Daimler AG (DDAIF) sees first-quarter earnings plunge almost 70% as the coronavirus-related lockdowns have left its auto showrooms closed.

The German luxury automaker announced that it expected preliminary adjusted first-quarter earnings before interest and tax (EBIT) to drop to 719 million euros, from 2.31 billion euros a year earlier. Adjusted EBIT for Mercedes-Benz cars & vans is forecast to plunge more than 50% to 603 million euros year-on-year, according to preliminary figures.

In view of the continuing impact of the coronavirus pandemic, the German carmaker pulled its financial outlook for this year.

Looking ahead, it sees total unit sales and revenue for 2020 to be lower compared to last year. Daimler forecasts depressed unit sales across its Mercedes-Benz cars, Mercedes-Benz vans, Daimler trucks and Daimler buses.

“The decline in the results will lead to a decline in our industrial free cash flow for 2020,” Daimler said in a statement. “Having implemented a comprehensive set of cash protection measures and having increased our financial flexibility, we are well positioned to manage the business, both during and after the COVID-19 pandemic.”

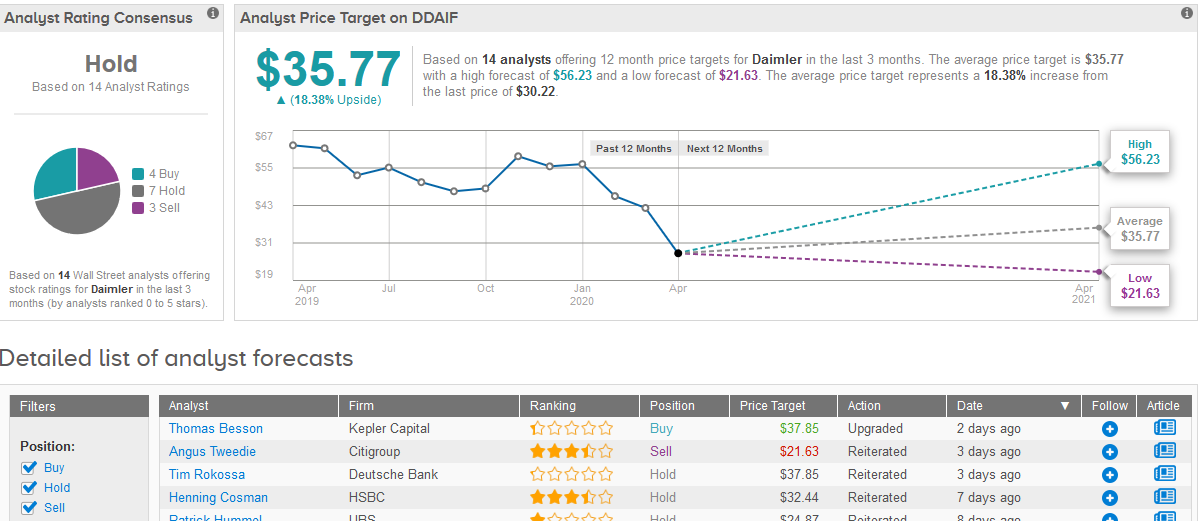

Wall Street analysts take a bearish stance on the stock. The Hold consensus rating is based on 8 Holds, 4 Buys and 3 Sells. The $37.23 average price target implies 23% upside potential, should the target be met in the coming 12 months.

Daimler is scheduled to release its first-quarter results on April 29.

Related News:

Boeing Sued by Kuwaiti Aviation Over $336 Million 737 MAX Jet Order

Quest Diagnostics Beats Quarterly Earnings But Pulls 2020 Outlook

O’Reilly Auto Reports Better-Than-Feared Q1 Earnings; Shares Up 3%