Shale oil and natural gas company Chesapeake Energy Corporation (CHK) announced that it has suspended dividend payments on each series of its outstanding convertible preferred stock with immediate effect.

The dividend suspension comes just days after the debt-laden shale producer’s shareholders on Monday voted in favor of a reverse stock split at a ratio 1:200, a move aimed at boosting its share price to stave off a delisting that could trigger calls for some immediate debt repayment. The move was initiated after Chesapeake shares plunged 81% this year to as low as 16 cents.

“Suspension of the dividend does not constitute an event of default under any of the company’s debt instruments,” Chesapeake said in a statement.

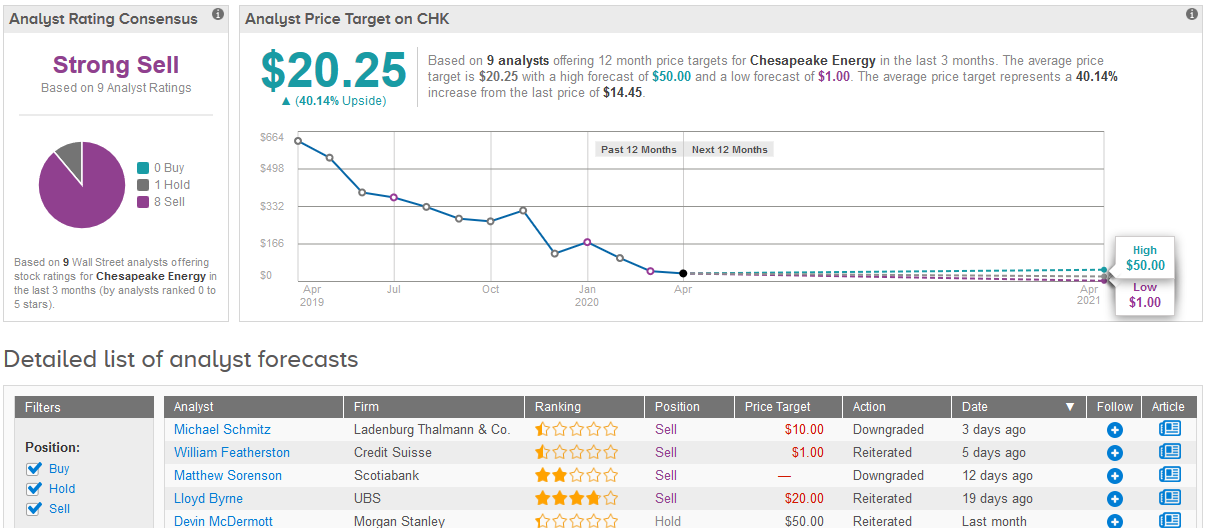

On Thursday, Michael Schmitz analyst at Ladenburg Thalman & Co. cut the company’s rating to Sell from Hold. with a price target of $10. The shale oil pioneer’s shares on Friday dropped 7.1% to close at $14.45.

“We believe uncertainty over the duration and magnitude of the negative impact on the financial and commodity markets from the coronavirus is likely to continue to significantly weigh on its stock price near-term given its high debt level,” Schmitz wrote in a note to investors

While Credit Suisse analyst William Featherston adjusted his price target to $1, suggesting that within a year, even Chesapeake’s post-reverse-split stock price gains will evaporate.

Turning to the rest of Wall Street analysts bearish sentiment reigns with 8 saying Sell the stock and 1 says Hold adding up to a Strong Sell consensus rating. Meanwhile the $20.25 average price target implies 40% upside potential in the coming 12 months. (See Chesapeake stock analysis on TipRanks).

Related News:

General Motors Secures $1.95 Billion Revolving Credit Line

AMC to Raise $500 Million in Debt Offer to Boost Cash Coffers; Shares Soar 31%

Weekly Market Review: Bulls Looking Past the Curve