Singles Day – China’s Hallmark Holiday, Done Big

Enter Singles Day, November 11. Started in the university scene during the 1990s, as a day to celebrate bachelorhood, over the last ten years it has become the largest online shopping day in China. This is now a day when singles buy a special gift to woo a special someone, or couples make purchases together. Alibaba Group Holdings (BABA – Research Report) encouraged the shopping with special sale prices available online this day, and quickly turned it into the company’s annual cash cow.

This years’ Singles Day matched its hype, though not without some asterisks. Let’s take a closer look at what happened.

Over $30 Billion In Sales

Start with the rawest number: $30.8 billion worth of sales in 24 hours. The first billion was achieved in one minute, 25 seconds, while the $10 billion mark was reached in just over one hour. The fast start shows that Alibaba’s marketing is effective, and customers were ready and waiting for the sales event to begin.

The total sales were 27% higher than last year, which itself was a record-breaking Singles Day. Interestingly, during the event, the post-90s generation accounted for 46% of total buyers. SunTrust Analyst Youssef Squali (Track Record & Ratings) said of the year-over-year sales growth: “[It] was particularly impressive amid concerns of the macro headwinds and also points to a 40% increase in consumers who made purchases from international brands as well as the 23% increase in the delivery orders from Alibaba’s Cainiao logistics network.” Squali gives BABA a $180 price target.

Impressive as the day was, however, it was also smaller than 2017’s 39% year-over-year beat. Seeking a reason for the difference, some analysts referenced the lower spending habits of rural Chinese buyers, as well as something perhaps unexpected. Oppenheimer’s Jason Helfstein (Track Record & Ratings), in a special report issued specifically on the Singles Day sales: “We believe this suggests a weaker macro environment in China, on top of the law of large numbers.”

Nonetheless Helfstein indicated a ‘Buy’ rating on Alibaba without setting a specific price target.

Did a Slow Third Quarter Spook the Analysts?

Alibaba did, indeed, lower its revenue predictions for next year. The third quarter report was less than spectacular. Revenues came in $140 million below expectations, making this the first quarter in three years that BABA has missed the estimates. EPS growth, at $1.40, was way above the $1.07 consensus, but the rate of growth was slower than 2016 and 2017.

However, like Helfstein, analysts are sticking to their bullish thesis. For example, Nomura’s Jailong Shi (Track Record & Ratings) noted Alibaba’s lower revenue per customer. He said “Ali officially revised down its FY19 revenue guidance by 4-6%, which the management says is attributable mainly to slower customer management revenue.” But he retained his ambitious $200 price target on the stock (38% upside potential).

Meanwhile, Binnie Wong (Track Record & Ratings) of HSBC gave BABA a $177 target, describing the stock as defensive to macro concerns “given its faster-than-peers’ growth and less vulnerability to regulation risk.”

Evaluating the Q3 Numbers

Ali’s success has not been easy, and the company is beginning to face headwinds. The Chinese government’s efforts to insulate their country from foreign influence, especially online, make it difficult for Alibaba to expand outside of China’s borders, which in turn makes it difficult to expand the customer base. Alibaba’s turn toward rural China has brought new customers, but they spend less than their urban counterparts, resulting in slowing earnings growth.

As CEO David Zhang said in the November 2 quarterly earnings call: “[I]n this quarter, over 75% of our new consumers are from less developed areas. They may need a simpler and a more direct user interface with product recommendations that are value for money.”

The slower rate of growth (as seen in the calendar-Q3 report) is directly related to Alibaba’s expansion into rural Chinese markets. As Mr. Zhang described, rural customers spend less per purchase and look for “value for money,” so while volume may do well, overall revenues can still drop.

At the same time, Alibaba may not have had so much choice in seeking new customers. China’s closed borders make it difficult for foreigners to muscle in but also make it difficult for Chinese companies to expand out. In addition, given China’s huge population, Ali has plenty of room for continued growth in its home market, even if the rate of growth or revenue per customer slow down. The company appears to be accepting slower growth – and a faster approach to market saturation – in return for a market it can absolutely dominate.

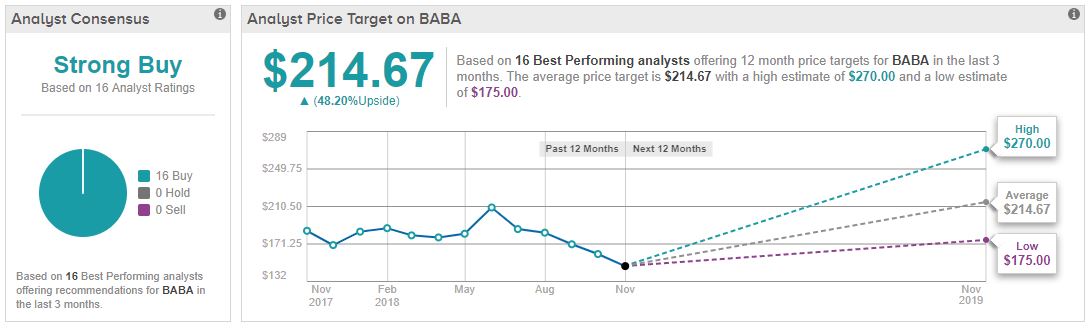

BABA still holds a ‘Strong Buy’ on the analyst consensus, and as noted above analysts’ comments indicate specific reasons for slowing growth while their price targets indicate confidence that that growth will continue. The average price target is $214. Compared to the share price of $144, this is a 48% upside potential.

Enjoy the Research Report on the Stock in this Article:

Alibaba Group Holdings (BABA) Research Report

Find your own best investment with the TipRanks Stock Screener tool. The screener offers a set of filters to narrow down your search, making it easy to evaluate all of your investment opportunities. Go to the Stock Screener tool now.