Disney’s (DIS) plans for a gradual return to normality have been thrown into disarray, as the coronavirus has made it clear it has not left the building yet. The recent spike in cases caused the company to delay the opening of Disneyland in California, which was originally slated for July 17. Walt Disney World in Florida is scheduled to open its doors again on July 11 but that also appears highly unlikely now, considering the host of new COVID-19 cases in the state.

Theme parks aren’t Disney’s only problem. No date has been set yet for the resumption of live movie production, either. What’s more, the highly anticipated release of its summer 2020 blockbuster, Mulan, has been pushed back yet again from July 24 to August 21.

The lack of clarity has led to a reevaluation at investment firm Needham. 5-star analyst Laura Martin noted, “Owing to persistent COVID-19 uncertainties, we lower our FY20 DIS estimates to revenue of $68.1 billion (down 3% year-over-year and 5.5% below our previous estimate), and Adjusted EPS to $1.34 (down 77% year-over-year and 51% below our previous estimate).”

Looking ahead to August’s FY3Q20 results, Martin expects revenue to decline by 35% year-over-year (13% below her original estimate) to $13.2 billion. Additionally, the analyst thinks adjusted EPS will plunge into the red, forecasting a loss of $0.65 per share. The figure is well below 3Q19’s EPS of $1.35, and lower than Needham’s previous call for EPS of $0.18.

The one bright spot amid all of the anticipated year-over-year contractions is reserved for Disney’s OTT offerings. Based on these products, Martin believes “DIS will be a winner of the ‘streaming wars’.”

The segment boasts three “unique” services – ESPN+, Disney+ and Hulu. These, according to Martin, provide Disney with “the ability to target different market segments and cross promote and bundle with discounts and a much more favorable subscription service than that of streaming leader and rival Netflix.”

To this end, Martin keeps a Hold rating on Disney without suggesting a price target. (To watch Martin’s track record, click here)

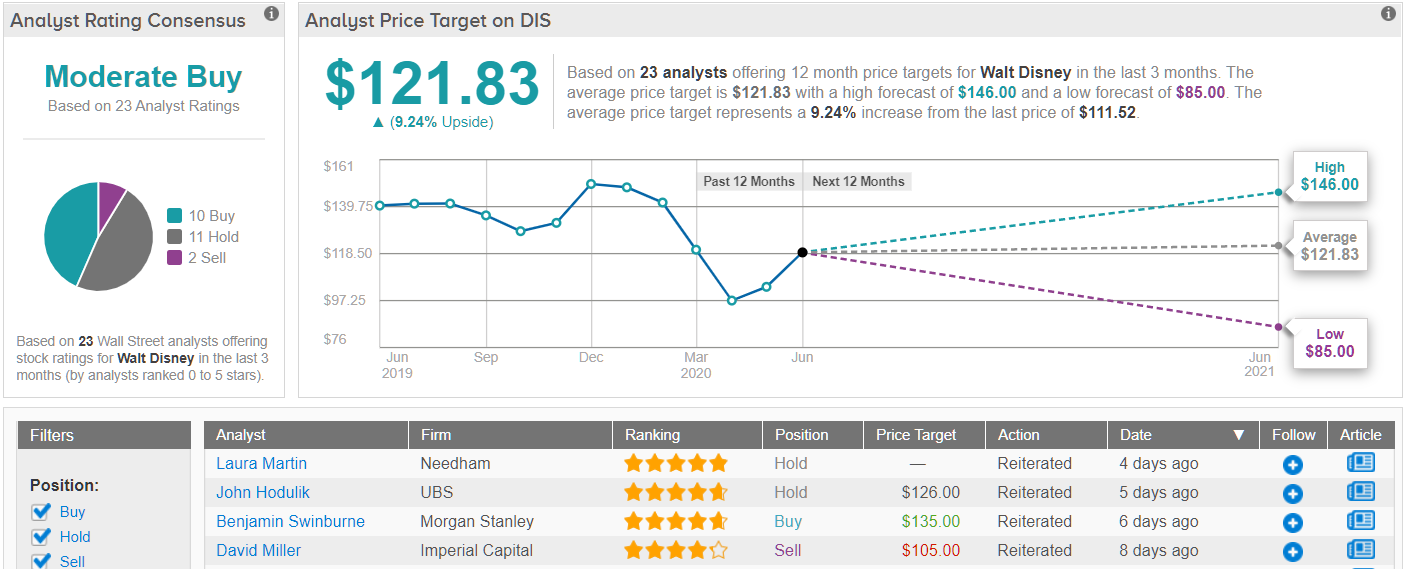

The rest of the Street remains cautiously optimistic about Disney. The analyst consensus rates the House of Mouse a Moderate Buy, based on 10 Buys, 11 Holds and 2 Sells. At $121.83, the average price target indicates upside potential of 12% over the coming months. (See Disney stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.