Is anything about to stop Netflix’s (NFLX) mercurial ascent? The 2010s’ best performing stock has been on fire this year, delivering a market-stomping 35% to build a 189 billion market cap. Driven by global stay-at-home measures in the wake of the coronavirus pandemic, viewership has increased, and the stock has not only proved resilient, but flourished throughout the period.

Investors and analysts will pay close attention to Netflix’s first-quarter earnings this evening, hoping to glean insights worthy of an investment thesis from the company’s financial data and management’s comments.

Wedbush’s Michael Pachter‘s estimates are roughly in-line with those of the Street, calling for Q1 revenue of $5.733 billion and EPS of $1.66. The analyst expects global stay-at-home guidelines to have “dampened churn,” and bring “moderate upside to subscriber additions and revenue.” Pachter also expects momentum to continue into Q2.

However, while Netflix 1Q earnings may benefit from stay-at-home economy, Pachter believes the streaming giant’s recent share gains on account of the “COVID-related streaming gains are more than priced in.”

While continuing to break down his bearish thesis on Netflix, Pachter added, “We estimate that content from Comcast, Fox, Disney and Warner Bros. accounted for 60 – 65% of Netflix viewing hours in 2019, and we continue to expect most of it ultimately to migrate away. While we expect the migration of third-party content to be relatively slow, it will be difficult for Netflix to replace it to keep its current subscriber base loyal.”

Additionally, the analyst believes the recent success of shows such as Tiger King and Ozark, will bring into sharp light the glaring lack of new content in 6 months’ time.

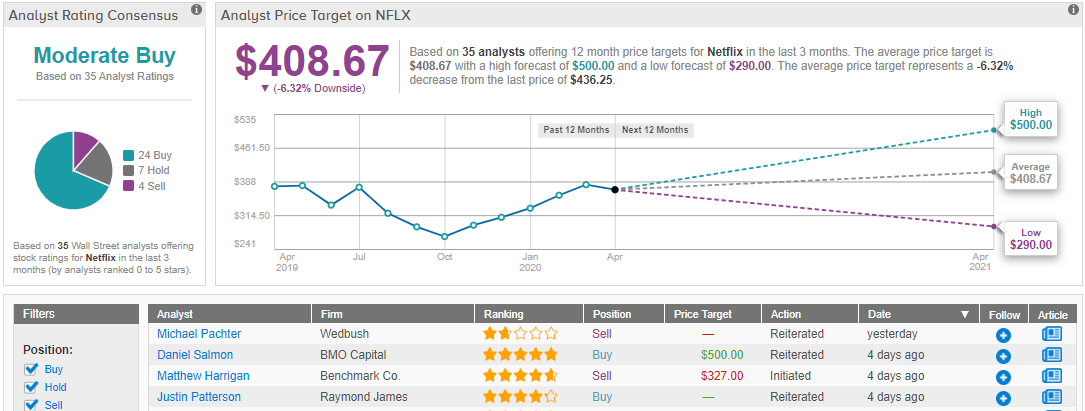

All in all, Pachter reiterated a Sell rating on Netflix shares, although he raised his price target from $173 to $194 “on declining risk-free rate.” Still, downside from current levels is a depressing 55%. (To watch Pachter’s track record, click here)

The rest of the Street remains more upbeat when considering Netflix’s prospects. 25 Buys, 7 Holds and 4 Sells add up to a Moderate Buy consensus rating. However, following the recent rally, the average price target of $408.67, indicates possible downside of 6%. (See Netflix stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.