Several of the heavy hitters will be reporting earnings this week, with the Street and investors keeping a close eye on the results. Apple (AAPL) will take the spotlight when it reports F2Q20 earnings on Thursday, April 30. The road to the anticipated statement has been paved with investment firms constantly readjusting estimates for the giant from Cupertino, on account of the pandemic’s disruptions.

The latest update comes from Oppenheimer’s Andrew Uerkwitz. The 5-star analyst lowered estimated FY20 revenue and EPS from $257 billion and $11.80 to $245 billion and $11.09, respectively, “to account for COVID-19 related weakness affecting C2H20.” These are below Wall Street consensus estimates of $263 billion and $12.36.

Due to the global shutdowns, Uerkwitz believes iPhone sales will suffer a year-over-year drop in the June quarter, while the analyst also lowered C2H20E total sales growth rate to negative 4%, compared to the previous forecast of 9% year-over-year growth.

Undoubtably, COVID-19 has sown a large amount of uncertainty concerning the rest of the year. Uerkwitz notes the gap between the highest and lowest consensus estimates for FY20 sales has grown considerably – from $19 billion in 1.31.20 to $82 billion on 4.23.20, according to FactSet. What this implies is “extremely uncertain and divided opinions.” The lack of clarity is particularly acute when considering the September quarter, when Apple was scheduled to launch its flagship product – the iPhone 12.

“It’s not surprising but still a sight to behold that, according to FactSet, the range of revenue outcomes for the September quarter for Apple is a staggering $30B. That compares with consensus sales of $63B for September,” Uerkwitz remarked.

Nevertheless, despite the possible delay and unfavorable macro conditions, the analyst remains bullish on Apple.

Uerkwitz said, “While such uncertainty should rattle investors, we believe that Apple with its balance sheet ($99B in net cash), supply chain expertise, customer satisfaction rating (98%+), growing service revenues, and capital return policy, will recover more quickly than most, and is in the best position to gain market share during this crisis.”

All in all, Uerkwitz maintains an Outperform rating on Apple shares, along with a $320 price target. Should the analyst’s thesis play out, 13% upside could be in the cards. (To watch Uerkwitz’s track record, click here)

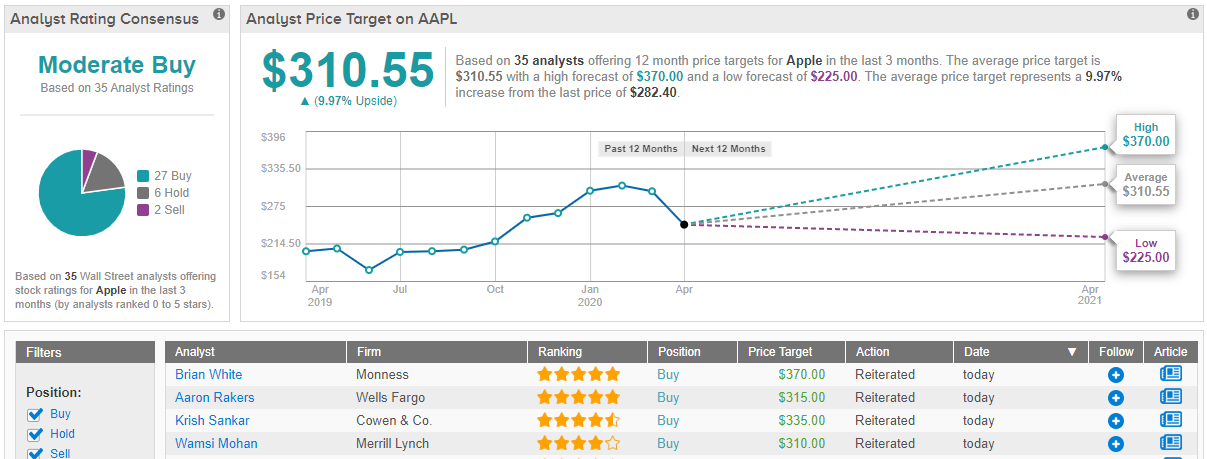

According to TipRanks’ data, 35 analysts have chipped in with a view on Apple’s prospects in the year ahead, with the majority keeping a bullish stance. 27 Buys, 6 Holds and 2 Sells add up to a Moderate Buy consensus rating. The average price target hits $310.55 and implies possible upside of 10%. (See Apple stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.