Earnings season is in full swing, and investors are waiting – eagerly – for the results. So far, the first 26% of companies to report results have showed a 4 to 1 split in favor of positive earnings surprises, beating the forecasts. It’s a good result, but only partially a result of good performance. The bar was set low for Q2, especially after Q1’s grim results. 1H20, encompassing the coronavirus crisis and the associated economic shutdowns, saw GDP contract dramatically, and earnings and revenues – in absolute numbers – have reflected that.

One measure of the damage that coronavirus did is the aggregate decline in earnings year-over-year. Looking at S&P 500 companies, that figure is 42%. If the trend holds, it will make Q2 2020 the worst since the 69% decline in Q4 2008.

But not every company is putting lipstick on a pig. Three Big Techs are reporting this evening, and early analyst reports have set a mood of guarded optimism. Using TipRanks database, we’ve pulled up the details. Here is what to expect.

Facebook, Inc. (FB)

A range of notable names are lined up to report results this evening. One worth watching is social media giant Facebook. The stakes are high for the company, as its stock has been soaring nearly 60% since March’s novel coronavirus selloff.

But it didn’t come easily. The company faced serious inquiry into the platform’s practices regarding hate speech – which brings us back to questions of corporate censorship which always seem to dog the company – and potentially hundreds of advertisers are threatening to boycott the company. This comes just as Mr. Zuckerberg is being summoned before Congress again.

On a positive note, Facebook saw gains in both Monthly Average Users and Average Revenue per User, two key metrics in measuring a social platform’s performance. The social lockdowns of the first half of the year kept people at home – and many turned to Facebook for solace and connection. The result was greater traffic, and more ad clicks.

And that has Wall Street expecting year-over-year gains for the social media giant. Revenues are expected to grow 3%, to $16.9 billion, while EPS is expected at $1.39, up an impressive 53% from last year.

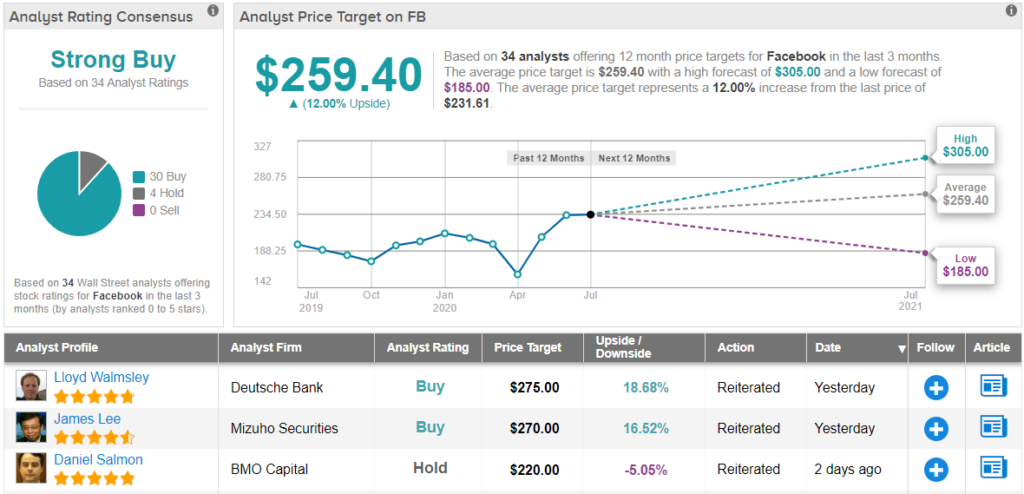

5-star analyst Lloyd Walmsley, of Deutsche Bank, takes a favorable view of Facebook’s near- and mid-term prospects. He writes, “Attention around FB has primarily been related to the social unrest in June and boycott in July and how it may impact 2Q results as well as the outlook / tone on the Facebook call. We trim our estimates but still remain above-consensus for Facebook and view the shares favorably positioned for the second half.”

Regarding advertiser boycotts, Walmsley believes that these will more likely than not turn out to be a blip: “While we do recognize that certain national brand advertisers are staying off FB with medium- or longer-term intentions, we have heard in checks that advertisers heavily dependent on FB to reach certain demographics, seem to have no choice but to continue their ad spend on the platform.”

