In the first two days of 2025, drugmakers raised the prices on 583 products, according to 46brooklyn Research. This marks a record increase in list prices for the start of a new year, with 590 pricing changes overall, including seven price cuts. Historically, about a third of wholesale acquisition cost (WAC) increases occur on January 1, but this year’s hikes were the highest since data collection began in 2011.

Among the drugs slated for 2026 Medicare price negotiations, only Merck’s ($MRK) Januvia saw a 42% price cut, while others like Eli Lilly’s ($LLY) Jardiance and Pfizer’s ($PFE) Eliquis saw WAC increases of 3% and 2%, respectively. Novo Nordisk’s ($NVO) Ozempic rose by 3%, Gilead’s ($GILD) Biktarvy increased 5.9%, and Roche’s Hemlibra saw an 8% jump. Meanwhile, Collegium Pharma ($COLL) hiked Nucynta’s price by up to 20%, likely to capture value before generics enter the market.

Some companies, however, cut prices amid regulatory pressure. Boehringer Ingelheim reduced the price of its asthma drug Atrovent HFA by 35% following scrutiny over patent-related practices. Other firms like AbbVie ($ABBV), GSK ($GSK), and Teva ($TEVA) also faced Federal Trade Commission warnings regarding patent issues for asthma inhalers and related treatments.

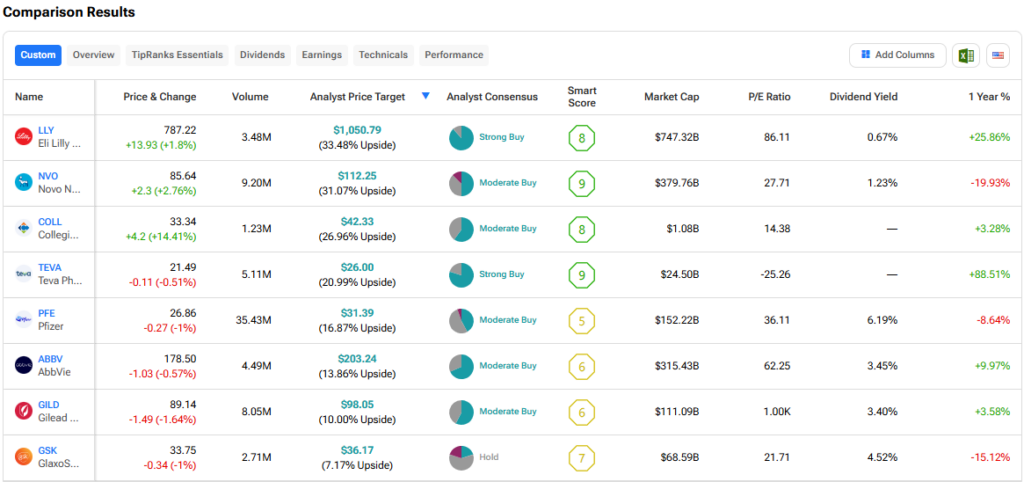

Which Drugmaker Stock Is the Best Buy?

Turning to Wall Street, out of the stocks mentioned above, analysts think that LLY stock has the most room. In fact, LLY’s average price target of $1,050.79 per share implies over 33% upside potential.