Donnelley Financial Solutions, Inc. (DFIN), industry leader in risk and compliance solutions, provides regulatory and compliance services for both private and public corporations. The company is the largest SEC filer in the United States with 2020 submissions of more than 80,000. In addition, it is the second largest SEC compliance software provider trailing Workiva Inc. (WK).

Despite being a dominant player in these fields, Donnelley Financial has seen its revenue decline for several years, ever since it was spun off from R. R. Donnelley & Sons Company (RRD) in 2016.

The drop in revenue is partially attributable to the secular decline of the company’s print business due to regulatory changes and the convenience of software-based solutions. The rest is associated with the elimination of non-strategic business assets and competition for regularized SEC filings as customers transition to software-based filing applications. Workiva has been grabbing market share from Donnelley Financial for several years with its software-based solutions.

Business Transformation

2020 appears to have been the turning point as Donnelley Financial progresses through its own digital transformation. Total organic revenue growth increased by 2.3% in FY’20 and expectations are for low single-digit growth in the coming year.

The company has been moving away from print media and shifting towards Software-as-a-Service (SaaS), with applications such as ActiveDisclosure and Venue Virtual Data Room, two products that provide regularized and transactional filings, respectively.

While “high-growth” won’t be in management’s vocabulary any time soon, investors can take comfort in the fact that the revenue mix is shifting towards software and tech-enabled solutions, resulting in a higher level of profitability and free cash flow. Donnelley Financial is in the process of completing its plan to minimize its manufacturing footprint, which will significantly reduce fixed costs, increase profitability, and allow for double-digit recurring revenue growth in the long run.

Business Segment Trends

Currently, Software Solutions and Tech-Enabled Services account for 26% and 51% of net sales, respectively, while Print and Distribution generate 23% of sales.

Q4’20 year-over-year revenue decreased by 12.9% for Print and Distribution, whereas revenue for Tech-Enabled Services increased by 27.6% and Software Solutions by 8%.

Looking ahead, the company is calling for Software Solutions revenue growth of 10% annually, while Print and Distribution sales are expected to shrink. Tech-Enabled Services, consisting of SEC transactional and compliance filings, delivered strong growth in Q4’20 due to increasing market share and a strong uptick in IPO and M&A activity, which is set to continue in the year ahead. The company anticipates that by 2024, the revenue mix will be 44% for Software Solutions, 40% for Tech-Enabled Services, and 16% for Print and Distribution.

Stock Chart

DFIN’s digital transformation has not gone unnoticed by the investment community, given that the share price is up 391.6% in the last year.

That said, even with the strong stock performance, there is still fuel left in the tank. Donnelley Financial has a low valuation with a price/sales ratio of only 1.11, far less than the industry average of 12.3.

Wall Street’s Take

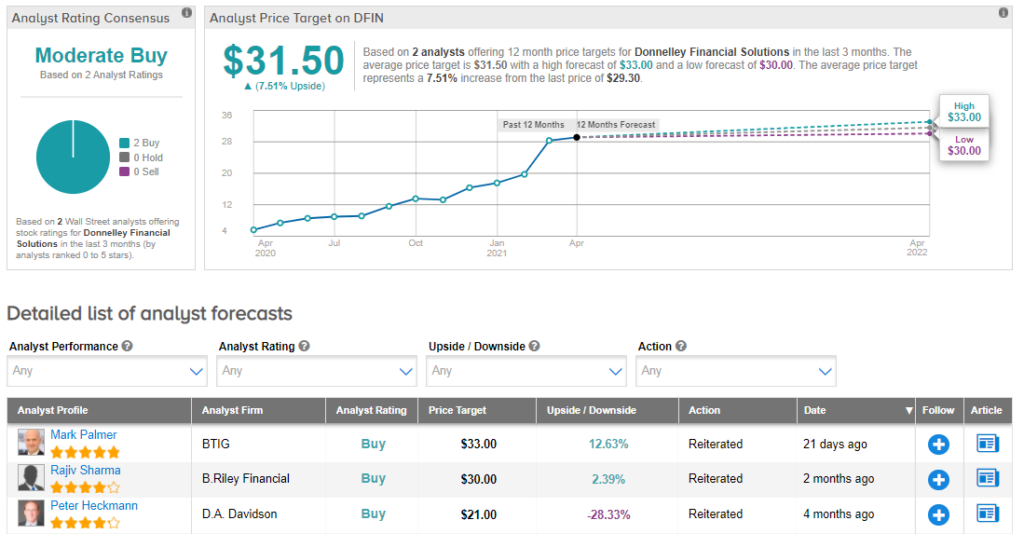

From Wall Street analysts, Donnelley Financial Solutions earns a Moderate Buy consensus rating, based on 2 Buys. Additionally, the average analyst price target of $31.50 puts the upside potential at 7.5%. (See Donnelley Financial Solutions stock analysis on TipRanks)

Summary And Conclusions

Donnelley Financial is the industry leader in risk and compliance solutions, assisting companies with global security regulations. However, being at the top of the food chain doesn’t guarantee success. In fact, DFIN’s revenue decline in recent years reflects the secular decline in the company’s Print and Distribution business.

Having said that, the company is undergoing a digital transformation, scaling down Print and Distribution while introducing SaaS solutions for SEC filing and other regulatory applications. Revenue growth was slightly positive in 2020, with hints of the strong growth and profitability to come in the next few years. Therefore, despite the impressive share price rise over the last year, DFIN is still undervalued.

Disclosure: On the date of publication, Steve Auger did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.