After hearing the latest earnings report from Aphria (APHA), it was good to see the company appear to start turning things around. Even so, the response from various financial outlets surprised me, as the way they gushed about the company was far too disproportionate when looking at what drove the performance of Aphria.

Even so, after some of the negative news that has come out of the sector, including the firing of Canopy Growth’s (CGC) Bruce Linton and the debacle surrounding CannTrust (CTST), the cannabis industry needed some good news, and Aphria was the company that delivered it.

Understanding why the response was so optimistic

To comprehend the extremely optimistic response of the market to Aphria, it has to be understood that the company itself had went through some painful moments that resulted in installing a new interim CEO.

Add to that the fact that Canopy Growth was considered the darling of the industry and Bruce Linton the face of the industry, and it shook a lot of investors, pundits and analysts up, as their chosen leaders very publicly feel after Constellation Brands shook up the company and the industry by its actions.

Afterwards numerous people in the financial media started to trash the industry and look for anything negative that could derail it. Some snarkily commented on what else would be found hidden under the hoods of the various cannabis companies, along with an inordinate conjecture and focus on probable big writedowns in the near future.

With all that as a backdrop, I think Aphria caught the tailwind of a pent-up need to hear something positive come from the sector, and its decent earnings report was the obvious catalyst that produced it.

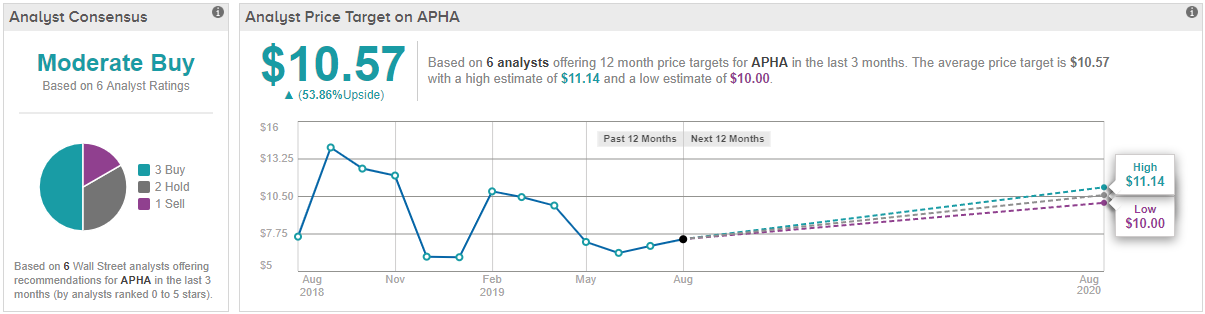

Several Wall Street analysts have also adopted an optimistic outlook on the company, as TipRanks analytics showcasing Aphria stock as a Buy. With an average price target of $10.57, analysts are predicting an upside of nearly 54% from current levels. (See APHA’s price targets and analyst ratings on TipRanks)

Why I’m a little dubious about the sustainability of the response

In the last quarter Aphria generated a record C$128.6 million in revenue, up almost 1,000 percent year-over-year, with C$15.8 million in net income.

While that appears impressive, it does have to taken into account that there was no recreational sales in Canada last year because legal during the same quarter, as it wasn’t legalized until October 2018. That said, on a sequential basis the company did manage to boost its revenue by 75 percent. Some of that came from higher prices.

Considering the C$128.6 million in revenue generated in the reporting period, a huge C$99.2 million of that was the result of the acquisition of German medical cannabis distributor CC Pharma.

On the recreational side of the business, Aphria had modest sales of C$18.5 million in the quarter. It was up 158 percent over the same reporting period last year, but again, that didn’t include recreational pot at the time, so the results were to be expected.

I think without the acquisition of the German cannabis distributor, Aphria would almost certainly produced a loss. I draw that conclusion because the EU in general, and Germany in particular, command among the highest medical cannabis prices in world. The C$99 million in sales would have represented the bulk of, if not all of its positive earnings.

When taking into account EBITDA was only C$209,000, and adjusted EBITDA from distribution operations being a negative 3.9 million, things weren’t quite as robust as the market so far has signaled.

Giving credit where it’s due

Not wanting to totally rain on everyone’s parade, the reality is the company does deserve credit concerning identifying a quality German company with a large distribution network, and successfully deploying its capital to acquire it.

This is not as easy to do as it would appear. Just ask Bruce Linton and the $4 billion he had at his disposal. That, probably more than anything, is what gave Constellation Brands the reason it needed to get rid of him.

This is why I haven’t been that impressed with the companies getting all the big cash infusions and the accompanying media coverage that came with it. After spending on acquisitions and initiatives, they are still struggling to come close to being profitable.

So the idea of locating a company like CC Pharma and leveraging the acquisition to propel it to almost immediate profitability is an impressive action and result.

If the company proves it can repeat this in other deals, then what it has accomplished in the last quarter will prove to not be a one-off event.

Conclusion

Aphria and the cannabis sector in general needed this earnings win, even if much of it was the direct result of an acquisition and not much in the way of organic growth.

The company was very positive in its guidance, but I still think it has a lot more to prove before investors can consider this a sustainable growth trajectory for the company.

If some other competitors surprise to the upside as earnings season rolls along, then the company will struggle to retain the strength of its huge upward move after the earnings surprise.

On the other hand, if most or all of its competitors are found to be far from profitability, the market will continue to look to Aphria as a key stock to take a position in.

For now, Aphria does deserve to celebrate its quarter after a rough period before that. But now expectations have been raised, and the market, in my opinion, has put it too high on a pedestal that it could get easily knocked off of.

Last, after this huge spike in its share price, new investors should beware of taking immediate action before the market gives some direction on where the company is going to go next.