DoorDash (DASH) was flying high during the pandemic, growing in tandem with its underlying business. With pandemic tailwinds fading away, DoorDash is finding it tough to maintain margins amidst the challenging macroeconomic backdrop. The stock trades at close to five times forward sales, a figure completely divorced from its fundamentals. Therefore we are bearish on DASH stock.

The market has slowed down remarkably over the past eight months, and the delivery giant is feeling the effects. Despite the surge in sales over the past couple of years, the company was unsuccessful in milking a profit. With the inflationary pressures and the pandemic fade, it’s tough to see how things wouldn’t get worse. Hence, I side with my colleague Joey Frenette in suggesting that it’s best to avoid the stock for now.

Is the Food-Delivery Business Inherently Unprofitable?

No one can argue over the success of the food delivery business during the pandemic. DoorDash and its peers experienced massive expansion during the period, but they remain unprofitable. Hence, it beckons the question of whether the industry itself is structurally unprofitable. All evidence shows that the companies in the sector are likely to have it tough due to reasons discussed later in the section.

From 2019 to 2020, DASH’s gross order volume shot up from $8 billion to a whopping $24.7 billion, representing over a 200% increase. A year later, orders increased by a dumbfounding 70%. It was able to solidify its position in the niche and become a massive player.

Nevertheless, profitability remained elusive despite the eye-catching performance in the past couple of years. If a company such as DoorDash can’t generate profits under incredibly favorable conditions, it’s tough to see how it could ever generate a profit.

One of the main issues with the food delivery services business is that exceptionally low switching costs categorize it with no difference in terms of service quality amongst peers. Sadly enough, the company actually burnt more money when its business was thriving. DASH posted a net loss of $461 million and $468 million in 2020 and 2021, respectively. Another example is the second quarter, where it yet again posted a quarterly loss despite a solid jump in revenues.

Things Will Only Get Worse from Here

The global economy is in a mess amidst rising inflation and interest rates. Moreover, geopolitical tensions due to the Ukraine War and re-opening headwinds have further complicated things. Though the current market situation is tough for virtually every company, loss-making entities such as DASH will likely suffer a lot more.

We discussed earlier how the business couldn’t generate a profit in the most conducive of market conditions. The market is in a slump, with minimal economic growth and investors gravitating toward less risky investment options. Hence, it’s a double-whammy for DASH and its peers.

The delivery services industry hasn’t witnessed a recession in its relatively short history, but it will now be under the pump for the first time. Inflation is eating away at disposable incomes and is likely to limit consumer spending significantly.

Moreover, there is the element of wage inflation which is perhaps an even bigger dent in the company’s business model. Delivery service companies have found it remarkably tough to attract workers over the past several years, and the current market downturn will create more challenges in that department.

Therefore, DoorDash can’t maintain its margins in such awful market conditions. The lack of profitability is perhaps not a question of scale. The firm has almost a billion in annual deliveries, yet it is far from profitable.

DASH is left with the equities market to bail it out from its current predicament. There was a time when the company flew high due to positive investor sentiment surrounding the stock. However, all that has changed dramatically, as investors are looking to value capital and profitability instead of lofty management claims. Hence, DoorDash will have it incredibly tough to raise funds during the market downturn.

Is DASH a Buy or Sell?

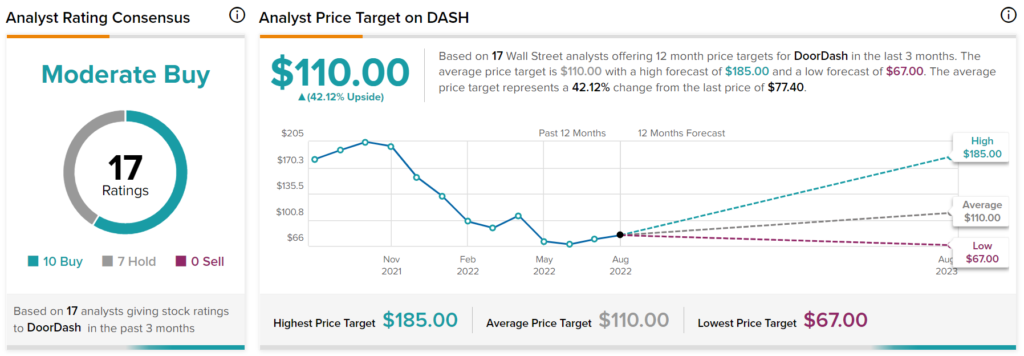

Turning to Wall Street, DASH stock maintains a Moderate Buy consensus rating. Out of 17 total analyst ratings, 10 Buys, seven Holds, and zero Sells were assigned over the past three months. The average DoorDash price target is $110, implying 42.1% upside potential. Analyst price targets range from a low of $67 per share to a high of $185 per share.

Takeaway – The Cracks in DoorDash’s Business Model Have Accentuated

DoorDash has it remarkably tough in a market that is as tough as it gets. The cracks in its business model have accentuated, and investors are taking note. DASH stock has shed a truckload of value as investors look toward more profitable companies to invest in the current bear market.

Profitability remains elusive for the company, and you probably shouldn’t count on it to flip the script at this time. However, the real question is whether it could ever turn a profit considering it couldn’t achieve that feat during its best years.

There is a flip side to the coin, though. The market’s appetite for risky investments might grow, and it could potentially continue as a loss-making entity. It might get the funding it needs to continue pushing forward without making a dollar profit. Moreover, there’s always the element of mergers and acquisitions, where DASH could become a much bigger force in the market.

However, there are a lot of ifs and buts with DASH’s bull case, and with it trading at close to five times forward sales, you wouldn’t want to touch it with a ten-foot pole.