CrowdStrike Holdings has agreed to acquire Preempt Security in a cash-stock deal valued at $96 million. Under the terms of the transaction, the cloud-based cybersecurity provider would pay approximately $86 million in cash and the remaining $10 million in its common stocks. The company expects the acquisition to be completed during its third-quarter fiscal 2021.

With the acquisition, CrowdStrike (CRWD) expects to offer enhanced Zero Trust security capabilities. Moreover, the company plans to strengthen its Falcon platform. Founded in 2014, Preempt is the first cybersecurity firm to offer “Zero Trust and Conditional Access solution for continuously detecting and preempting threats based on identity, behavior and risk.”

CrowdStrike’s CEO George Kurtz said, “Hybrid work environments will become the norm for many organizations which means that Zero Trust security with an identity-centric approach and detecting threats in real-time are critical for business continuity. With the addition of Preempt Security’s capabilities, the CrowdStrike Falcon platform will provide enhanced protection against identity-based attacks and insider threats.” (See CRWD stock analysis on TipRanks).

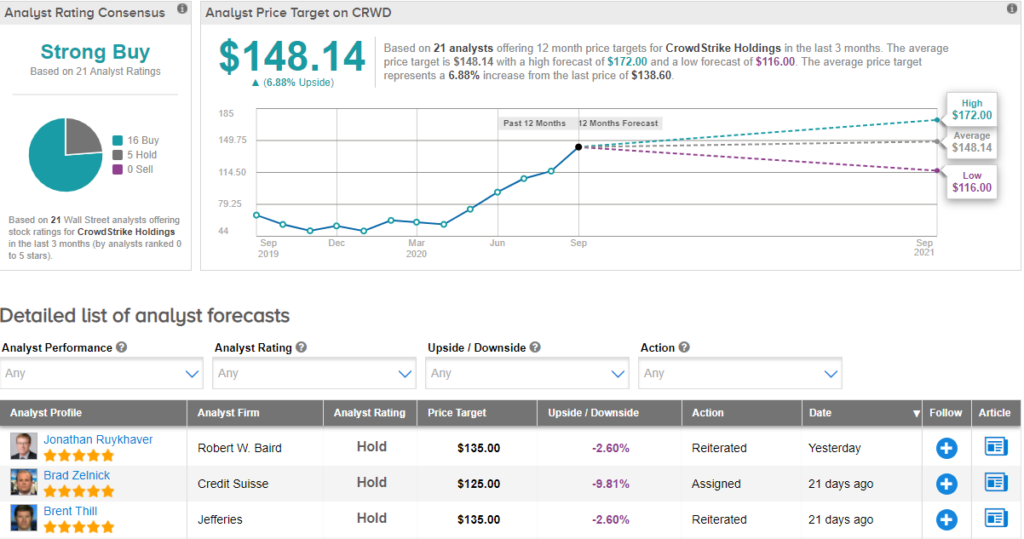

Following the announcement, Robert W. Baird analyst Jonathan Ruykhaver said, “we like the strategic rationale behind the deal.” He further added, “we believe adding an identity-focused security solution points to the continued potential for expansion of CrowdStrike’s platform.” Ruykhaver reiterated his Hold rating and a price target of $135 (2.6% downside potential).

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 16 Buys and 5 Holds. With shares up nearly 177%, the average price target of $148.14 implies further upside potential of 6.9% to current levels.

Related News:

GDS Holdings To Buy Data Centers In Beijing For About $570 Million

Western Digital Separates Flash And Hard Disk Units

Accenture To Acquire N3 To Boost Clients’ Sales