The Dow Jones Industrial Average (DJIA) is sliding 0.09% today after the release of the October Job Openings and Labor Turnover Survey (JOLTS) report. This report showed job openings increased by 372,000 from September to 7.74 million in October. That’s a surprise compared to experts’ estimate of 7.52 million job openings for the month. It’s also worth mentioning that job openings increased by 941,000 year-over-year.

Breaking down this data further, hires were down slightly from September to October, with year-over-year hires dropping 501,000. One increase in the report was quits, which were up 228,000 to 3.3 month-over-month. Even so, quits fell 308,000 year-over-year.

What This Means for the Dow Jones Industrial Average Index

The October JOLTS report is important as it’s the final jobs report to come out before the next Federal Reserve meeting on Dec. 18. That meeting is when the central bank will decide if an interest rate cut is in order.

The Fed started increasing interest rates in 2022 to combat rising inflation. That peaked at 5.25% to 5.5% in July 2023. Since then, rates have been falling and are currently sitting at 4.5% to 4.75%. A December cut could drop rates to between 4.25% and 4.5%.

Lowering interest rates could be good news for the stock market as it would show the Fed isn’t as worried about inflation. Traders are betting a rate cut will happen, with 69% believing so. However, comments from the Fed later today could alter those bets.

Should You Buy Dow Jones Stocks?

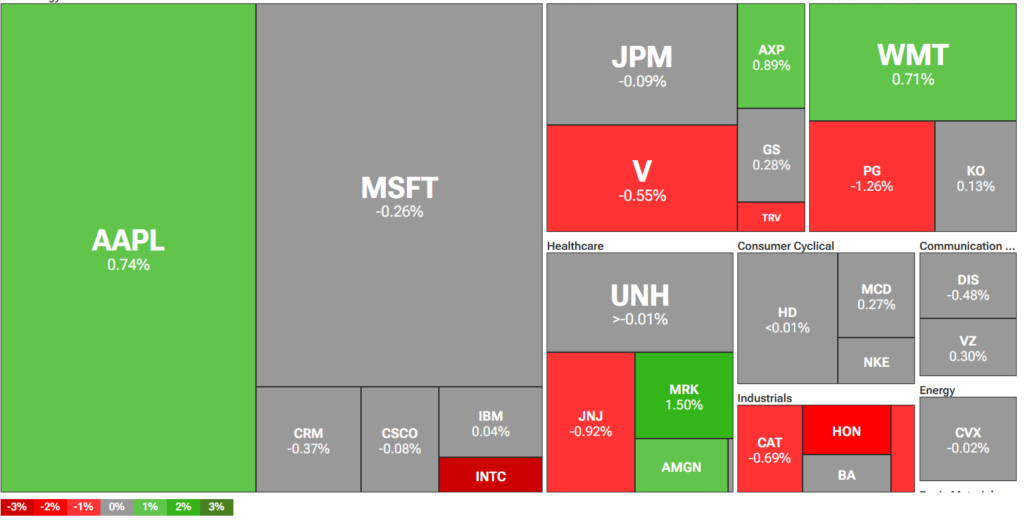

With the Dow Jones slipping today, investors may be wondering about the stocks on the index resisting this fall. There are a few options for traders to invest in, and they are spread across several sectors. Among them are Apple ($AAPL), Walmart ($WMT), Merck ($MRK), American Express ($AXP), and Amgen ($AMGN) shares.