Walt Disney (DIS) heiress Abigail Disney is calling upon the company’s executives to give up some of their ample compensation at a time when the media and entertainment giant furloughs 100,000 employees.

“The real outrage is, of course, those bonuses…All 1.5 billion of them,” the Disney heiress wrote in a Twitter post. “That would pay for three months salary to front line workers. And its going to people who have already been collecting egregious bonuses for years.”

The comments come as Disney is reportedly protecting its executive-bonus schemes and a $1.5 billion dividend payment due in July. At the same time, the company is furloughing 100,000 workers at its theme parks, which have been closed for the past weeks. The move is expected to generate $500 million in savings a month as the company grapples with the coronavirus-related shutdown of a large part of its operations, which also affects its resorts and entertainment productions.

“Disney faces a rough couple of years, to be sure. The challenges are existential, even. But that does not constitute permission to continue pillaging and rampaging by management,” Disney wrote in the post. “In fact, if a bonus reflects performance, we might want to claw back some of those millions given how they have managed cash.”

Between March 2018 and June 2019, the company made $11.5 billion of stock buybacks, according to Disney.

“Those buybacks are beginning to look pretty self indulgent right now,” Disney wrote. “Just give up some of your already ample compensation, especially this year. Give up, god forbid two or three basis points on the annual return.”

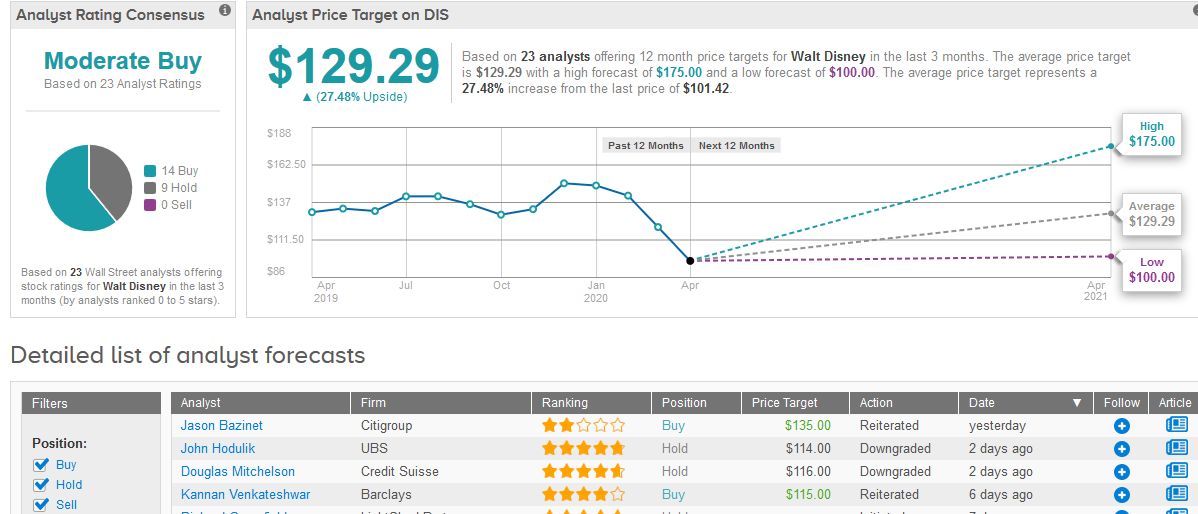

Overall Wall Street analysts have a Moderate Buy consensus rating on Disney stock as 14 out of 23 recommend investors buy its shares, and 9 say Hold the stock. The $129.29 average price target implies 27% upside potential in the shares in the coming year. (See Walt Disney stock analysis on TipRanks).

Related News:

Delta Air Lines Posts Quarterly Loss, Plans 50% Cut in Daily Cash Burn

Oppenheimer: 3 Stocks That Are Worth a Close Look

Facebook Invests An Eye-Watering $5.7B in India’s Jio Platforms