Earnings season is nearing the finish line, but that doesn’t mean the excitement is over. On top of the better-than-expected numbers, the latest market rally, which saw the S&P 500 close just shy of an all-time high on Tuesday, has investors on the edge of their seats awaiting the remaining results.

With this in mind, investors are looking for the best way to get the lowdown on the companies that have yet to report. To do this, we recommend using TipRanks’ Stock Screener.

The tool helped us get the full scoop on 3 stocks that look especially promising ahead of their November 7 earnings releases. Going into the releases, each of the stocks has earned the Street’s approval with “Strong Buy” consensus ratings, which are based on all of the calls published in the last three months.

Walt Disney (DIS)

After posting lackluster fiscal Q3 results, Wall Street’s focus has zeroed in on Disney. That being said, many analysts like the stock’s setup as the house of mouse’s earnings release inches closer.

The company has given the Street reason to believe that key upcoming catalysts outweigh any concerns regarding its legacy Fox businesses that hampered DIS in Q3. Three of its films, namely The Lion King, Aladdin and Toy Story 4, all generated more than $1 billion at the box office driving a 60% year-over-year increase in box office gross. Not to mention two more movies are slated for a December release.

Disney’s new Star Wars attractions in both California and Orlando are also set to contribute to a solid quarterly performance based on current attendance levels. It should be noted that the media networks segment is a must-watch area as well. The company’s ability to close new carriage agreements with various networks could be a step in the right direction in terms of affiliate pricing.

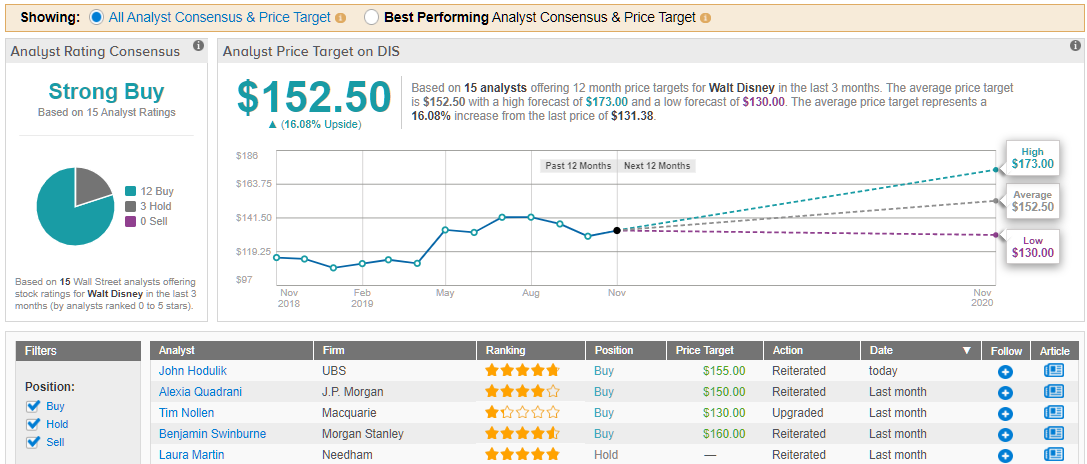

J.P. Morgan analyst Alexia Quadrani deems DIS as a “standout among its media peers” thanks to its “scale, strategy and brand to succeed in this rapidly changing media consumption environment”. As a result, the four-star analyst reiterated her Buy rating and $150 price target. (To watch Quadrani’s track record, click here)

Evercore ISI analyst Vijay Jayant added, “We like the setup for the stock here and think improved visibility into pro forma financials, combined with the aforementioned catalysts, suggest compelling reward / risk trade-off. We think Disney’s legacy businesses are worth ~$100/share assuming a blended 14.5x P/E multiple, and separately see ~$55 in value for the streaming platforms (8.5x EV/2025E sales discounted back to present).”

Like Quadrani and Jayant, Wall Street takes a bullish approach when it comes to DIS. 12 Buy recommendations and 3 Holds received in the last three months add up to a ‘Strong Buy’ analyst consensus. At a $152.50 average price target, shares could surge 16% over the next twelve months. (See Disney stock analysis on TipRanks)

Take-Two Interactive (TTWO)

Take-Two is one of the top video game developers in the U.S. and owns two major publishing labels including Rockstar Games and 2K. With one analyst expecting further upside despite already trading at the high-end of its historical range, it’s no wonder investors have been captivated by TTWO.

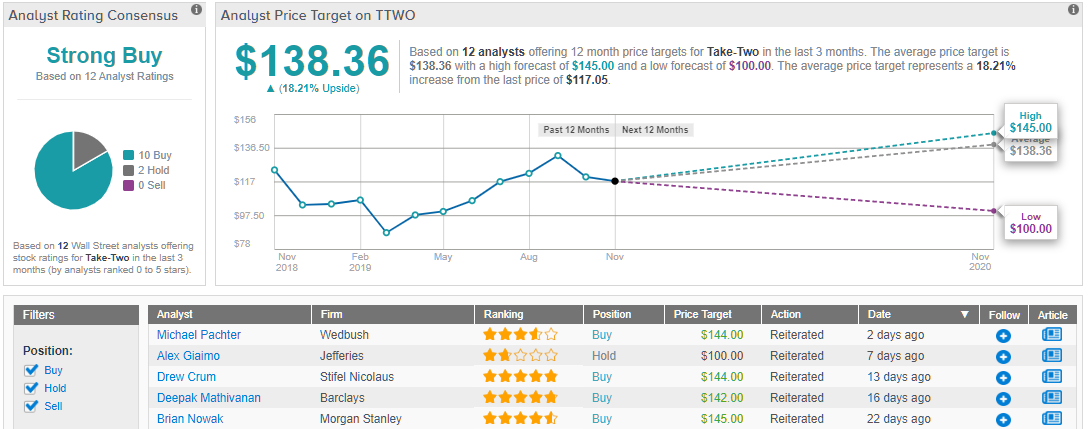

Barclays’ Deepak Mathivanan cites TTWO’s high-quality games as cementing its status as “best positioned for the cloud gaming future”. He adds that significant roster changes during the NBA offseason bodes well for its NBA 2K19 game as it’s expected to cause higher repeat purchase rates.

