Dogecoin’s (DOGE-USD) social chatter has nearly hit rock bottom, and while this might seem like a red flag to some, it could actually be the perfect time to buy, according to Santiment. In a recent report from January 9, Santiment labeled Dogecoin’s crowd sentiment as “bearish” with a score of just 1 out of 5, the lowest in a year. Despite this, the crypto analysis firm suggests there’s potential for a “nice upside” if the market shifts.

Contrarian Traders Bet on Dogecoin’s Potential Upside

For those daring enough to go against the crowd, Santiment is making the case for a contrarian bet on DOGE. The coin has been relatively quiet lately, even with brief bursts of activity like when Elon Musk briefly changed his Twitter handle to “Kekius Maximus” earlier this year. Since then, Dogecoin has seen its market cap drop by 28%.

But some traders, like pseudonymous crypto trader Wizz, are predicting Dogecoin will outperform major cryptocurrencies in the next 3-6 months. In a post on X (formerly Twitter), Wizz shared their optimism, suggesting that Dogecoin’s price action mirrors last year’s movements, which led to a major surge in 2025.

Dogecoin Searches Plummet amid Lawsuit Fallout

The sentiment surrounding Dogecoin has cooled off, with searches for the coin dropping nearly 74% since November 2024. This coincides with the dismissal of a class-action lawsuit accusing Elon Musk and Tesla ($TSLA) of manipulating Dogecoin’s price. Despite the dip in hype, some analysts remain bullish, with predictions placing Dogecoin between $3 and $5 in 2025, according to Cointelegraph.

The quiet period could actually be a golden opportunity for traders ready to jump in when the crypto market picks up again.

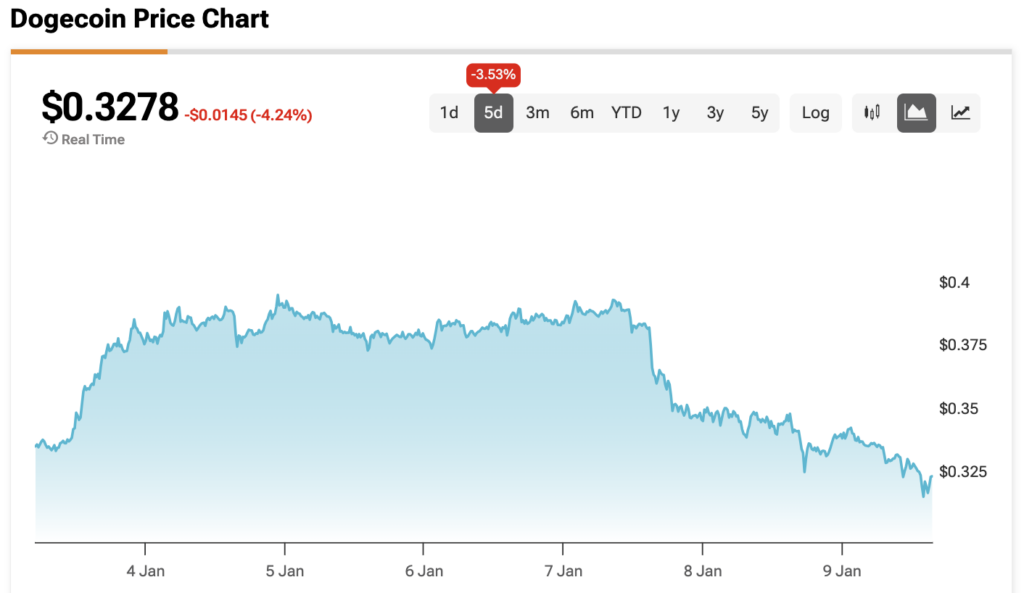

At the time of writing, Dogecoin is sitting at $0.3278.