Are you ready for another round of earnings reports? We’re looking at three Strong Buy stocks which are reporting on Tuesday, and investors should be excited. The Q3 earnings season has been better than was anticipated, with 60% of S&P listed companies beating forecasts on revenues, and 74% beating on EPS. It’s a good end to a rough summer in the markets.

We found these top stocks through TipRanks’ Stock Screener tool, by setting the filters to sort for ‘strong buy’ ratings, any upside, and dividend payouts. The results are stocks that investors can expect to show solid returns in the coming months.

Diamondback Energy (FANG)

Based in Texas, Diamondback Energy engages in ‘hydrocarbon exploration,’ or to put it layman’s terms, oil drilling. Diamondback operates in the Permian Basin, of the richest oil regions in Texas and a driver of the fracking boom in the oil and gas industry that has bumped the US to the #1 spot as the world’s largest oil producer. The company is a mid-size player in the industry, with a market-cap of $14 billion, annual revenues exceeding $2.18 billion, and net profits in the range of $940 million – based on a daily production greater than 130,000 barrels of oil equivalent.

A product that the modern world cannot do without, along with smart management, has kept FANG profitable despite a 6% drop in share value this year. The company makes up for the lack of share appreciation with a modest dividend of 0.8% yield, or roughly half the sector average. The quarterly payout is 4.75 cents per share.

Looking ahead, the markets expect to see FANG report an earnings increase year-over-year, along with higher quarterly revenues Diamondback’s EPS has been rising steadily since Q1 of this year, although the company did miss the forecast last quarter by 2%. In the last eight quarters, Diamondback has beaten the earnings forecasts five times.

Putting this into raw numbers, analysts expect FANG to show $1.73 in the Q3 report, based on $1.05 billion in revenues. This represents an earnings beat of 3.6%, and a revenue beat of an impressive 95.3%.

Speaking of analysts, Roth Capital’s John White sees reason for optimism in FANG’s low debt load. As he points out, the company operates with low leverage, allowing it to focus on drilling activities and production. White writes, “Our rationale is that FANG does not receive proper credit for its lower leverage… In our view FANG is one of the premier Permian focused companies as it has displayed through its strong record of successful drilling and completion results over a multi-year period and capital return initiatives.”

White rates FANG a Buy along with $147 price target, which implies an upside potential of about 60% for the stock. (To watch White’s track record, click here)

Michael Glick, of JPMorgan, is also bullish on this oil producer. He points out the company’s expanding oil drilling activity, high free cash flow, and acquisitions of new drilling exploration areas. In a report dated October 9, Glick writes, “Diamondback is uniquely positioned in that it should have the highest growth rate among peers while delivering industry leading returns. We model the company growing oil ~16% in 2020Ey/y at a ~5.9% post-dividend FCF yield, and free cash flow continues to expand, particularly in the out-years. Late 2018 acquisitions doubled the size of the company…” Like White, Glick sets a high price target on this stock: $139, suggesting an upside of 60%.

