Shares in Editas Medicine (EDIT) are falling 6% in Wednesday’s pre-market trading after the company announced a price of $31.25 per share for its underwritten public offering of 6 million shares of common stock.

The genome editing company notes that this is the price before deducting underwriter discounts and commissions and estimated offering expenses.

Gross proceeds from the offering are expected to be approximately $187.5 million.

According to the SEC filing, EDIT intends to use these proceeds to fund the Phase 1/2 clinical trial for EDIT-101, the research, development and preclinical studies for other in vivo CRISPR medicine research programs, including EDIT-102, engineered cell medicines research programs, including EDIT-301, and for working capital and other general corporate purposes.

Editas Medicine has also granted the underwriter a 30-day option to purchase up to an additional 900,000 shares of common stock on the same terms and conditions.

All of the shares in the offering are to be sold by Editas Medicine. The offering is expected to close on or about June 26, 2020, subject to customary closing conditions.

Morgan Stanley is acting as sole book-running manager for the offering.

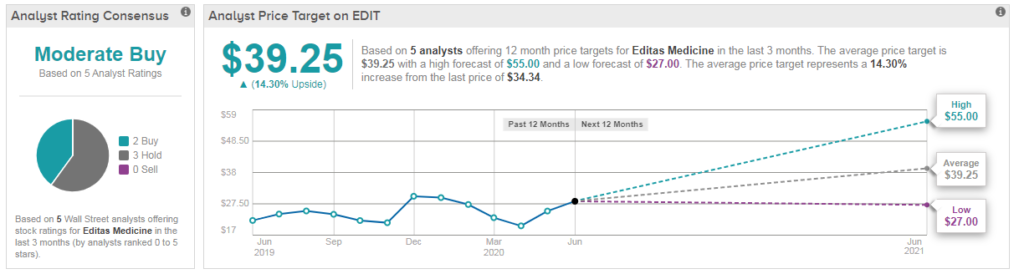

Shares in Editas are trading up 16% year-to-date at $34.33, and analysts have a cautiously optimistic Moderate Buy consensus on the stock’s outlook. Meanwhile the $39 average analyst price target indicates upside potential of 14%. (See EDIT stock analysis on TipRanks)

“We believe EDIT will make progress in LCA10 and USH2A with in-vivo editing as well as SCD, beta-thalassemia, and cell therapies in oncology. However, we view the shares as fairly valued at the current price” commented Oppenheimer analyst Jay Olson on June 14 as he reiterated his Hold rating on the stock.

Similarly, JP Morgan’s Cory Kasimov is staying on the sidelines, despite encouraging data from the EDIT-301 program in sickle cell disease. He writes: “if in fact EDIT-301 is “best-in-class” as management believes it could be, it will take a considerable amount of time to bear out. While we remain intrigued by the science and still see plenty of disruptive potential long term, the EDIT story is one of patience.”

Related News:

Gilead To Acquire Stake in Cancer Drug Developer Pionyr For $275 Million

Merck, BioInvent Enroll First Patient In Solid Tumor Combo Trial

J&J Fails To Overturn Baby Powder Verdict, Damages Cut To $2.12B