D.R. Horton (DHI), the largest U.S. homebuilder by market capitalization, has seen its stock decimated in recent months as recession expectations for the U.S. economy increase. Despite an uncertain near-term outlook, I believe that lower mortgage rates will blunt the impact of U.S. economic weakness, akin to what happened during the 2020 recession. Considering D.R. Horton’s very undemanding valuation and modest leverage, I am bullish on the shares.

Increased Recession Risks in the United States

In recent weeks, the likelihood of a recession in the United States has increased. Indicators pointing in this direction are:

- J.P. Morgan gives a 40% chance of a U.S. recession in 2025.

- The U.S. unemployment rate increased 0.1% month/month in February 2025.

- Real time GDP growth trackers have shown weaker or even negative readings.

While we should not overexaggerate recent weak readings, I have to admit that the initial rosy GDP growth outlook for the U.S. economy in 2025 faces significant downside risks.

D.R. Horton’s Fortress Balance Sheet

D.R. Horton enters the current turbulent period with a very sound financial footing. The company’s key debt to total capital measure stood at only 17% at the end of 2024, well below the 25.3% leverage the company employed before the 2020 recession.

If we consider the premium the company trades at relative to its book value we see that leverage is even lower. Net debt accounts for just 7% of the company’s enterprise value.

D.R. Horton’s current 2025 outlook

D.R. Horton has a fiscal year ending in September. Its current financial outlook for 2025 envisages:

- Consolidated revenues of $36-37.5 billion (growth of 2.4% year-over-year)

- Homes closed by homebuilding operations of 90,000-92,000 homes (an increase of 1.5% year-over-year)

Earnings per share stood at $14.34/share in fiscal 2024, with the company reporting EPS of $2.61/share in Q1 2025, down 7.4% year-over-year. Profits were impacted by marginally lower revenues and higher expenses, partially offset by a smaller share count.

In summary, we can say that before the recent increase in U.S. economic uncertainty, D.R. Horton was expecting a pickup in operating performance in the remainder of fiscal 2025 – something that appears less likely in light of increasing recession expectations.

How did D.R. Horton perform during the 2020 recession

You may be surprised to learn that D.R. Horton performed quite well in its fiscal 2020. Homes closed increased by 15% relative to 2019, with revenues increasing by 15% as well. These results were achieved even as the unemployment rate reached 14.9% in April 2020 before declining to 7.8% in September 2020 (the end of D.R. Horton’s fiscal year). Earnings per share actually increased by 49% relative to 2019.

The stellar performance was driven by extensive fiscal and monetary stimulus, with the Federal Reserve cutting interest rates to a range of 0-0.25%. This drove long-term mortgage rates to historically low levels, with interest on 30-year fixed mortgages at 3.04% in September 2020.

From an operational perspective, D.R. Horton performed quite well during the 2020 recession, but the company’s stock still fell roughly 50% from February to March 2020. This behavior is typical in bear markets when stocks fall in tandem regardless of underlying fundamentals. During the market recovery, we did see differentiation, with D.R. Horton stock performing quite well in recent years, notwithstanding the recent pullback.

Current outlook for Fed policy

Before the recent economic weakness hit the United States, the Federal Reserve only expected to reach its neutral 3% Fed funds rate towards the end of 2027. Futures prices for the Fed funds rate now indicate a Fed funds range of 3.25-3.50% by December 2026. In essence, deteriorating economic fundamentals have pulled forward expectations for Fed rate cuts.

While I don’t expect a recession as deep as the one in 2020 (hence, the likelihood of the Fed cutting rates to zero is quite low), I do think that Fed rate cuts will have a similar effect on mortgage rates, providing a boost to D.R. Horton’s operations.

D.R. Horton Valuation

D.R. Horton trades at only 8.7 times its trailing 2024 earnings. Even if the company falls short of its 2025 growth ambitions and receives little benefit from lower mortgage rates, I do not think earnings will fall more than 20-30%. Suppose we conservatively factor in earnings of just $10/share (representing a 30% drop from 2024 levels). In that case, we still see the company trading at 12.5 times forward earnings, which is quite attractive considering the circa 21 times forward earnings multiple for the S&P 500 (SPX).

I should again underscore that Q1 2025 earnings were only 7.4% lower, implying that Q2-Q4 2025 earnings would need to decline in excess of 30% to reach a 30% drop for the full year.

To summarize, D.R. Horton’s current valuation provides a wide safety margin, amplifying the Buy case for the company. This is further reinforced by a strong balance sheet and a historically robust performance during the 2020 U.S. recession.

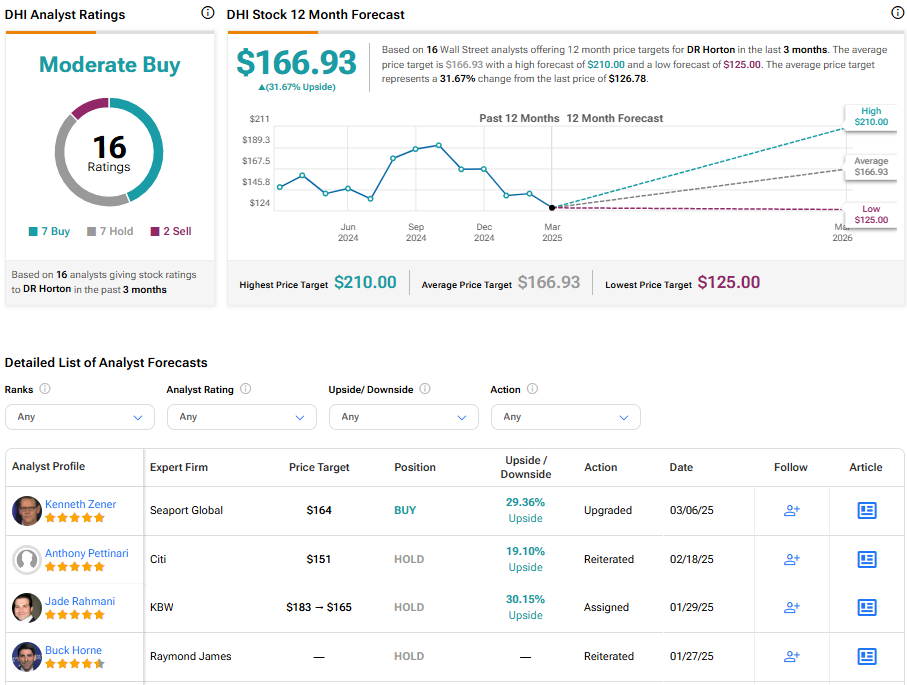

Wall Street confirms Buy rating

Turning to Wall Street estimates we see that sell-side analysts share my enthusiasm for the shares. D.R. Horton currently has a Moderate Buy consensus rating based on seven Buys, seven Holds, and two Sell ratings. The average target price of DHI stock of $166.93 per share implies a 31.67% upside from current levels.

Conclusion

D.R. Horton stock has slumped in recent months resulting in the company trading at a very undemanding trailing P/E multiple of only 8.7 times. While the company’s growth outlook for 2025 appears in doubt, considering the originally envisioned pickup in performance in Q2-Q4 2025, I think that the shares are a Buy as D.R. Horton should benefit from Fed rate cuts and a strong balance sheet.

As a result I am confident that just as D.R. Horton emerged stronger out of the 2020 U.S. recession the company will manage to navigate the current economic uncertainty, providing attractive returns for investors. Wall Street analysts share my enthusiasm for the shares and project significant upside from current levels over the next 12 months.