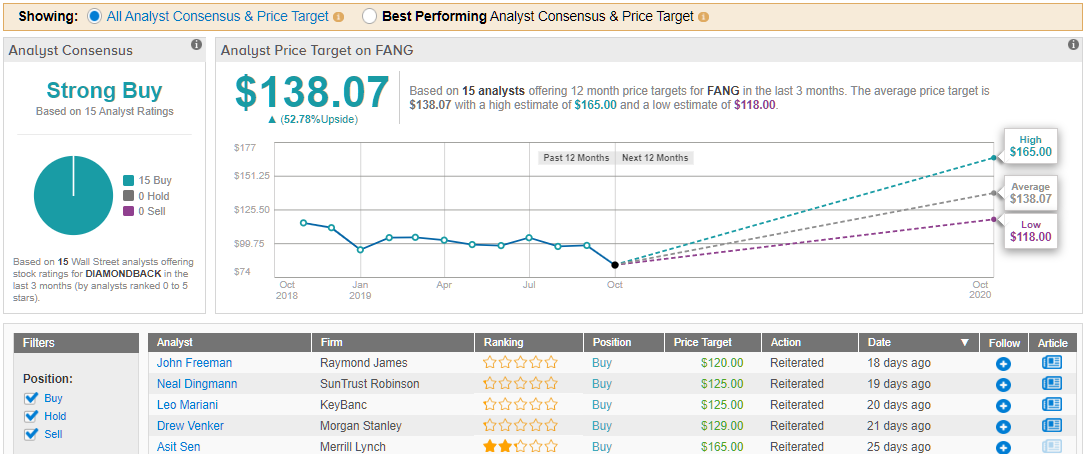

All in all, FANG’s Strong Buy consensus rating is unanimous – 15 analysts have given this stock an up-check. The average price target is $138, which indicates a 53% upside from the share price of $86. (See Diamondback stock analysis on TipRanks)

Microchip Technologies (MCHP)

Even at $5.35 billion in annual revenues, Microchip is considered a second-tier player in the semiconductor chip industry. The top-ten companies all exceed $12 billion annual revenues; add in the next five, and annual revenues are still above $8 billion. But just because it’s smaller than the competition doesn’t mean MCHP isn’t high-end; the company is a leader in its segment, producing microcontrollers, mixed-signal, and Flash-IP integrated circuits, among other products. Based in Arizona, the Microchip has three wafer fabrication facilities in the Western US, and assembly/test facilities in Thailand and the Philippines.

The company will report earnings for Q2 fiscal 2020 tomorrow. Microchip is still feeling the effects of the 2H18 slowdown, and analysts expect that the company’s results will show significant declines from one year ago. Conventional wisdom says the company will report $1.43 EPS based on quarterly revenues of $1.35 billion. This is a 21% earnings decline and a 10% revenue drop. On the positive side, just meeting the expectation will mean a 14% EPS sequential gain – and MCHP has a history of beating the earnings forecasts, having done so in 7 of the last 8 quarters.

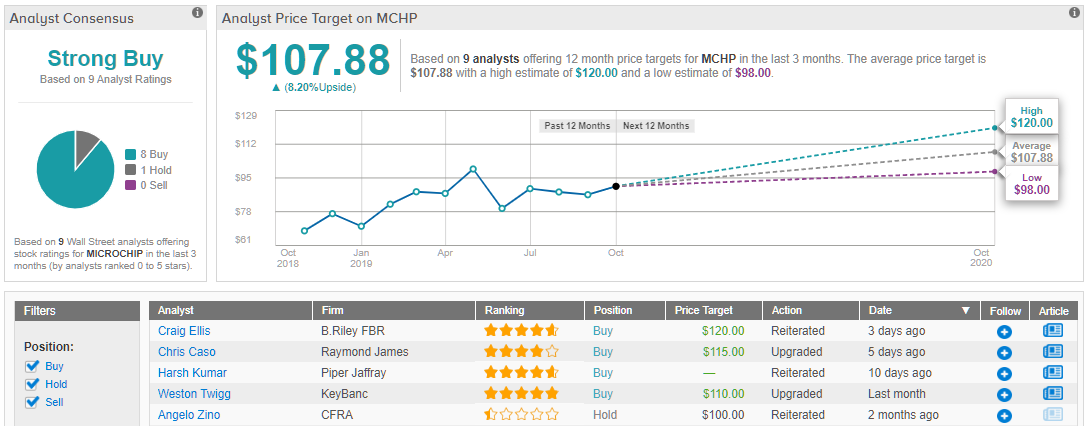

So, Microchip is well positioned in its industry, occupying a solid position in a clear niche. This, plus the company’s proven track record of product success has B. Riley’s 5-star analyst Craig Ellis reiterating his Buy rating along with a $120 price target. (To watch Ellis’ track record, click here)

The analyst says of the stock, “We expect another quarter of robust execution validate our thesis. We believe the company’s operational excellence will become even more visible when macro pressures subside, or at a minimum when channel inventory reduction pressure eases from acute to a more neutral factor, as we believe is starting to happen.”

