)