Delta Air Lines will be able to avoid involuntary furloughs for its flight attendants and ground-based frontline employees in the US due to voluntary leaves of absence, buyouts and shorter schedules. The stock is trading 1% higher in pre-market trading.

However, Delta (DAL) still expects some of its pilots to lose jobs when the federal government’s airline bailout package expires on Oct. 1. Over 1,900 Delta pilots are facing potential layoffs. The company disclosed that it is still in discussions with the pilots’ union about cost-cutting measures.

The company disclosed that over 40,000 Delta staff opted for short and long-term unpaid leaves of absence since the pandemic and in addition, 20% of the staff chose voluntary exits. These departures helped the carrier avoid major job cuts.

The pandemic crushed travel demand and significantly impacted airlines. Delta’s peer United Airlines recently announced its intention to furlough over 16,000 workers on Oct.1. Also, American Airlines disclosed that it will furlough about 19,000 workers.

Meanwhile, on Monday Delta announced its plans to raise $6.5 billion in debt backed by its SkyMiles loyalty program as part of the company’s efforts to boost its liquidity.

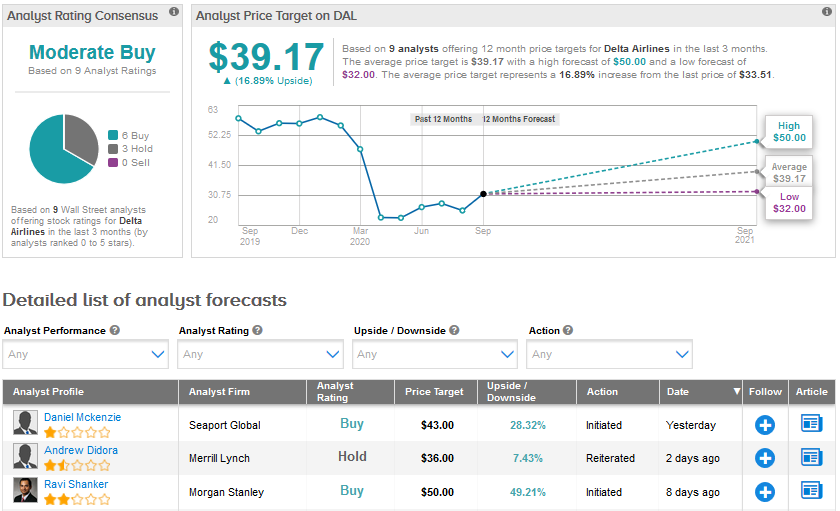

On Tuesday, Seaport Global analyst Daniel McKenzie initiated coverage of Delta with a Buy rating and $43 price target. The analyst opined, “We may be early with our Buy rating but believe the value is there for those that can look out a year and stomach near-term volatility tied to COVID-19 uncertainty. Net/net, consensus is under-appreciating DAL’s ability to recover from the COVID-19 crisis, and thus the durability of DAL’s earnings and FCF which are worthy of a stock re-rating.”

The analyst also added that Delta is right-sizing its network and streamlining its cost structure to become a more efficient and profitable airline. (See DAL stock analysis on TipRanks)

Overall, a Moderate Buy consensus for Delta breaks down into 6 Buys, 3 Holds and No sell ratings. The stock has plunged 42.7% year-to-date. But the average analyst price target of $39.17 reflects a possible upside of about 17% ahead.

Related News:

Delta To Raise $6.5B Debt Backed By Frequent-Flyer Program

Boeing’s 737 MAX Jets To Face Joint Training Review – Report

United Airlines Lowers 3Q Revenue Forecast As Travel Demand Fails To Return