Wall Street is on the same page. This ‘Strong Buy’ stock received 8 Buy ratings vs 1 Hold over the last three months. Its $108 average price target suggests about 8% upside potential from current levels. (See Microchip stock analysis on TipRanks)

Fidelity National Information Services (FIS)

The last stock on our list today is FIS, Fidelity National Information Services. This Florida-based company is a major provider of technology and outsourcing to the financial services industry. FIS brings in over $12 billion in annual revenue, and realized more than $825 million annual net income. The company has strongly outperformed the broader markets this year, gaining over 30% in so far in calendar 2019.

The fintech sector is a known money-maker, and FIS is widely expected to report a year-over-year gain for Q3. Analysts are forecasting an EPS of $1.35, or 1.5% higher than one year ago. Revenues are also expected to show a yearly gain, of 34%. Market watchers expect the company to report $2.8 billion in revenues for the quarter. Over the last month, analysts have increased their EPS forecast by a modest 0.11%; this is taken a signal that the company is likely to meet expectations.

Major research firms – and some 5-star analysts – are showing FIS some love in the lead-up to the earnings release. Writing from Canaccord, Joseph Vafi sets a $150 price target on the stock, writing of the stock’s near- to mid-term prospects, “We think the new FIS, fueled by material cost and revenue synergies… can achieve enough accretion to drive earnings growth towards twenty percent in a couple of years… realistic synergies could drive mid-teens EPS growth in 2021 and 2022; but we believe a more optimistic scenario is achievable, driving EPS growth closer to 20%. Of course, strong cash flow conversion here could also drive additional shareholder initiatives, in boosted buybacks and dividends.” Vafi’s price target suggests an upside of 12.5%. (To watch Vafi’s track record, click here)

Wolfe Research analyst Darrin Peller is also optimistic about FIS’ profit outlook. He writes, “The company sales/backlog up >30%/7% in 2Q and WP/VNTV’s cross-sell wins now totaling 56 should enable a continuation of its organic growth story.” He added, “…we model organic, constant currency growth of 5.5%. That said, we see our estimate as conservative given 2Q’s pro-forma growth of nearly 6%…” Like Vafi, Peller gives FIS a $150 price target.

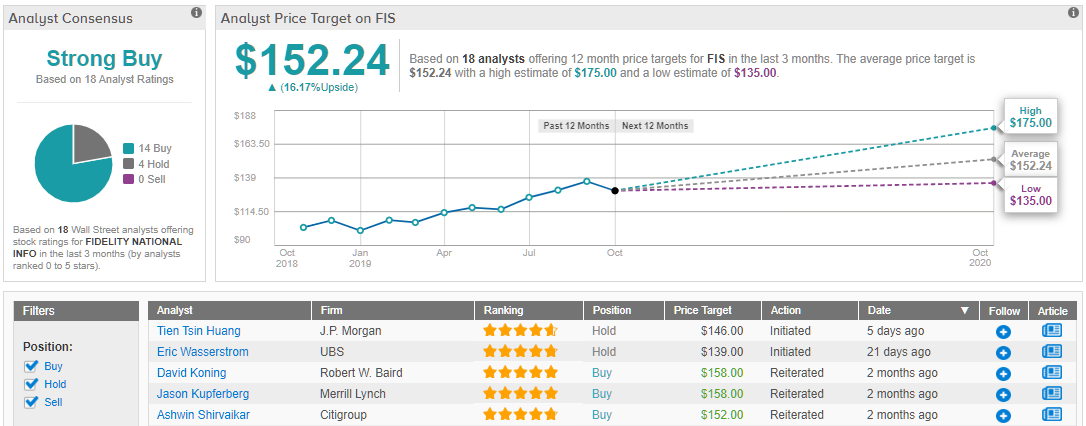

FIS has built its Strong Buy consensus rating on solid performance which has attracted 14 buys in the last three months, as opposed to only 4 holds. This stock is selling for $133, so the $152 average price target implies an upside of 16%. (See FIS stock analysis on TipRanks)