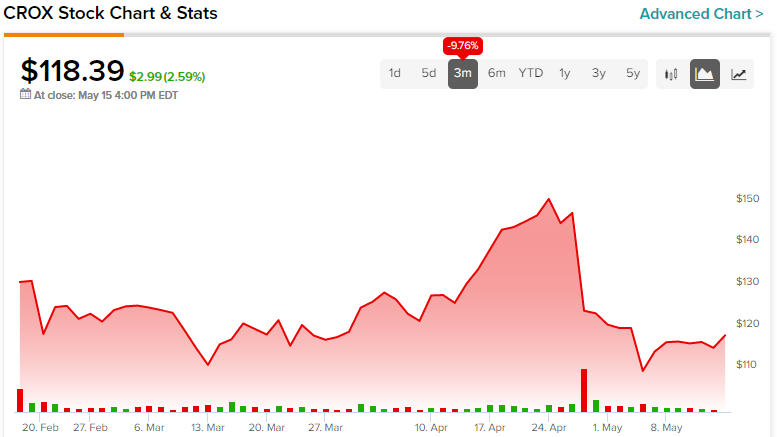

Shares of Crocs (NASDAQ:CROX) dipped significantly following the company’s most recent results. In fact, the stock is currently trading about 22% lower from its April high, prompting speculation about its investment prospects at present.

On the whole, it seems that the primary brand is still enjoying brisk sales, and the recent acquisition of HEYDUDE has further enhanced the company’s potential for increased revenue and profitability. If anything, the recent sell-off of Crocs stock has exposed that the company’s earnings potential is not sufficiently reflected in its current valuation. Accordingly, I am bullish on the stock.

Momentum is Not Slowing Down

The market may have reacted negatively to Crocs’ Q1 results, but the company’s momentum has not shown any signs of slowing down.

Crocs’ “clogs” remain incredibly popular and sell like crazy. The company has taken a clever approach to this by teaming up with numerous celebrities and influencers to create a wide range of unique designs that cater to different audiences. By executing this strategy, they have successfully attracted a diverse customer base and boosted sales significantly.

But besides its core brand, Crocs has been seeing great success with HEYDUDE, the Italian comfort-shoe brand it acquired last year. With Crocs’ established sales channels and infrastructure in the same market, HEYDUDE is in an excellent position to reach even greater heights in the future. The company’s latest results were a testament to this, as they were once again exceptional and showed remarkable growth.

For its fiscal Q1, Crocs reported revenue growth of 33.9% to $884.2 million (36.2% on a constant-currency basis). What’s quite remarkable is that this phenomenal growth was achieved on top of the robust 43.5% growth recorded in the same quarter last year, underscoring the sustained momentum of the company’s growth trajectory. Although bears anticipated Crocs’ growth to come to a standstill after the frenzy of sales growth from 2020-22, believing that the company’s hype would eventually subside, Crocs has defied expectations and is still flourishing.

In particular, in Q1, the Crocs brand grew by 19%, with growth powered by strong international growth of 31.8%, or 37.7%, in constant currency. Seeing Crocs expand so fast internationally during such a tough macro environment is truly impressive and should set the foundation for the Crocs brand to expand beyond the U.S. for years to come. North America DTC comparable sales also advanced by a satisfactory rate of 12.1% compared to Q1 2022.

In addition to the remarkable achievements of the Crocs brand, the acquisition of HEYDUDE has also been a resounding triumph for the company. Following the acquisition, the company effectively leveraged its established sales channels and distribution network to introduce HEYDUDE shoes to a broad range of retail outlets. The overwhelming response from retailers, as evidenced by the phenomenal growth in sales, underscores their eagerness to include HEYDUDE in their product portfolios.

Since Crocs closed the HEYDUDE acquisition on February 17th, 2022, it’s challenging to compare its sales on a year-over-year basis. Still, according to management, HEYDUDE sales for the quarter landed $235.4 million, up 104.8% compared to the partial period last year.

To get a better sense of HEDUDE’s growth trajectory, however, we can see management’s outlook, which forecasts that HEYDUDE sales are set to grow in the mid-20% range through 2023. That’s a great growth rate in my book, especially given that the company has yet to fully optimize and scale the brand’s production and distribution processes.

Guidance Raised, Exceptional Profit Growth

It’s puzzling to see the stock’s negative response to the company’s earnings release, given that Crocs even raised its guidance, pointing toward exceptional profit growth.

Along with management’s outlook for mid-20% growth in HEYDUDE sales, they are also projecting that consolidated revenue growth is likely to be between 11% and 14% compared to Fiscal 2022. Most importantly, the company is once again targeting industry-leading margins, projecting that its adjusted operating margin will be sustained between 26.0% to 27.0% — that’s a profit margin even the giants like Nike (NYSE:NKE) and Adidas (OTC:ADDYY) would envy. Consequently, adjusted EPS is now expected to be between $11.17 and $11.73 for the year, up from $11.00 to $11.31 previously.

The midpoint of the updated outlook implies year-over-year growth of about 4.9%. Although the growth rate may not appear astonishing, it is quite remarkable that Crocs is achieving new levels of profitability in the current market landscape (rising interest rates and inflationary expenses), particularly when considering the 31.3% increase in adjusted earnings per share the company experienced last year.

Is CROX Stock a Buy, According to Analysts?

Turning to Wall Street, Crocs has a Strong Buy consensus rating based on seven Buys and two Holds assigned in the past three months. At $160.13, the average Crocs stock price target suggests 35.3% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell CROX stock, the most accurate analyst covering the stock (on a one-year timeframe) is Susan Anderson from Canaccord Genuity, with an average return of 66.86% per rating and a 67% success rate. See below.

The Takeaway

Crocs keeps growing at a pleasing rate, despite last year’s skyrocketing sales, illustrating the resilience of its brands. At the same time, following the stock’s post-earnings plunge, the stock appears quite undervalued.

At the midpoint of management’s adjusted earnings-per-share outlook, Crocs is currently trading at a forward P/E of 10.3. This is a very attractive multiple, in my view (essentially near a 10% earnings yield), given the company’s double-digit growth being maintained. Hence, I remain bullish and invested in CROX stock.