By Zach Wohlberg

With earning season for Biotech companies approaching, Jefferies’ analysts detailed their thoughts on several mid to large cap biotech companies. The analysts anticipate positive prescription trends and an increase in EPS due to buybacks will help the sector with its recent climb. Below, the analysts provide updates on Gilead Sciences, Inc. (NASDAQ:GILD), Medivation Inc (NASDAQ:MDVN) and Amarin Corporation plc (ADR) (NASDAQ:AMRN).

Gilead Sciences, Inc.

Gilead’s earnings will be released on July 25th after markets close. Analyst Brian Abrahams believes that an increase in demand for its newer HIV products and aggressive share buybacks should cause Gilead to beat EPS expectations. Sovaldi, Gilead’s Hepatitis C drug, has experienced more U.S. stability recently and the analyst expects this stability to help with Gilead’s revenues. Abrahams does note that Harvoni, Gilead’s flagship HCV drug, is experiencing uncertain sales that could “offset potential enthusiasm about strength of other products.”

The analyst states that the stock is slightly undervalued and reiterates his Hold rating with a price target of $97, marking an increase of 13% from current levels.

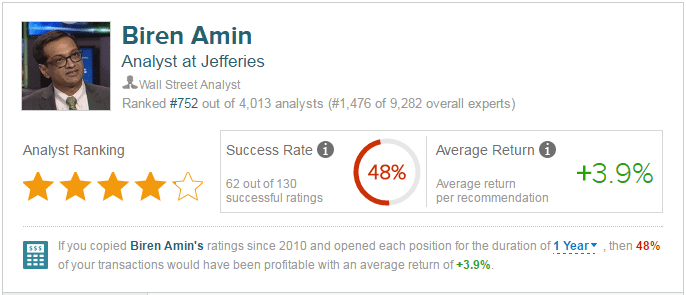

As usual, we like to include the analyst’s trackrecord when reporting on new analyst notes to give a perspective on the effect it has on stock performance. According to TipRanks, Abrahams is ranked #909 out of 4,013 analysts on TipRanks, where he achieved a trackrecord of 50% success rate and 3.3% average return.

As of this writing, out of the 13 analysts who have rated the company in the past 3 months, 62% gave a Buy rating and 38% gave a Hold rating. The average 12-month price target for the stock is $114.30, marking a 33.33% upside from current levels.

Medivation Inc

Analyst Biren Amin is expecting Q2 U.S sales of $338 million for Xtandi, a drug for prostate cancer, when Medivation releases its earnings on August 4th. The analyst will also keep an eye for “commentary on label update on Xtandi” as well as data from Xtandi in ER/PR+ breast cancer and the PLATO trials. Lastly, Amin will continue to monitor updates regarding the testing of talazoparib in “BRCA mutant breast cancer trial” and possible M&A.

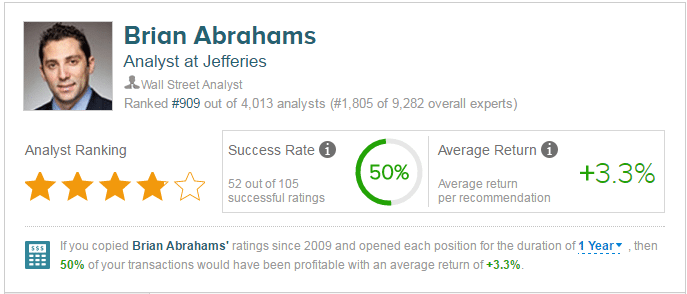

The analyst reiterates his Hold rating with a price target of $56, marking a decrease of 10% from current levels. Adam Jonas is ranked #752 out of 4,013 analysts on TipRanks with a success rate of 48% and an average return of 3.9%.

Out of the 15 analysts who have rated the company in the past 3 months, 73% gave a Buy rating and 27% gave a Hold rating. The average 12-month price target for the stock is $64.29, marking a 3.14% upside from current levels.

Amarin Corporation plc (ADR)

Finally, analyst Hugo Ong is predicting better than expected Vascepa Q2 sales of $26.9 million when Amarin reports earnings on August 4th. Total prescription trends continue to rise, increasing 19% during April-May compared January-February. Furthermore, AMRN is determined to improve Vascepa visibility and uptake, with the help from “off-label promotion in mixed dyslipidemia using ANCHOR and JELIS data.” Amarin has already reached 60% of the target primary cardiovascular events in the REDUCE-IT study. The analysis by the DMC is expected in early fall.

These developments led Ong to reiterate his Buy rating with a price target of $3.50, marking an increase of 65.5% from current levels. Ong has a success rate of 21% with an average loss of 7.5% per recommendation.

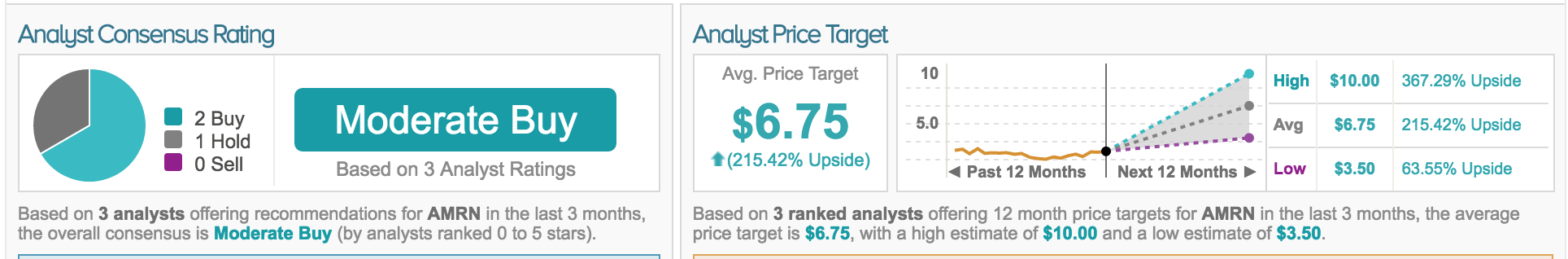

According to TipRanks, out of the 3 analysts who have rated the company in the past 3 months, 2 gave a Buy rating and 1 gave a Hold rating. The average 12-month price target for the stock is $6.75, marking a 215.42% upside from current levels.