Shares in Dell Technologies (DELL) spiked 14% in pre-market trading on a report that the PC maker is mulling a spinoff of its roughly $50 billion stake in cloud computing software maker VMware Inc. (VMW)

The stock surged to $55.90 in pre-market trading. Meanwhile, VMware shares rose 8.8% to $162.39.

Dell is exploring the possibility of divesting the stake or taking other steps that could include buying the rest of the cloud-software giant, the Wall Street Journal reported. The companies are working with outside advisers on a number of scenarios.

However, the report also stated that the evaluation deliberations are at an early stage and that no decision is imminent adding that any move is “unlikely” before 2021.

Dell’s 81% stake in VMware has been valued at $50 billion, while the PC maker’s own market capitalization stood at $36 billion as of Tuesday.

Commenting on the report, five-star analyst Daniel Ives at Wedbush, said that the Dell-VMware “soap opera” has been a multi-year ownership structure partnership that has been a “frustration point” for investors since EMC sold its 81% stake to Dell in 2015.

“The likely path in our opinion and the one most appetizing to investors would be a tax free spinoff for this stake,” Ives wrote in a note to investors. “The Dell ownership structure has been an albatross around the VMware story and ultimately causes the stock to trade at a discount, a dynamic that would be removed if Dell ultimately decided to head down this path.”

Ives estimated that if Dell did not own VMware this would add $15 to $20 per share as he expects a positive knee jerk reaction from investors. However, the analyst cautioned that it was too early to pop the champagne yet as there could be many twists and turns in this strategic relationship which could potentially end with no deal at all.

Ives maintains a Buy rating on VMware stock with a $175 price target given its “position in the cloud evolution with an expanding product footprint that could see an acceleration of growth for the coming years”.

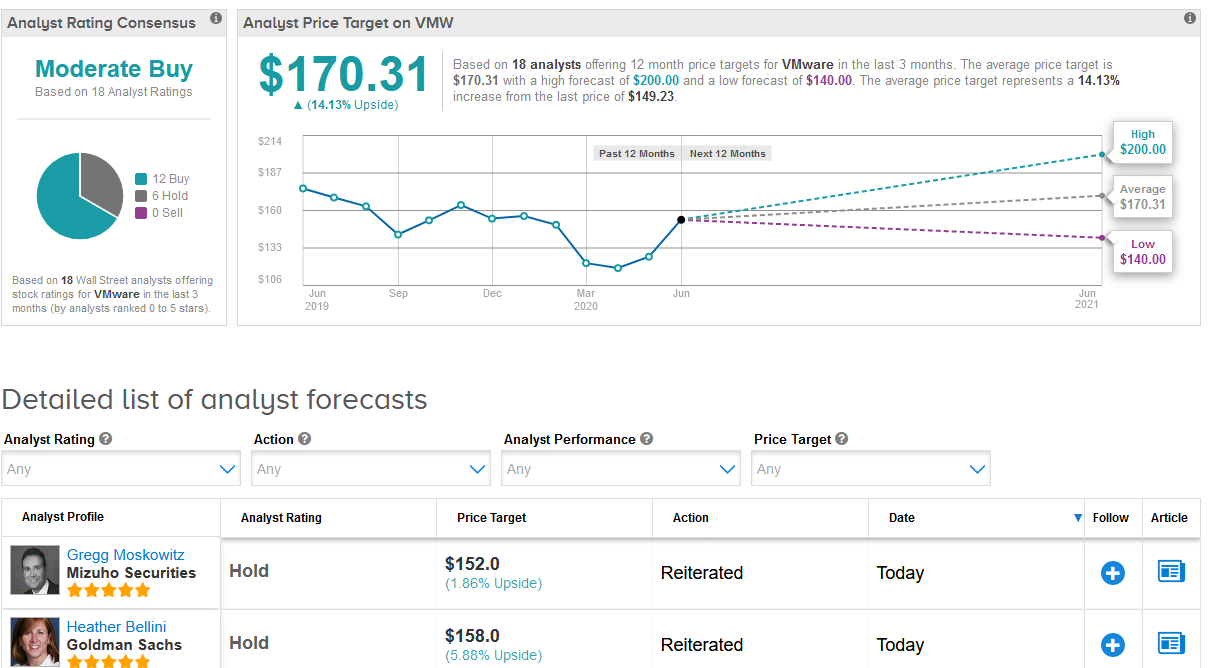

Overall, analysts have a cautiously optimistic outlook on the stock. The Moderate Buy consensus shows 12 Buy ratings vs 6 Hold ratings. The average analyst price target, at $170.31, implies 14% upside potential over the coming year. (See VMW stock analysis on TipRanks).

Related News:

Microsoft’s Xbox Closes Mixer Live Streaming, Partners With Facebook Gaming

Check Point Teams Up With Coursera For Cybersecurity Education Program

Lyft Agrees To Pay Damages, Revise Wheelchair Policy In Settlement Agreement