While researching various office and industrial REITs lately, I came across two relatively unknown names whose qualities should shield them from the ongoing concerns surrounding the office and industrial property markets. Easterly Government Properties (NYSE: DEA) and Postal Realty Trust (NYSE: PSTL) have managed to avoid many of the underlying challenges impacting their industries by catering to the world’s most reliable tenant: The United States Government.

Due to this remarkable quality, their high dividend yields, and reasonable valuations, I am bullish on both names.

Other kinds of REITs often present more risk. Undoubtedly, commercial real estate was changed forever two years ago, as the COVID-19 pandemic disrupted the market dynamics massively. While the pandemic has largely faded, commercial real estate properties have failed to recover meaningfully, as demand for such spaces remains rather soft.

Sure, most companies do utilize office space, but following the pandemic, hybrid working (i.e., working from home and from the office) seems to have prevailed. Industrial properties were proven more resilient during the pandemic, but with rates on the rise and the economy slowing down, their future also appears somewhat bleak.

Therefore, DEA and PSTL are interesting REITs due to their well-known, high-quality tenant.

What Do DEA and PSTL Do?

To be more specific about DEA’s and PSTL’s unique advantages in the current environment, let’s quickly break down their operations.

DEA provides office space for several mission-critical U.S. Federal Agencies. As of its latest filings, the company wholly owned 87 operating properties in the United States and has another six as part of a joint venture. 92 of these are operating properties that are leased primarily to U.S. Government tenant agencies.

With 99% of its properties leased, the company enjoys robust lease income backed by the full faith and credit of the U.S. government. This is also the case with PSTL, as its properties exclusively serve the USPS.

Why is Uncle Sam Such a Great Tenant?

Having the U.S. government as your exclusive tenant comes with grand advantages that can form a stronghold moat. The greatest advantage, and what separates DEA and PSTL from ordinary REITs, is the unparalleled credit of Uncle Sam. Essentially, the U.S. government is universally agreed to be the most trustworthy creditor in the world (i.e., the institution that has the lowest chances among any other institution globally to fail.)

It is quite safe to say that Uncle Sam has his rental payments entirely covered – especially when the tenants include mission-critical properties that house crucial agencies like the Federal Bureau of Investigation (FBI), the Environmental Protection Agency (EPA), the U.S. Citizenship & Immigration Services (USCIS), the U.S. Department of Veterans Affairs (VA), the Defense Health Agency (DHA), and the USPS.

After all, the government can always print money to satisfy its obligations. Hence these two REITs face no counterparty risk or rent collection issues. This is a massive advantage these days, as “ordinary” REITs do experience these challenges.

Further, no matter the underlying conditions, these agencies will “never” cease to exist due to being essential assets for vital government operations and national security. If this doesn’t convince of how high the quality of DEA’s cash flows and lease agreements are, the REIT has preserved a 100% occupancy ratio since its public listing.

This is likely to remain the case for decades to come, as its weighted average lease term stands at a lengthy 19.6 years. Combined with the critical nature of the company’s tenants and the fact that they can’t just simply relocate (these properties are purpose-built for each agency’s needs), investors enjoy an unparalleled margin of safety.

When it comes to PSTL, its occupancy stands at 99.7%. While its weighted average lease term stands at around four years (yes, postal offices are not as critical as agency centers), cash flows should be quite secured over the medium term. If anything, I would argue that PSTL even has an advantage here, as it can renegotiate leases at higher rates sooner.

Is DEA Stock a Buy, According to Analysts?

Turning to Wall Street, Easterly Government Properties has a Hold consensus rating based on one buy and four Holds assigned in the past three months. At $21.20, the average DEA stock forecast suggests around 34.5% upside potential.

Interestingly, DEA stock only has a 5 out of 10 Smart Score rating, implying that it will perform in line with the market, going forward – according to this metric, at least.

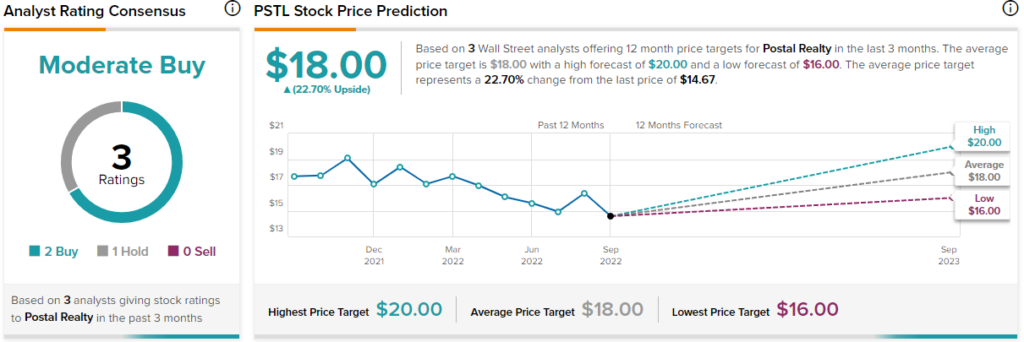

Is PSTL Stock a Buy, According to Analysts?

Turning to Wall Street, Postal Realty has a Moderate Buy consensus rating based on two buys and one Hold assigned in the past three months. At $18.00, the average PSTL stock forecast suggests around 21.13% upside potential.

Unlike DEA, PSTL stock has an 8 out of 10 Smart Score rating, suggesting that it can outperform the market, going forward.

Conclusion: Safety Without Overpaying

DEA and PSTL are rather unique, with all of their cash flow essentially guaranteed by the government under multi-year leases. Accordingly, their risk profiles are certainly reduced compared to ordinary REITs, and their respective yields of roughly 6.4% and 6.3% can be relied upon. Considering their unique qualities and high dividend yields, it’s quite surprising to see that both names trade at rather reasonable valuations.

DEA and PSTL trade at around 11.5x and 16.2x their projected FFOs for the year. PSTL’s multiple is higher due to the likelihood of renegotiating leases sooner compared to DEA amid earlier expirations.

Regardless, both names should be proven fruitful investments and eventually attract increased investor attention due to their exceptional positioning in such an uncertain environment.