In line with these comments, Walmsley rates FB shares a Buy, with a $275 price target representing a 18% upside potential in the coming year. (To watch Walmsley’s track record, click here)

The conventional wisdom agrees that Facebook shares are Buying proposition. FB has an analyst consensus rating of Strong Buy, based on 30 Buys against just 4 Holds. The stock is selling for $231.55, and the average price target, $259.40, suggests an upside potential of 12% from that level. (See Facebook stock analysis on TipRanks)

PayPal Holdings, Inc. (PYPL)

Next on our list, PayPal, had an obvious path to succeed during the corona crisis: when life moved online during the shutdown policies, the major online payment processor saw business boom. PYPL shares rose steeply during the pandemic period, in sharp contrast to the general market turndown, and outperformed the market by a wide margin. PYPL is up an impressive 42% since the February/March market crash, compared to the S&P 500 which is down a net of 4.9% over the same time frame.

During the first quarter, which saw the strongest shut-down measures and greatest fears regarding the pandemic, PayPal did see earnings contract. EPS fell from Q4’s 67 cents per share to 44 cents. But the Q2 forecast is looking better; analyst estimates predict a rise back to 61 cents per share. At the top line, the expected revenue of $4.99 billion should represent 16% growth year-over-year. The big metric, however, will be in the total payment volume, a key measure of the company’s business performance: analysts expect it to reach $210 billion, up 10% from Q1, and 22% year-over-year.

Writing for Piper Sandler, 4-star analyst Christopher Donat initiates coverage of PYPL shares with an unequivocal bullish tone: “We view PayPal as one of the best-positioned companies to take advantage of changes in consumer purchasing behavior due to the pandemic. We would encourage investors to build or add to positions in PYPL, especially in any future pandemic-related market pullbacks. We expect PayPal to be one of the better revenue growth stories in the payments sector in coming quarters.”

Donat’s rating, of course, is a Buy, and his $210 price target implies a one-year upside of 15%. (To watch Donat’s track record, click here)

The Strong Buy analyst consensus rating on PayPal is based on 33 reviews, including 27 Buys and 6 Holds. The shares have appreciated recently, and the $181.80 trading price is pushing up to the average target of $184.14. (See PayPal’s stock analysis on TipRanks)

Qorvo, Inc. (QRVO)

Last on our list today is Qorvo, a semiconductor chip maker with a solid reputation for quality integrated circuits in the networking communications niche. The company’s products are used in PCs, laptops, smartphones, and tablets to enable wireless connections, and are also found in older hardware such as cordless phones and industrial radios.

The essential nature of Qorvo’s niche has insulated the company, and shares recovered from the market crash well. QRVO is currently trading back at levels seen in early February. And, despite a sequential drop in EPS for Q1, Qorvo reported an earnings beat in the last quarter; the EPS of $1.46 beat the forecast by 24%. The calendar first quarter typically has Qorvo’s lowest EPS of the year, so it’s important to note that Q1 2020 showed a 28% gain year-over-year.

Looking ahead to tonight’s calendar Q2 release, analysts are less sanguine. The company faces headwinds from a series of bottlenecks related to the pandemic: manufacturing slowdowns, supply and distribution chain disruptions, and lower sales. EPS is expected to come in at 96 cents. On a positive note, the company is well positioned to benefit from the shift to wifi 6 for IoT apps, and the shift to 5G which will require new modem chips.

Rajvindra Gill, from Needham, sees those last positives as overbalancing the headwinds in the long term. He writes, “We view QRVO as a major beneficiary of the expected upgrade cycle at Apple and Samsung with 5G phones. Although we expect QRVO’s RF content to remain relatively flat at Apple, it is benefiting from higher builds, plus QRVO has multiple 5G engagements at four of the largest Chinese OEMs. Moreover, we expect QRVO’s margin profile to benefit from a higher mix of IDP sales, which include 5G infrastructure and IoT.”

Gill’s upbeat stance and Buy rating are backed by a $160 price target, indicating a robust upside potential of 41% in the year ahead. (To watch Gill’s track record, click here.)

Qorvo has 13 Buys and 4 Holds behind its Strong Buy analyst consensus rating. The stock’s $124.47 average price target suggests an upside potential of nearly 8% from the trading price of $115.37. (See Qorvo stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.