Dell Technologies ($DELL) is set to report its Q3 earnings next week after market close on Tuesday, November 26. Interestingly, some analysts expect moderate growth now but a stronger performance in CY2025 that will be driven by AI servers. Morgan Stanley, led by analyst Erik Woodring, maintained an Overweight rating with a $154 price target and highlighted Dell’s potential to see its fundamentals “accelerate” next year, even without accounting for market share shifts from Super Micro Computer ($SMCI).

Indeed, a UBS survey of 76 senior IT executives showed strong demand for Dell’s storage solutions, which significantly outpaced competitors. Dell’s all-flash storage was rated as “strong” by 71% of respondents, ahead of NetApp (53%), Hewlett Packard Enterprise (32%), and Pure Storage (20%). Overall, 66% rated Dell’s Storage segment as “strong” or “very strong,” up from 57% a year ago. By comparison, only 24% and 37% said the same thing for HPE and NetApp, respectively.

Nevertheless, near-term results may be constrained by flat AI server growth, mixed storage trends, and weak PC market performance, according to Morgan Stanley. Overall, for Q3, the analyst consensus expects adjusted earnings per share of $2.07 on $24.66 billion in revenue, which equates to increases of 10.1% and 11.3%, respectively.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see that options traders are expecting a 10.48% move from DELL stock in either direction right after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement.

However, it is worth noting that DELL’s after-earnings price moves in the past 10 quarters have exceeded this expected 10.48% move five times and by wide margins. This suggests that the options might present a speculative opportunity to profit from a large post-earnings swing.

Is DELL a Good Buy?

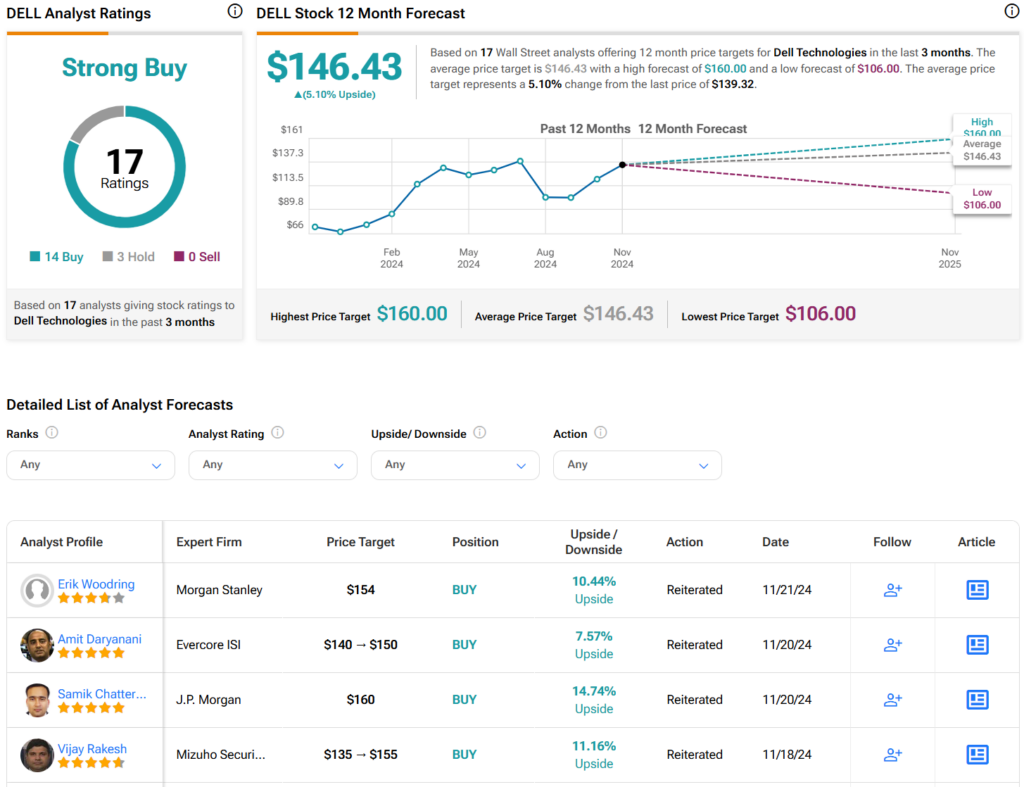

Overall, analysts have a Strong Buy consensus rating on DELL stock based on 14 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 90% rally in its share price over the past year, the average DELL price target of $146.43 per share implies 5.1% upside potential.