“This should drive an increase in repeat purchaser rate from 70% historically to closer to 80% this year, delivering an incremental $80mn/$0.52 in revenue/EPS or a 11% lift vs. our NTM (2Q20-1Q21) EPS estimates,” he explained.

Ahead of the upcoming earnings release date, Mathivanan reminds investors that TTWO is especially appealing as there is still a large runway left for margin growth. “We see three drivers of margin expansion: 1) a strong pipeline of content including Borderlands 3 in FY20, additional content updates in Rockstar Online, and additional titles from Social Point; 2) a greater mix of revenue from high-margin recurrent consumer spend including mobile and full-game downloads; and 3) significant contribution from two, highly-profitable open worlds running simultaneously,” he stated.

All of this played into the five-star analyst’s conclusion that TTWO remains a Buy. Adding to the good news, he sees 21% upside potential in store. (To watch Mathivanan’s track record, click here)

Similarly, the rest of the Street likes what it’s seeing. 10 Buys vs 2 Holds assigned in the last three months give TTWO a ‘Strong Buy’ consensus rating. Additionally, its $138 average price target indicates 18% upside potential from the current share price. (See Take-Two stock analysis on TipRanks)

Noble Energy (NBL)

Going into Thursday’s earnings release, the oil and gas company appears right on track to meet its impressive growth targets.

While NBL set the bar pretty high in terms of its U.S. onshore growth objectives, recent data suggests that the company will be able to meet this lofty goal. Oil production in the Delaware Basin has increased 13% sequentially and is up 35% in Eagle Ford from its second quarter. In addition, NBL successfully completed the Aseng development well in West Africa, which could bolster overall volumes.

If that wasn’t enough, NBL announced that it had amended its agreement with Dolphinusin in Egypt to not only double the amount of firm contracted volumes but also provide a five-year extension in the supply agreement.

“We expect a solid print from NBL with the company appearing on track to deliver against its lofty US onshore growth objectives, albeit with less fireworks than the 2Q19 print,” J.P. Morgan analyst Arun Jayaram commented. “Partial quarter state data suggest that operated Delaware Basin oil production is up 13% sequentially, while Eagle Ford oil production is up 35% relative to 2Q19 levels. On the other hand, DJ Basin data looks incomplete, but we note the company was able to achieve its targeted DJ TILs for the quarter. Consistent with its peers, 3Q19 financials will be neutered by weak gas and NGL pricing, which we believe is largely anticipated by the buy-side. In West Africa, the company successfully completed a development well at Aseng, which is expected to be tied into the production facility in 4Q19 thereby providing a lift to volumes, although West Africa liftings are expected to be higher in 3Q vs. 4Q. Finally, it appears that the company will make its decision regarding the strategic alternatives process regarding NBLX during 4Q19.”

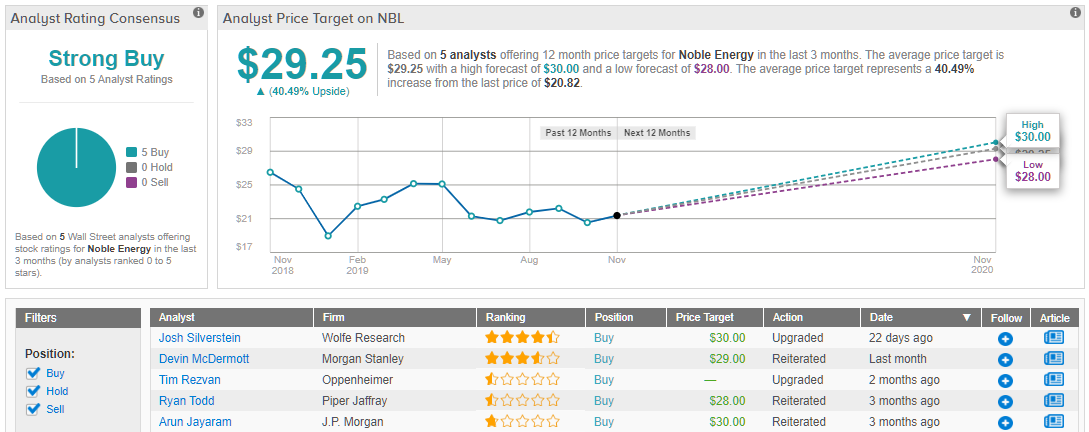

With all of this in mind, the analyst tells investors that he’s staying with the bulls when it comes to NBL. Jayaram also keeps his $30 price target, which conveys his confidence in NBL’s ability to climb 38% higher over the next twelve months. (To watch Jayaram’s track record, click here)

As NBL boasts 100% Street Support, the message is clear: the energy name is a ‘Strong Buy’. It should also be noted that its $29.25 average stock-price forecast implies a potential twelve month gain of 40%. (See Noble Energy stock analysis on TipRanks)